GOEX VS GLDM

Compare the GOEX and GLDM ETFs with our thorough analysis. Dive into the performance metrics, underlying assets, and investment strategies.

The BBIN issuer, JPMorgan Fundshe Fund, endeavors to closely mirror the performance of the Morningstar® Developed Markets ex-North America Target Market Exposure IndexSM, with a focus on securities from developed countries excluding North America. Constituents primarily comprise large- and mid-cap companies across various sectors, including financials and industrials. While the Fund primarily invests in common stock, stapled securities, and depositary receipts, it may employ a representative sampling strategy to approximate the investment characteristics of the Underlying Index when replication is impractical. The Fund, classified as diversified under the Investment Company Act of 1940, may temporarily operate as non-diversified based on changes in the Underlying Index's composition. Additionally, the Fund may utilize up to 10% of its assets in exchange-traded futures and forward foreign currency contracts to align with the Underlying Index's performance. Through a passive indexing approach, the Fund aims to provide investors with exposure to various markets while closely tracking the benchmark, reflecting its BetaBuilders moniker.

The BBIN issuer, JPMorgan Fundshe Fund, aims to provide investors with passive exposure to dividend-paying securities within developed markets excluding North America. While the Fund primarily focuses on replicating the performance of the Morningstar® Developed Markets ex-North America Target Market Exposure IndexSM, it also emphasizes dividend-yielding stocks. With constituents primarily comprising large- and mid-cap companies across various sectors, including financials and industrials, the Fund's dividend strategy seeks to deliver a stream of income to investors. Additionally, the Fund's diversified classification under the Investment Company Act of 1940 enables it to invest in a range of dividend-paying issuers while maintaining a balanced portfolio. Through its indexing approach, the BBIN issuer aims to provide investors with a passive means of accessing dividend income within developed markets outside of North America.

The BBIN issuer, JPMorgan Fundshe Fund, employs a rigorous tracking methodology to closely mirror the performance of the Morningstar® Developed Markets ex-North America Target Market Exposure IndexSM. With a focus on securities from developed countries excluding North America, the Fund primarily invests in large- and mid-cap companies across various sectors, including financials and industrials. Utilizing a passive indexing approach, the Fund aims to replicate the constituent securities of the Underlying Index as accurately as possible. While replication is the preferred strategy, under certain circumstances where it may not be feasible to hold all constituents in their respective weightings, the Fund may employ a representative sampling strategy. This strategy involves selecting securities that approximate the investment characteristics of the Underlying Index. Despite potential variations due to representative sampling, the Fund commits to investing at least 80% of its assets in securities included in the Underlying Index, ensuring a high degree of correlation with the benchmark's performance. Through its meticulous tracking process, the BBIN issuer seeks to provide investors with a reliable means of accessing developed markets outside of North America while closely aligning with the performance of its designated benchmark.

The BBIN issuer, JPMorgan Fundshe Fund, maintains a strong correlation with the Morningstar® Developed Markets ex-North America Target Market Exposure IndexSM, reflecting its commitment to passive indexing. By investing primarily in securities from developed countries excluding North America, with a focus on large- and mid-cap companies across various sectors, including financials and industrials, the Fund aims to closely track the performance of its designated benchmark. Through meticulous replication or representative sampling strategies, the Fund ensures that at least 80% of its assets are invested in securities included in the Underlying Index. This disciplined approach not only helps to mitigate tracking error but also enhances the Fund's ability to deliver returns that closely correspond to the benchmark's performance. As a result, investors can rely on the BBIN issuer to provide a high degree of correlation with the designated index, offering a reliable means of accessing developed markets outside of North America while minimizing tracking discrepancies.

The BBIN issuer, JPMorgan Fundshe Fund, strategically allocates its investments across various sectors within developed markets excluding North America, aiming to capture opportunities while maintaining diversification. With constituents primarily comprising large- and mid-cap companies across sectors such as financials and industrials, the Fund's sector allocation reflects the composition of the Morningstar® Developed Markets ex-North America Target Market Exposure IndexSM. Through a passive indexing approach, the Fund seeks to replicate the sector distribution of the Underlying Index as closely as possible, ensuring alignment with market trends and dynamics. While the Fund does not actively overweight or underweight sectors, its diversified portfolio enables exposure to a broad spectrum of industries, enhancing risk management and potential returns for investors. By adhering to a disciplined sector allocation strategy, the BBIN issuer aims to provide investors with a well-rounded exposure to developed markets outside of North America, reflecting its commitment to delivering consistent and reliable performance over the long term.

The BBIN issuer, JPMorgan Fundshe Fund, offers investors exposure to developed markets excluding North America through its meticulously constructed investment strategy. By closely tracking the Morningstar® Developed Markets ex-North America Target Market Exposure IndexSM, the Fund provides passive exposure to a diverse array of large- and mid-cap companies across various sectors, including financials and industrials. With constituents spanning countries such as Australia, Japan, and the United Kingdom, the Fund's exposure reflects the economic and market dynamics of developed regions worldwide. Through a combination of replication and representative sampling strategies, the Fund ensures that at least 80% of its assets are invested in securities included in the Underlying Index, enabling investors to benefit from broad market trends while minimizing tracking error. This comprehensive approach to market exposure, coupled with the Fund's commitment to aligning with its benchmark's performance, underscores its role as a reliable vehicle for accessing developed markets outside of North America, providing investors with opportunities for long-term growth and diversification.

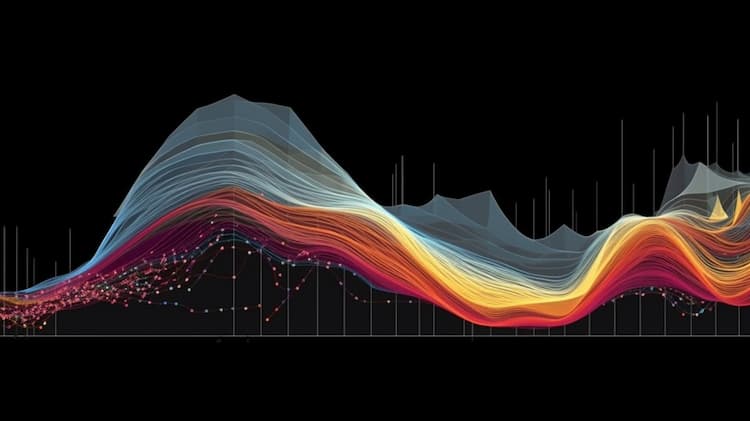

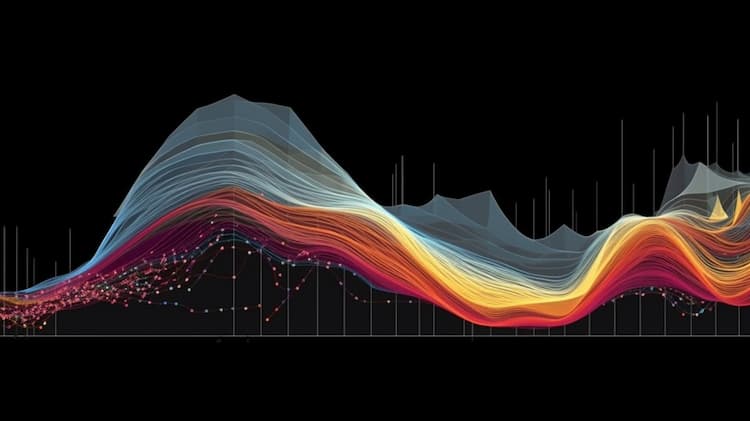

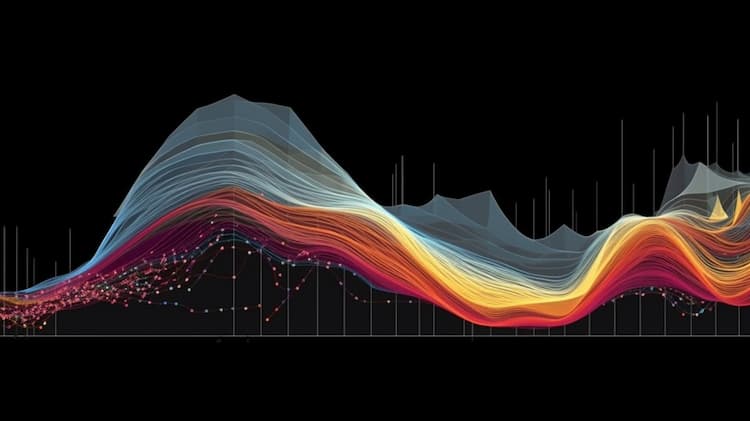

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

Compare the GOEX and GLDM ETFs with our thorough analysis. Dive into the performance metrics, underlying assets, and investment strategies.

The BBIN ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

The ETF with Amazon.com Inc. and Dollar Tree Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Amazon.com Inc. and Dollar Tree Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.