BILS ISSUER

The State Street Global Advisors, LLC (SSGA) is the issuer behind the SPDR Bloomberg 3-12 Month U.S. Treasury Bill UCITS ETF (BILS). With its dedication to delivering innovative investment solutions, SSGA has crafted this ETF to track the performance of the Bloomberg 3-12 Month U.S. Treasury Bill Index. Through a strategic sampling strategy, BILS aims to provide investors with a portfolio of securities that closely mirrors the risk and return characteristics of the Index. SSGA's commitment to offering investment opportunities in U.S. Treasury Bills with maturities between 3 and 12 months makes BILS a valuable addition to the fixed-income segment of the ETF market.

BILS DIVIDEND

The BILS Dividend reflects the dividend distribution of the SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BILS). While BILS primarily focuses on short-term Treasury bills and may not be known for high dividend yields, it provides a safe haven for investors seeking stability. Dividend distributions from BILS typically occur on a monthly basis and are determined by the interest earned on its portfolio of short-term government securities. Investors looking for a low-risk option with some income potential may consider BILS as a part of their portfolio.

BILS TRACKING

Tracking the Bloomberg 3-12 Month U.S. Treasury Bill Index lies at the core of the strategy behind the BILS ETF. BILS utilizes a sampling strategy, allowing flexibility in the selection of securities to closely mirror the risk and return characteristics of the Index. Under normal market conditions, the fund predominantly invests in securities comprising the Index, along with potential investments in debt securities not included in the Index, cash equivalents, and money market instruments. The Index itself is designed to measure the performance of U.S. Treasury Bills with a remaining maturity of 3 to 12 months, providing investors with exposure to short-term, investment-grade U.S. government debt securities.

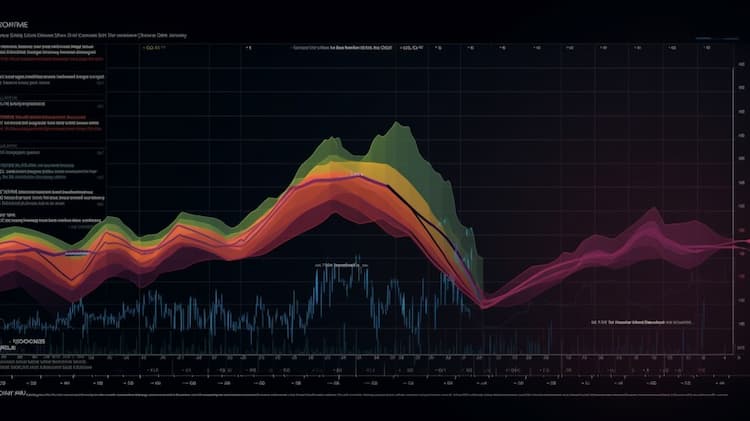

BILS CORRELATION

The correlation aspect of the SPDR Bloomberg Barclays 3-12 Month U.S. Treasury Bill ETF (BILS) primarily revolves around its tracking of the Bloomberg 3-12 Month U.S. Treasury Bill Index. As an ETF focused on short-term U.S. Treasury bills, BILS typically exhibits a strong positive correlation with movements in short-term interest rates. This correlation makes BILS an attractive option for investors seeking a low-risk, income-generating investment during periods of rising interest rates. For more specific and in-depth correlation analysis, investors can utilize our tool, ETF Insider. This web app provides comprehensive data and insightful visualizations, helping investors understand correlations and overlaps with other assets, making informed investment decisions.

BILS SECTOR

The BILS ETF (BILS) primarily focuses on the U.S. Treasury Bill sector, specifically targeting short-term government debt securities with maturities ranging from 3 months to less than 12 months. This ETF aims to provide investors with exposure to the safety and stability of U.S. Treasury Bills, making it a suitable choice for those seeking a low-risk investment option. With its emphasis on short-term government bonds, BILS offers a conservative investment approach that may appeal to risk-averse investors looking to preserve capital and earn modest returns.

BILS EXPOSURE

The exposure profile of the SPDR Bloomberg 3-12 Month T-Bill ETF centers around its investment strategy, which primarily focuses on large- to mid-capitalization U.S. companies. As of September 30, 2022, the fund considers companies with a market capitalization over $2 billion as its investment universe, and it dynamically adjusts its holdings in response to changing market conditions. Furthermore, the ETF seeks to identify and invest in leading securities from various sectors of the U.S. economy, employing a combination of fundamental and technical analysis for stock selection. The fund also utilizes options for hedging purposes to manage risk, with a preference for selling covered call options. To delve deeper into the exposure and characteristics of this ETF and others, consider using our ETF Insider web app, which provides comprehensive data and visualization tools, helping you uncover overlap, correlations, and more for U.S. ETFs.