What is the ALFA ETF ?

Discover the DRN and ALFA ETFs - This article delves into the world of Exchange-Traded Funds (ETFs) and explores the DRN and ALFA ETFs, providing insights into their investment strategies and potential benefits for investors.

The BKSE Issuer is the creator and manager of the BNY Mellon US Small Cap Core Equity ETF. This issuer is known for its commitment to providing investors with exposure to the small-capitalization segment of the U.S. stock market. The ETF is designed to track the Solactive GBS United States 600 Index TR, which consists of 600 small-cap companies listed on various U.S. stock exchanges. With a focus on delivering investment opportunities in this market segment, BKSE has established itself as a reliable source for investors seeking to diversify their portfolios with small-cap stocks.

While the primary objective of the BKSE Dividend ETF may not revolve around dividend-focused strategies, it still mirrors the dividend distribution of the underlying index. Dividend distributions typically occur periodically, influenced by the constituent companies' individual dividend policies and financial performance. Investors considering this ETF can expect dividend eligibility based on the index's criteria, ensuring that the selected securities meet certain tradability and market capitalization requirements, making it a suitable choice for those seeking both capital appreciation and potential dividend returns.

The BNY Mellon US Small Cap Core Equity ETF (BKSE) closely tracks the Solactive GBS United States 600 Index TR. This index is designed to measure the performance of 600 small-capitalization companies listed on U.S. stock markets. Eligible securities for this index include common stock and shares of real estate investment trusts (REITs) listed on major U.S. exchanges and traded in U.S. dollars. The index selects its constituents based on total market capitalization, with the top 510 securities included, and the remaining slots filled with the highest-ranking remaining securities. It undergoes quarterly reconstitution and as of June 30, 2023, consisted of 597 securities. BKSE aims to mirror this index's performance while maintaining industry concentration in line with the index itself.

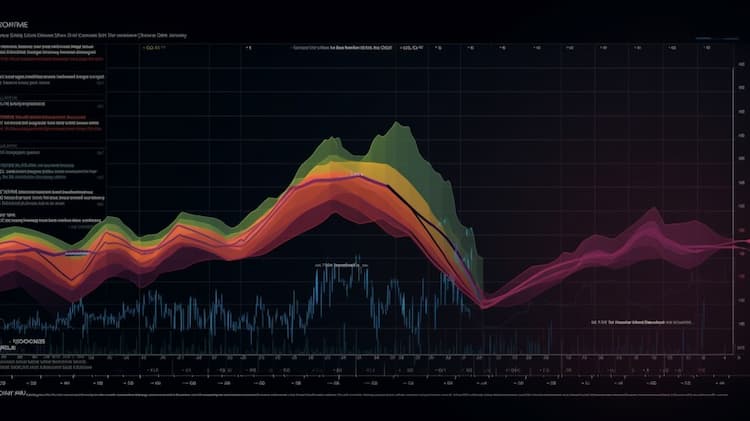

The correlation aspect of the BKSE ETF (insert ETF name here) is not widely known, as there is limited information available regarding its specific correlations with various market segments or assets. However, investors seeking to understand BKSE's correlation patterns can utilize ETF Insider's web app. This tool offers comprehensive data and visualization options to analyze BKSE's correlations with other US ETFs, providing valuable insights into its behavior in relation to different market sectors and asset classes. By using ETF Insider, investors can uncover correlations, identify potential diversification opportunities, and make informed investment decisions.

The BKSE Sector ETF is primarily focused on the financial sector, with a significant allocation to banking and related industries. This ETF offers exposure to a range of financial institutions, including banks, insurance companies, and investment firms. Investors interested in the financial sector's performance and potential for growth may find this ETF appealing. However, it's important to note that the financial sector can be influenced by economic cycles and regulatory changes, which may introduce volatility and risk to the fund's performance.

The exposure characteristic of the BKSE ETF highlights its focus on a specific index known as the Solactive GBS United States 600 Index TR. This index is designed to track the performance of 600 small-capitalization companies listed on U.S. stock markets. The index includes common stocks and shares of real estate investment trusts (REITs) listed on major U.S. exchanges, traded in U.S. dollars, and meeting certain tradability requirements. BKSE ETF aims to mirror the composition and performance of this index, offering investors exposure to the small-cap segment of the U.S. market. For more detailed insights into BKSE''s exposure and its correlation with other assets, investors can utilize ETF Insider''s web app, which provides comprehensive data and visualization tools to make informed investment decisions.

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

Discover the DRN and ALFA ETFs - This article delves into the world of Exchange-Traded Funds (ETFs) and explores the DRN and ALFA ETFs, providing insights into their investment strategies and potential benefits for investors.

The BKSE ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

The BKSE ETF is a specialized investment fund that focuses on global companies in the relevant sectors. This exchange-traded fund offers investors exposure to a diverse range of innovative and cutting-edge companies engaged in advancements in the industry. Discover the potential growth opportunities and risks associated with investing in this dynamic sector through the BKSE ETF.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.