What is the VOOG ETF ?

Unveiling the DRN and VOOG ETFs: Exploring two prominent investment options. Learn about these ETFs' strategies and potential benefits for investors looking to diversify their portfolios and tap into specific market sectors.

The BSMS ETF, managed by Invesco Capital Management LLC, focuses on investing at least 80% of its total assets in securities constituting the Underlying Index, meticulously compiled and maintained by Invesco Indexing LLC. This index aims to track the performance of U.S. dollar-denominated investment-grade municipal bonds maturing or effectively maturing in 2028. Notably, the index takes into account embedded issuer call options and utilizes a market value weighting system with a 5% cap on individual issuers. Bonds must meet stringent criteria including federal tax exemption, fixed interest payments, and minimum credit ratings. The fund itself operates until December 15, 2028, distributing net assets to shareholders upon termination, potentially investing in variable rate demand obligations (VRDOs), derivatives, ETFs, or municipal bonds not included in the index. Unlike target date funds, the INVESCO ETF employs a sampling methodology to achieve its investment objective and avoids excessive concentration in any one industry or group of industries, aligning its investment strategy with the composition of the Underlying Index.

The BSMS Dividend, managed by Invesco Capital Management LLC, is designed to provide investors with exposure to a diversified portfolio of dividend-paying securities. With a focus on generating income, the fund invests in a range of dividend-yielding assets, including equities, real estate investment trusts (REITs), and dividend-paying fixed-income securities. Invesco Indexing LLC, affiliated with the fund's investment advisor, meticulously constructs and maintains the underlying index, ensuring that constituents meet specific criteria for dividend yield, stability, and growth potential. The fund employs a disciplined investment approach, seeking to capture dividend income while also considering factors such as dividend growth and sustainability. With a commitment to delivering consistent dividends to investors, BSMS Dividend aims to provide a reliable source of income within a diversified investment portfolio.

The BSMS Tracking ETF, overseen by Invesco Capital Management LLC, is crafted to closely mirror the performance of a specific benchmark or index. In line with its objective, the fund typically invests a significant portion of its assets in securities that comprise the designated benchmark. Invesco Indexing LLC, affiliated with the fund's investment advisor, rigorously constructs and maintains the underlying index, ensuring accurate representation and adherence to tracking objectives. Utilizing sophisticated tracking methodologies and investment strategies, the fund aims to replicate the benchmark's returns efficiently. By closely tracking the selected index, BSMS Tracking ETF provides investors with an opportunity to gain exposure to a particular market segment or investment strategy while potentially mitigating tracking error and deviations from the benchmark's performance.

The BSMS Correlation Fund, managed by Invesco Capital Management LLC, is strategically designed to provide investors with exposure to assets that exhibit a strong correlation with a specific market index or asset class. With a focus on capturing movements in correlation, the fund invests in a diverse range of securities and instruments that demonstrate a high degree of correlation to the designated benchmark. Invesco Indexing LLC, affiliated with the fund's investment advisor, meticulously constructs and maintains the underlying index, ensuring that constituents closely track the performance of the target market or asset class. Employing sophisticated correlation analysis and risk management techniques, the fund aims to deliver returns that closely align with fluctuations in the selected benchmark, offering investors a tool to hedge against market risk or to enhance portfolio diversification by targeting assets with predictable correlation patterns.

The BSMS Sector Fund, managed by Invesco Capital Management LLC, is designed to offer investors exposure to specific sectors within the market, allowing them to capitalize on opportunities and trends within those industries. The fund strategically invests in a diverse array of securities that are representative of the targeted sectors, seeking to capture potential growth and performance within each sector. Invesco Indexing LLC, affiliated with the fund's investment advisor, meticulously constructs and maintains the underlying index, ensuring that constituents accurately reflect the composition and performance of the designated sectors. Through a disciplined sector rotation strategy and rigorous analysis of sector-specific fundamentals, the fund aims to provide investors with the potential for enhanced returns while managing sector-specific risks. Whether investors seek to overweight or underweight certain sectors within their portfolios, the BSMS Sector Fund offers a flexible and efficient means of gaining exposure to targeted segments of the market.

The BSMS Exposure Fund, managed by Invesco Capital Management LLC, is tailored to provide investors with targeted exposure to specific asset classes, regions, or investment strategies. With a focus on achieving precise exposure to desired market segments, the fund strategically allocates its assets across a diversified range of securities and instruments that align with the selected investment objectives. Invesco Indexing LLC, affiliated with the fund's investment advisor, meticulously constructs and maintains the underlying index, ensuring that constituents accurately represent the targeted exposure. Utilizing advanced quantitative models and risk management techniques, the fund aims to deliver returns that closely track the performance of the designated market segments or investment strategies. Whether investors seek exposure to emerging markets, alternative assets, or thematic investment themes, the BSMS Exposure Fund offers a versatile and efficient solution to meet their specific investment needs and objectives.

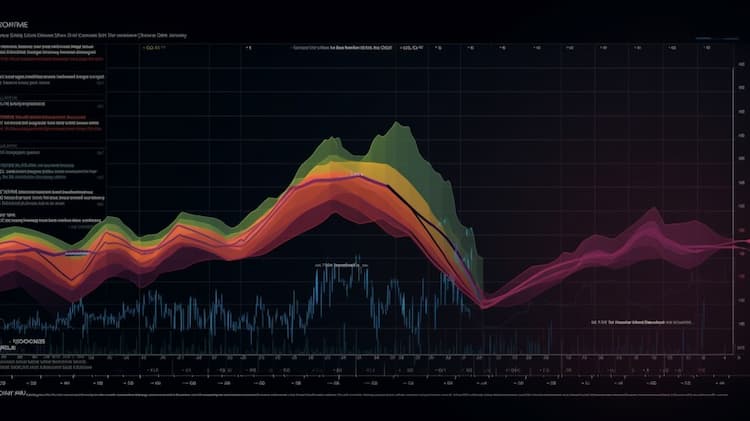

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

Unveiling the DRN and VOOG ETFs: Exploring two prominent investment options. Learn about these ETFs' strategies and potential benefits for investors looking to diversify their portfolios and tap into specific market sectors.

Discover the top-performing Clouty ETFs that are capturing the attention of investors. These innovative exchange-traded funds focus on companies harnessing the power of social media and digital influence to drive their growth, making them attractive options for those seeking exposure to the evolving landscape of online trends and viral phenomena. Explore the best Clouty ETFs and potentially capitalize on the dynamic world of internet-driven success stories.

The BSMS ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.