IWM VS QQQ

Compare the IWM and QQQ ETFs with our thorough analysis. Dive into the performance metrics, underlying assets, and investment strategies.

The Cabot ETF Partners, LLC (CBTG) is the issuer of the actively-managed exchange-traded fund (ETF) known as the Cabot Growth Opportunities ETF. Founded with the aim of identifying companies poised for above-average secular growth, CBTG combines fundamental and technical analysis to select equity securities of U.S. large-, mid-, and small-capitalization companies. CBTG also may invest in American Depositary Receipts (ADRs) representing foreign company stock. The fund allocates its assets to companies in expanding market segments, those with a growing compound annual growth rate (CAGR), and opportunistic investments in temporarily dislocated stocks, all with the goal of providing investors exposure to companies with strong growth potential driven by factors such as new product development, technological advancements, and evolving consumer and business trends.

While the primary objective of the Cabot ETF Partners Growth ETF (CBTG) is to invest in companies with superior growth prospects, it still engages in dividend distribution. The ETF typically distributes dividends on a quarterly basis, in accordance with the dividend policies and performances of the constituent companies within its portfolio. CBTG primarily focuses on companies that demonstrate above-average growth potential, aiming to provide investors with capital appreciation alongside the possibility of dividend returns as a result of the underlying companies' success and profitability.

Tracking the Cabot ETF Partners Growth ETF (CBTG) involves an actively-managed approach focused on identifying companies with above-average secular growth potential in expanding market segments. CBTG aims to invest primarily in equity securities, including U.S. large, mid, and small-cap companies, as well as ETFs and American Depositary Receipts (ADRs) representing foreign stocks. The fund leverages fundamental and technical analysis, along with the research of the Cabot Wealth Network, to select companies poised for above-average returns driven by earnings growth, valuation-based opportunities, or other growth catalysts. CBTG seeks to balance its portfolio by allocating assets to companies in growing market segments, those with expanding compound annual growth rates (CAGR), and opportunistic investments in undervalued stocks.

The correlation aspect of the Cabot Growth ETF (CBTG) is influenced by its active management strategy focused on seeking above-average secular growth. While specific correlations may vary depending on the companies and sectors within its portfolio, CBTG aims to identify and invest in businesses with superior growth prospects over a multi-year horizon. As such, its correlation with various market segments and economic conditions may fluctuate, making it essential for investors to monitor these correlations for effective risk management and diversification.

The Cabot ETF Growth (CBTG) focuses on investing in companies operating in sectors that offer significant growth potential over the long term. The fund primarily targets businesses with above-average secular growth prospects in expanding market segments, which are expected to thrive in a positive economic landscape. CBTG primarily invests in U.S. large, mid, and small-capitalization companies, along with ETFs and American Depositary Receipts (ADRs) representing foreign company stocks. The fund's portfolio is strategically constructed through fundamental and technical analysis, aiming to identify companies with compelling prospects for generating above-average returns, driven by factors such as earnings growth, valuation-based opportunities, and other identifiable growth catalysts. CBTG seeks to capitalize on trends like new product developments, technological advancements, and shifts in consumer and business preferences with above-average growth potential. Investors considering CBTG should be aware of its concentrated focus on companies with growth potential, which can entail a higher level of risk compared to more diversified ETFs.

The exposure characteristic of the CBTG ETF emphasizes an actively-managed approach focused on companies poised for above-average growth in expanding market segments. This ETF primarily invests in equity securities of U.S. large-, mid-, and small-capitalization companies and may also include American Depositary Receipts (ADRs) representing foreign company stock to a lesser extent. CBTG''s investment strategy incorporates research from the Cabot Wealth Network, leveraging both fundamental and technical analysis to identify companies with growth potential driven by factors such as earnings growth, valuation-based opportunities, and identifiable growth catalysts. Investors interested in exploring the exposure of CBTG ETF can utilize the ETF Insider web app, which provides in-depth data and visualizations to understand its portfolio composition, sector allocations, and correlations with other ETFs.

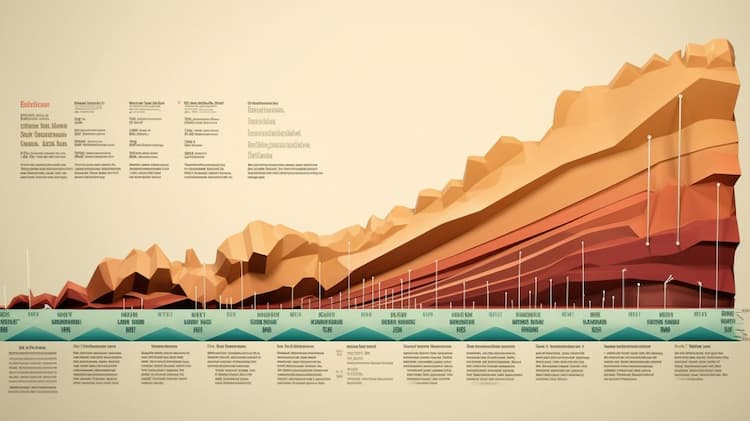

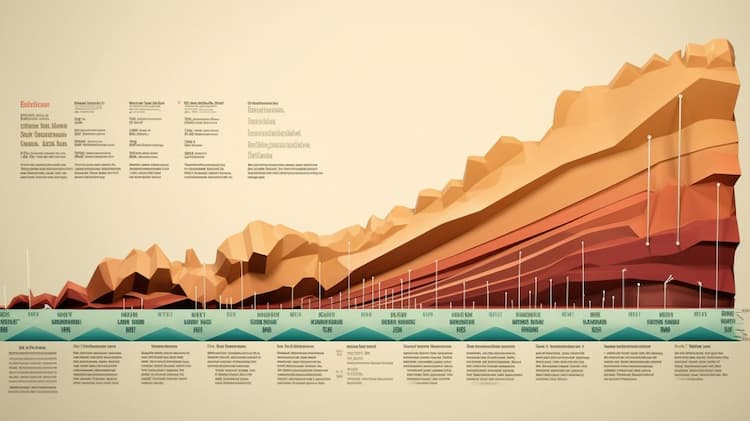

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

Compare the IWM and QQQ ETFs with our thorough analysis. Dive into the performance metrics, underlying assets, and investment strategies.

Compare the WDIV and DES ETFs with our thorough analysis. Dive into the performance metrics, underlying assets, and investment strategies.

The CBTG ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.