CIBR Vs WCLD: Investment Strategy

CIBR and WCLD are distinctive ETFs, each providing a specialized avenue for investing in the dynamic technology sector. Read our article.

The CEMB ETF, also known as the iShares J.P. Morgan EM Corporate Bond ETF, is managed by BlackRock Fund Advisors (BFA). This ETF seeks to track the performance of the J.P. Morgan CEMBI Broad Diversified Core Index, which covers the U.S. dollar-denominated emerging market corporate bond market. BFA utilizes a passive indexing strategy, investing in a representative sample of securities to closely mimic the index's investment profile. The CEMB ETF primarily holds bonds issued by corporations in various emerging market countries, without ratings restrictions, aiming to provide diversified exposure to this asset class while keeping costs and portfolio turnover low.

While the primary objective of the iShares J.P. Morgan EM Corporate Bond ETF (CEMB) is to track the performance of the J.P. Morgan CEMBI Broad Diversified Core Index, which focuses on the U.S. dollar-denominated emerging market corporate bond market, it also has implications for dividend distribution. The ETF's dividend distributions typically follow the underlying index's rules and occur on a regular basis. The eligibility of bonds within the index is determined by specific inclusion criteria, including issuer location, guarantees, and asset locations within emerging market economies. As a result, CE

Tracking the J.P. Morgan CEMBI Broad Diversified Core Index is the primary objective of the CEMB ETF. This index monitors the performance of the U.S. dollar-denominated emerging market corporate bond market. The index's components are selected based on specific inclusion criteria related to issue size, bond type, maturity, and liquidity, with eligible countries determined by JPMorgan Chase & Co. The index encompasses bonds from Latin American, Eastern European, Middle Eastern/African, and Asian countries, excluding Japan, provided the issuer meets certain criteria. The CEMB ETF employs a passive, indexing approach to achieve its investment objective, aiming to minimize costs and achieve performance closely aligned with the Underlying Index, which includes both investment-grade and non-investment-grade bonds from a diverse range of emerging market countries.

The correlation aspect of the iShares J.P. Morgan USD Emerging Markets Corporate Bond ETF (CEMB) is essential in understanding its performance relative to the U.S. dollar-denominated emerging market corporate bond market. CEMB seeks to track the J.P. Morgan CEMBI Broad Diversified Core Index, and its correlation with the underlying index is expected to be strong due to its passive indexing approach. This correlation makes CEMB a valuable tool for investors looking to gain exposure to emerging market corporate bonds while maintaining diversification within their portfolios. To study CEMB's correlations and access in-depth data, investors can utilize the ETF Insider web app, which offers simple visualization tools and highlights overlaps with other U.S. ETFs, providing comprehensive insights for informed decision-making.

The iShares J.P. Morgan USD Emerging Markets Corporate Bond ETF (CEMB) is primarily focused on the emerging market corporate bond sector. CEMB seeks to track the performance of the J.P. Morgan CEMBI Broad Diversified Core Index, which consists of U.S. dollar-denominated bonds issued by corporations in emerging market countries across Latin America, Eastern Europe, the Middle East, Africa, and Asia (excluding Japan). This ETF offers investors exposure to the diverse and potentially high-yielding world of emerging market corporate debt, allowing them to participate in the growth potential of these markets while managing risks associated with the asset class. However, it's important to note that the underlying index may include both investment-grade and non-investment-grade bonds, which can introduce varying degrees of credit risk into the portfolio.

The exposure characteristic of the iShares J.P. Morgan EM Corporate Bond ETF (CEMB) revolves around the U.S. dollar-denominated emerging market corporate bond market. CEMB seeks to replicate the performance of the J.P. Morgan CEMBI Broad Diversified Core Index, which comprises bonds issued by corporations based in emerging market countries across Latin America, Eastern Europe, Middle East/Africa, and Asia (excluding Japan). These bonds, selected based on strict inclusion criteria, offer investors access to a diverse set of emerging market economies and a mix of investment-grade and non-investment-grade bonds. CEMB provides an avenue for investors to tap into the potential growth and yield offered by emerging market corporate debt while maintaining liquidity and exposure to a broad array of countries and industries.

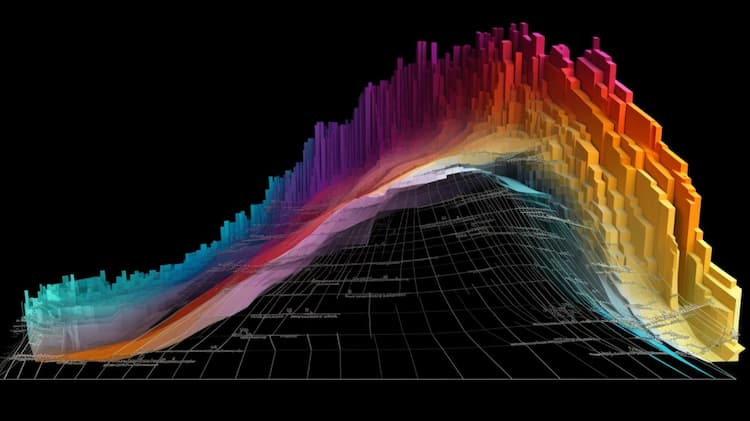

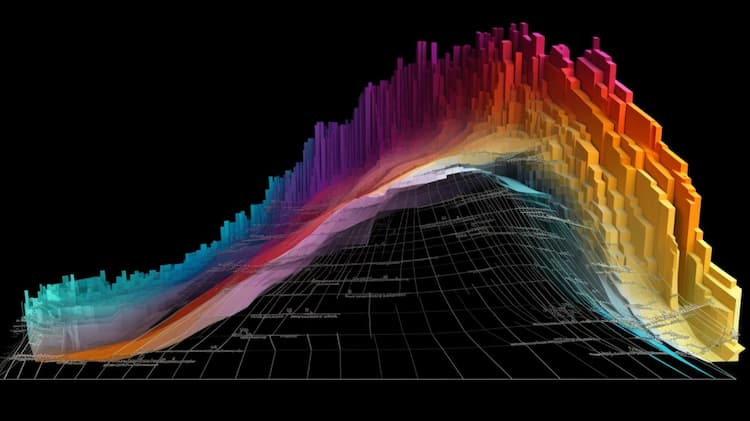

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

CIBR and WCLD are distinctive ETFs, each providing a specialized avenue for investing in the dynamic technology sector. Read our article.

The CEMB ETF is a specialized investment fund that focuses on global companies in the relevant sectors. This exchange-traded fund offers investors exposure to a diverse range of innovative and cutting-edge companies engaged in advancements in the industry. Discover the potential growth opportunities and risks associated with investing in this dynamic sector through the CEMB ETF.

The CEMB ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.