What is the RETL ETF ?

Discovering DRN and RETL ETFs: Unraveling the Potential of Two Prominent Exchange-Traded Funds. Learn about the DRN and RETL ETFs and their potential benefits for investors in this insightful overview.

Change Finance Diversified Impact U.S. Large Cap Fossil Fuel Free Index ETF (CHGX) is offered by Change Finance, PBC. Established in 2017, CHGX is designed to track the performance of the Change Finance Diversified Impact U.S. Large Cap Fossil Fuel Free Index, which comprises an equally-weighted portfolio of approximately 100 large and mid-capitalization U.S.-listed companies.

The Change Finance Diversified Impact U.S. Large Cap Fossil Fuel Free ETF (CHGX) may not be primarily focused on dividends, but it still offers investors opportunities for dividend income. The fund tracks the performance of the Index, which includes approximately 100 large- and mid-cap U.S.-listed companies that meet strict environmental, social, and governance (ESG) standards while excluding those in the fossil fuel industry. CHGX's dividend distributions are influenced by the dividend policies and performances of these ESG-compliant companies, making it a unique choice for socially responsible investors seeking both capital appreciation and dividend returns.

Tracking the Change Finance Diversified Impact U.S. Large Cap Fossil Fuel Free Index is the primary objective of the CHGX (Change Finance Diversified Impact U.S. Large Cap Fossil Fuel Free ETF). This ETF was established in 2017 by Change Finance and follows an equal-weighted portfolio of around 100 large and mid-cap U.S. companies. The index is meticulously constructed to exclude firms involved in the fossil fuel industry, fossil-fired utilities, and those failing to meet specific environmental, social, and governance (ESG) criteria, as determined by Change Finance with the assistance of ISS ESG data. CHGX aims to replicate the index's performance by investing primarily in its constituent securities, promoting sustainable and responsible investing while targeting returns that closely mirror the index's performance.

The correlation aspect of the Change Finance Diversified Impact U.S. Large Cap Fossil Fuel Free ETF (CHGX) is an important consideration for investors looking to align their portfolios with socially responsible and environmentally conscious investing. CHGX tracks an equal-weighted portfolio of approximately 100 large- and mid-cap U.S.-listed companies that are excluded from the fossil fuel industry and adhere to a set of diverse environmental, social, and governance (ESG) standards. As a result, its correlation with traditional fossil fuel-based indexes can be lower, offering investors a unique opportunity to diversify their portfolios while promoting sustainability. For a deeper understanding of CHGX's correlations and to explore its overlap with other ETFs and market indices, ETF Insider provides a user-friendly web app with powerful visualization tools.

The Change Finance Diversified Impact U.S. Large Cap Fossil Fuel Free ETF (CHGX) primarily focuses on companies that meet strict environmental, social, and governance (ESG) criteria. CHGX excludes companies involved in the fossil fuel industry, fossil-fired utilities, and those failing to meet diverse ESG standards. The ETF offers investors exposure to a diversified portfolio of approximately 100 large and mid-cap U.S.-listed companies, evenly weighted across various sectors. This sector-neutral approach aims to provide a responsible investment option for those seeking to align their portfolios with ESG principles while avoiding exposure to fossil fuel-related businesses.

The exposure characteristic of the Change Finance Diversified Impact U.S. Large Cap Fossil Fuel Free Index, tracked by the CHGX ETF, highlights its commitment to socially responsible investing in the U.S. large-cap equity market. This index is designed to measure the performance of an equally-weighted portfolio of around 100 large and mid-capitalization equity securities of U.S.-listed companies. The unique feature of CHGX is its exclusion of companies involved in the fossil fuel industry, fossil-fired utilities, and those failing to meet a diverse set of environmental, social, and governance (ESG) standards. By aligning with ESG principles, CHGX offers investors a way to support companies that prioritize sustainability and responsible business practices while seeking returns in the U.S. large-cap market.

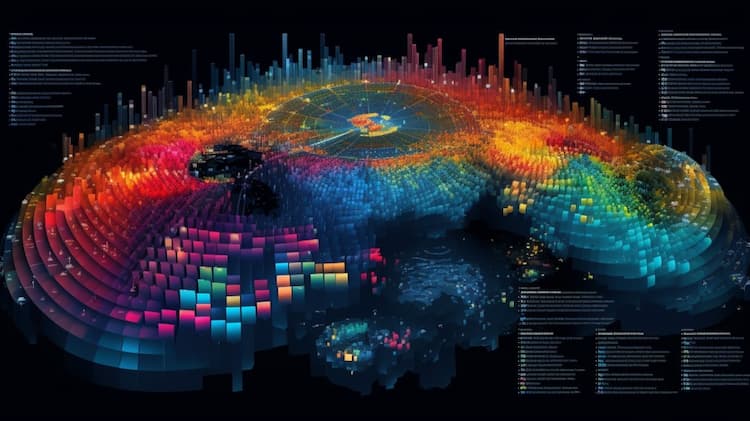

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

Discovering DRN and RETL ETFs: Unraveling the Potential of Two Prominent Exchange-Traded Funds. Learn about the DRN and RETL ETFs and their potential benefits for investors in this insightful overview.

The CHGX ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

INDY VS smin are specialized investment funds that focus on a diverse range of sectors in the financial market. these exchange-traded funds offer investors exposure to various industries and companies, presenting potential growth opportunities and risks. it's essential to understand the underlying assets and strategies of these etfs before considering an investment.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.