What is the RIET ETF ?

Discover the world of ETFs and delve into the concept of RIET ETFs in this informative article. Gain insights into their unique features and potential benefits as an investment tool.

The Fidelity Blue Chip Growth ETF (FBCG) is managed by Fidelity Management & Research Company LLC (FMR), a well-established and reputable investment management firm. FMR is known for its expertise in actively managing investment portfolios and has a strong track record of delivering growth-oriented investment strategies. FBCG, as an actively managed ETF, follows an exemptive order from the Securities and Exchange Commission, allowing it not to publicly disclose its complete portfolio holdings daily. Instead, it publishes an ISSUER Basket on its website, comprised of select portfolio holdings, representative ETFs, and cash equivalents. FBCG focuses on investing in blue-chip companies with substantial market capitalizations, utilizing fundamental analysis to identify growth potential in both domestic and foreign issuers.

While the Fidelity Blue Chip Growth ETF (FBCG) primarily focuses on capital growth, it still offers investors dividend distributions. These dividends are dependent on the dividend policies and performance of the blue-chip growth stocks held within the ETF. Typically distributed on a quarterly basis, FBCG's dividends can provide investors with a potential source of income alongside the potential for long-term capital appreciation.

Tracking the Fidelity Blue Chip Growth ETF, or FBCG, involves a strategy that primarily focuses on actively managed investments in blue-chip companies, which are recognized for their well-established and well-capitalized nature. This ETF seeks to identify companies with above-average growth potential, commonly referred to as growth stocks. FBCG utilizes fundamental analysis, assessing factors like financial condition, industry position, market conditions, and economic trends to make investment decisions. Additionally, it aims to provide exposure to both domestic and foreign issuers, offering investors a diverse portfolio that aligns with its growth-oriented strategy. FBCG uses a unique approach to portfolio disclosure, utilizing a Tracking Basket structure, providing investors with insights into its holdings and alignment with its investment goals.

The correlation aspect of the Fidelity Blue Chip Growth ETF (FBCG) is crucial for investors seeking exposure to blue-chip companies with above-average growth potential. While specific correlation data is not available here, understanding FBCG's correlations with various market segments can aid in portfolio diversification and risk management. To gain insights into FBCG's correlation with other assets and sectors, investors can utilize our tool, ETF Insider. ETF Insider offers a web app with simple visualization tools that provide deep and valuable data on correlations for all US ETFs, helping investors make informed decisions and uncover potential market trends.

The Fidelity Blue Chip Growth ETF (FBCG) primarily focuses on investing in blue-chip companies, which are well-known, well-established, and well-capitalized. These companies typically have large or medium market capitalizations. FBCG also seeks above-average growth potential, making it a growth-oriented ETF. This fund invests in both domestic and foreign issuers, employing fundamental analysis to select investments based on factors such as financial condition, industry position, and market and economic conditions. Please note that FBCG operates under an exemptive order from the Securities and Exchange Commission, allowing it to maintain some portfolio confidentiality while closely tracking its performance through a Tracking Basket.

The exposure characteristic of the FBCG ETF focuses on tracking the investment results of the ICE U.S. Treasury 0-5 Year Inflation Linked Bond Index. This index comprises inflation-protected public obligations of the U.S. Treasury, known as TIPS, with a remaining maturity of less than or equal to five years. TIPS are designed to provide investors with a hedge against inflation by adjusting both interest and principal payments for changes in the Consumer Price Index for All Urban Consumers (CPI). The ETF primarily invests in these TIPS, aiming to offer investors a way to protect their purchasing power in an inflationary environment. For more in-depth analysis and insights into this ETF's exposure and its correlation with other assets, ETF Insider's web app provides a valuable tool with simple visualization and data exploration features.

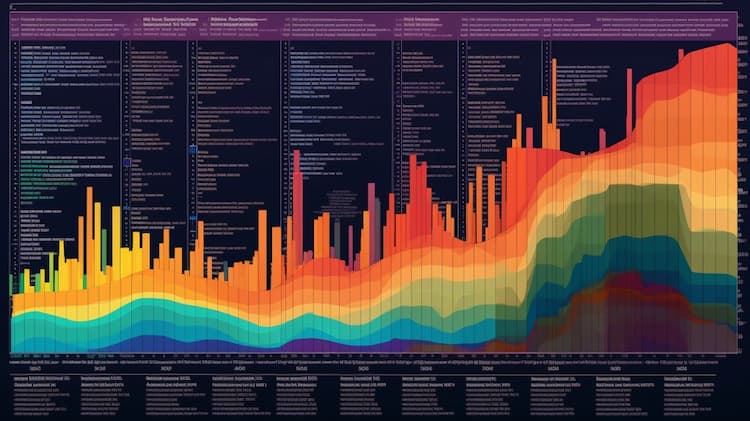

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

Discover the world of ETFs and delve into the concept of RIET ETFs in this informative article. Gain insights into their unique features and potential benefits as an investment tool.

The FBCG ETF is a specialized investment fund that focuses on global companies in the relevant sectors. This exchange-traded fund offers investors exposure to a diverse range of innovative and cutting-edge companies engaged in advancements in the industry. Discover the potential growth opportunities and risks associated with investing in this dynamic sector through the FBCG ETF.

The ETF with Microsoft Corp. and Micron Technology Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Microsoft Corp. and Micron Technology Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.