How does the FDTS ETF work?

The FDTS ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

The FDTS issuer, managed by First Trust Advisors L.P., focuses on replicating the performance of the Index, in which it invests at least 90% of its net assets. This index, developed and maintained by Nasdaq, Inc., comprises securities issued by small-cap companies operating in developed market countries outside the United States. With a methodology aimed at selecting stocks that could potentially generate positive alpha relative to traditional indices, the Index employs the AlphaDEX® selection methodology. This involves screening for eligibility based on liquidity, market capitalization, and adherence to certain exchange criteria. Additionally, the Index is subject to sector and country weighting constraints to prevent over-concentration. Rebalanced semi-annually, the Fund's portfolio aligns with changes in the Index, leading to potential sector or jurisdiction concentration. As of March 31, 2023, the Fund had notable investments in industrials, materials, Japanese, Asian, and European issuers, though this allocation may vary over time, subject to Index adjustments. Consequently, the Fund's exposure to specific jurisdictions or sectors carries associated risks.

The FDTS Dividend fund, managed by First Trust Advisors L.P., operates with a primary objective of generating dividend income. The fund invests in a diversified portfolio of dividend-paying securities, which may include common stocks, real estate investment trusts (REITs), preferred securities, and other income-generating assets. Leveraging an indexing investment approach, FDTS Dividend aims to replicate the performance of its underlying index, which is likely composed of dividend-paying companies across various sectors and geographies. With a focus on securities that offer attractive dividend yields, the fund provides investors with the potential for regular income streams. As with any dividend-focused strategy, FDTS Dividend may also offer the opportunity for capital appreciation over the long term, making it suitable for income-oriented investors seeking both dividend income and potential growth.

The FDTS Tracking fund, overseen by First Trust Advisors L.P., is designed to closely track the performance of a specific market index. With an investment strategy grounded in indexing, the fund aims to replicate, before fees and expenses, the returns of its designated benchmark index. This index, typically owned and maintained by a reputable financial entity, serves as the reference point for FDTS Tracking's investment decisions. The fund invests at least 90% of its net assets in securities that constitute the index, ensuring a high level of correlation with the index's performance. Employing meticulous tracking methodologies, FDTS Tracking endeavors to minimize tracking error, striving to deliver returns in line with the index it mirrors. This passive investment approach offers investors a cost-effective way to gain exposure to the targeted market segment while maintaining transparency and simplicity in its investment strategy.

The FDTS Correlation fund, managed by First Trust Advisors L.P., seeks to achieve a high degree of correlation with a specific market index. Employing sophisticated investment techniques, the fund aims to closely match the performance of its designated benchmark index, before fees and expenses. By investing at least 90% of its net assets in securities that mirror the index, FDTS Correlation endeavors to replicate the index's returns over time. Through meticulous portfolio construction and asset allocation strategies, the fund strives to minimize tracking error and maintain consistency in its correlation with the benchmark. This approach provides investors with an efficient means of gaining exposure to the targeted market segment while aiming to mitigate deviations from the index's performance. FDTS Correlation offers investors the opportunity to align their investment outcomes closely with the movements of the chosen index, facilitating potential returns in line with market trends.

The FDTS Sector fund, under the management of First Trust Advisors L.P., is structured to focus on specific sectors within the market. With a strategic emphasis on sectoral investments, this fund aims to capitalize on the growth potential and unique dynamics of selected industries. Utilizing a diversified portfolio approach, FDTS Sector invests in securities primarily within targeted sectors, which may include technology, healthcare, consumer goods, or other industry segments. Through in-depth sector analysis and careful selection of securities, the fund seeks to identify opportunities for potential outperformance within chosen sectors. By concentrating on specific industries, FDTS Sector offers investors the potential for targeted exposure to areas of the market exhibiting promising growth prospects while providing diversification benefits across sectors. This approach allows investors to tailor their portfolios to specific sectoral themes and capitalize on the potential opportunities within those segments.

The FDTS Exposure fund, managed by First Trust Advisors L.P., is designed to provide investors with exposure to a broad array of market segments and asset classes. With a diversified portfolio approach, this fund aims to capture opportunities across various sectors, geographies, and investment types. By investing in a mix of equities, fixed income securities, real estate investment trusts (REITs), and other asset classes, FDTS Exposure seeks to offer investors a comprehensive investment solution. Through strategic asset allocation and active portfolio management, the fund aims to optimize risk-adjusted returns while mitigating volatility. FDTS Exposure provides investors with a convenient way to access a diversified portfolio, offering exposure to a wide range of investment opportunities within a single fund.

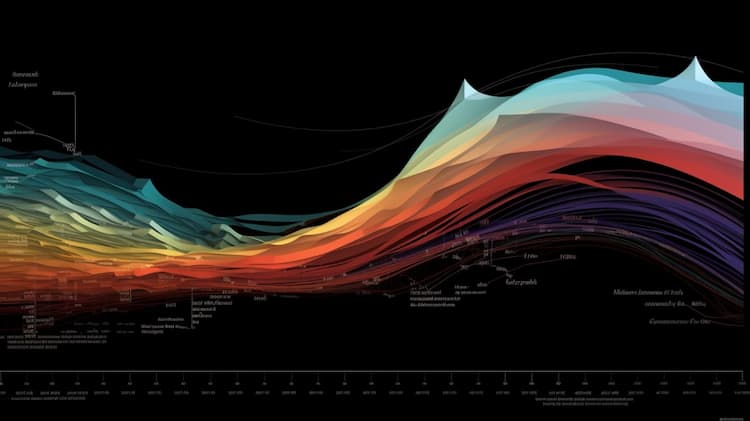

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

The FDTS ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

Discover the world of ETFs and unravel the mystery behind the DIVO ETF in this insightful article. Learn about the features and benefits of this investment option that has been gaining popularity among investors.

Compare the SGDJ and AAAU ETFs with our thorough analysis. Dive into the performance metrics, underlying assets, and investment strategies.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.