ARKK VS VGT: Sectors and Top Holdings

ARKK and VGT are unique ETFs, each offering a specialized approach to investing. We'll explore different aspects, including the ETF tickers, and more.

The Defined Risk Options Premium Income ETF (FIAX) is an actively managed exchange-traded fund (ETF) designed to generate income by employing a strategy centered on short-term U.S. Treasury fixed income securities and a defined risk option premium. This innovative fund utilizes options on ETFs and securities indices across various asset classes, including equities, commodities, and fixed income. By employing vertical credit spreads and vertical debit spreads, the fund aims to capture premiums representing a blend of dividends and asset growth, all while adhering to defined risk levels. Under normal circumstances, FIAX invests at least 80% of its net assets in U.S. Treasury fixed income securities, providing investors with a unique income-generating approach with controlled risk attributes.

The Fidelity 500 Index Fund (FIAX) offers investors exposure to the S&P 500 Index, which means it primarily focuses on capital appreciation rather than dividend income. However, the fund does distribute dividends on a quarterly basis. The eligibility for these dividends is determined by the underlying companies within the S&P 500, and the distribution amount is influenced by the dividend policies and performances of these constituents. While FIAX may not be the go-to choice for income-focused investors, it can still provide a modest source of dividend returns alongside potential capital growth.

The FIAX ETF utilizes an actively managed approach to provide income for investors. It achieves this through a combination of short-term U.S. Treasury fixed income securities and a defined risk option premium strategy. This strategy involves engaging in options transactions across various asset classes, including equities, commodities, and fixed income, to capture premiums. FIAX's option positions consist of vertical credit spreads and vertical debit spreads, allowing for a balance between risk and potential return. The ETF primarily generates returns by writing options, where investors seek protection or participation in asset price movements, making it an option-focused ETF with a defined risk approach.

The correlation aspect of the FIAX remains relatively uncharted territory, making it an intriguing choice for investors seeking unique insights. As an actively managed exchange-traded fund (ETF) focusing on short-term U.S. Treasury fixed income securities and employing a defined risk option premium strategy, its correlation patterns may differ from traditional equity-based ETFs. To delve deeper into the correlations involving FIAX, investors can utilize the ETF Insider web app, which offers comprehensive data visualization tools. By studying correlations with other US ETFs, users can uncover valuable information and potential opportunities within this distinctive ETF.

The First Trust International Equity Opportunities ETF (FIAX) focuses on international equity opportunities. It invests in various sectors across global markets, including but not limited to technology, healthcare, consumer discretionary, and more. FIAX offers investors a chance to diversify their portfolio by accessing international markets and capitalizing on growth prospects in different sectors. However, it's essential to consider the inherent risks associated with international investments when considering FIAX.

The exposure characteristic of the First Trust International Equity Opportunities ETF(FIAX) highlights its focus on tracking the investment results of the ICE® BofA® 1-5 Year US Corporate Index. This index measures the performance of investment-grade corporate bonds from both U.S. and non-U.S. issuers, all of which are denominated in U.S. dollars and have a remaining maturity of greater than or equal to one year and less than five years. As of February 28, 2023, the underlying index consisted of 3,667 issues, with a significant portion representing securities in the financials industry or sector. FIAX is a tool investors can use to gain exposure to this specific segment of the corporate bond market. For detailed insights into its holdings and correlations, investors can turn to ETF Insider's web app for comprehensive data visualization and analysis.

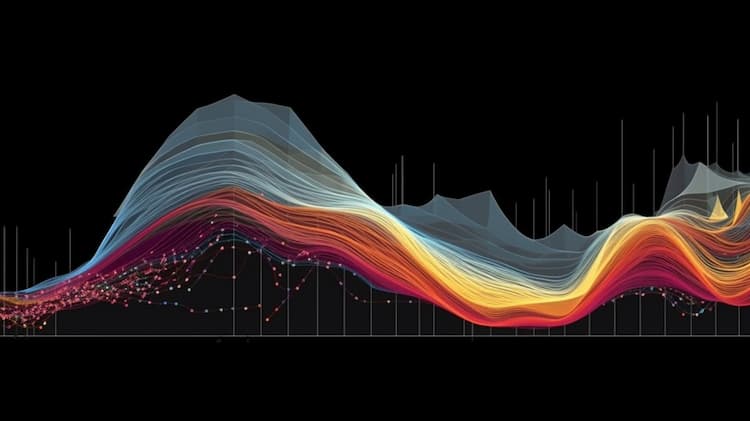

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

ARKK and VGT are unique ETFs, each offering a specialized approach to investing. We'll explore different aspects, including the ETF tickers, and more.

The BBSA ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

The FIAX ETF is a specialized investment fund that focuses on global companies in the relevant sectors. This exchange-traded fund offers investors exposure to a diverse range of innovative and cutting-edge companies engaged in advancements in the industry. Discover the potential growth opportunities and risks associated with investing in this dynamic sector through the FIAX ETF.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.