AAAU Vs SGOL: Tracking Methods & Exposure

AAAU and SGOL offer investors distinct ways to access the value of physical gold through the convenience of ETFs. Both cater to investors seeking exposure.

The Fidelity MSCI Industrials Index ETF (FIDU) is managed by Fidelity Investments, a renowned financial institution with a long-standing reputation for providing innovative and diversified investment solutions. Fidelity, founded in 1946, is known for its commitment to helping investors achieve their financial goals by offering a wide range of investment products and services. FIDU seeks to replicate the performance of the MSCI USA IMI Industrials 25/25 Index, focusing on the industrial sector within the U.S. equity market. Utilizing a representative sampling indexing strategy, the ETF aims to provide investors with exposure to a diversified portfolio of industrial companies while maintaining an investment profile similar to the underlying index. FIDU offers investors an efficient way to access this specific sector, benefiting from Fidelity's extensive expertise in managing exchange-traded funds.

While the Fidelity MSCI USA Industrials Index ETF (FIDU) primarily aims to track the performance of the industrial sector, it also offers dividend distributions to investors. These dividends are typically distributed on a regular basis, following the dividend policies and performances of the industrial sector companies represented in the MSCI USA IMI Industrials 25/25 Index. Investors interested in the industrial sector's growth potential may find FIDU appealing, as it provides both exposure to this sector and the potential for dividend income.

Tracking the MSCI USA IMI Industrials 25/25 Index is the primary objective of the Fidelity MSCI Industrials Index ETF (FIDU). FIDU invests at least 80% of its assets in securities included in its underlying index, which represents the performance of the industrial sector in the U.S. equity market. Employing a representative sampling indexing strategy, FIDU seeks to replicate the investment profile, fundamental characteristics, and liquidity measures of the MSCI USA IMI Industrials 25/25 Index. While it may not hold all the securities in the index, FIDU aims to closely mirror the performance of the industrial sector within the U.S. equity market, making it a suitable choice for investors interested in this segment.

The correlation aspect of the Fidelity MSCI Industrials Index ETF (FIDU) is essential for investors looking to understand its performance in relation to the U.S. industrial sector. Since FIDU tracks the MSCI USA IMI Industrials 25/25 Index, it is expected to have a strong correlation with the industrial sector in the U.S. equity market. This high correlation makes FIDU a valuable tool for investors seeking exposure to the industrial sector or looking to hedge against its fluctuations. ETF Insider's web app provides a convenient way to study FIDU's correlations with various assets and sectors, offering deep insights into its behavior and helping investors make informed decisions while visualizing overlaps in their portfolios.

The Fidelity MSCI Industrials Index ETF (FIDU) focuses on the industrial sector, with investments in companies within industries such as aerospace, machinery, and transportation. By tracking the MSCI USA IMI Industrials 25/25 Index, FIDU aims to provide investors with exposure to the performance of the U.S. industrial sector. This sector ETF offers a diversified approach to capturing growth potential within the industrial space, although it may not hold all the securities in its benchmark index.

The exposure characteristic of the Fidelity MSCI Industrials Index ETF (FIDU) reflects its dedication to the industrial sector within the U.S. equity market. FIDU endeavors to track the MSCI USA IMI Industrials 25/25 Index, which provides investors with a comprehensive view of the performance of industrial companies in the United States. This ETF employs a representative sampling indexing strategy to mirror the index''s characteristics, aiming to deliver returns that align with the industrial sec

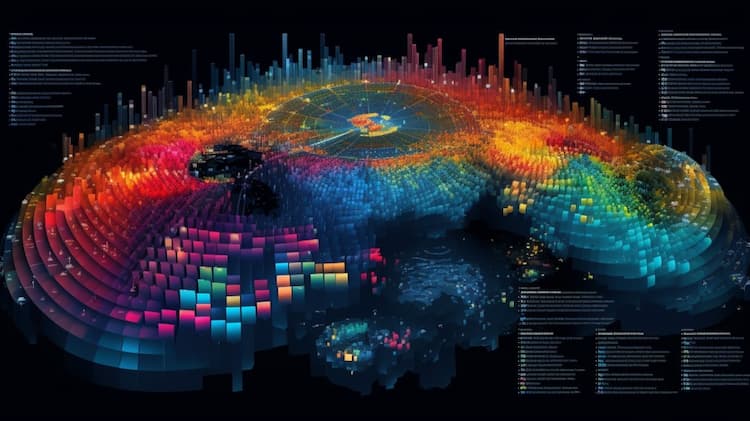

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

AAAU and SGOL offer investors distinct ways to access the value of physical gold through the convenience of ETFs. Both cater to investors seeking exposure.

FR VS FLFR are specialized investment funds that focus on a diverse range of sectors in the financial market. these exchange-traded funds offer investors exposure to various industries and companies, presenting potential growth opportunities and risks. it's essential to understand the underlying assets and strategies of these etfs before considering an investment.

The FIDU ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.