What is the FLSW ETF ?

Discover the world of ETFs and delve into the specifics of FLSW ETF. Uncover the features and benefits of this unique investment vehicle, designed to cater to diverse financial goals.

The issuer of the Fidelity U.S. Sustainability Index ETF (FLSW) is Fidelity Investments. Fidelity is a renowned financial services company with a long-standing history of providing investment solutions to individuals and institutions. Established in 1946, Fidelity has earned a reputation for its commitment to helping investors achieve their financial goals through a wide range of investment products and services. FLSW reflects Fidelity's dedication to sustainable investing by tracking the performance of an index that adheres to specific environmental, social, and governance (ESG) criteria, aligning with the growing demand for socially responsible investment options.

While the main focus of the Franklin Liberty Systematic Style ETF (FLSW) revolves around systematic investment strategies, it also offers investors a glimpse into the dividend distribution of the underlying index. Dividend payments within this ETF are contingent on the performance of the index, influenced by constituent companies' dividend policies and market dynamics. Investors considering FLSW may appreciate the potential for dividend returns alongside the systematic investment approach it embodies.

The Franklin Logan Select Growth ETF (FLSW) focuses on tracking innovative companies that exhibit robust earnings growth potential. Its investment strategy revolves around identifying businesses that have the capacity for sustainable, long-term earnings growth, often attributed to factors like superior pricing power, effective distribution channels, and innovative management approaches. FLSW primarily invests in large-cap U.S. equities traded on domestic exchanges, with an emphasis on firms harnessing innovative technologies and ideas to gain a competitive edge. Additionally, up to 20% of its assets may be allocated to foreign issuers, including those in emerging markets. The ETF employs a meticulous bottom-up approach, combining macroeconomic analysis, fundamental research, and technical analysis to select securities that meet its stringent criteria for inclusion in the portfolio. This multifaceted strategy ensures that FLSW effectively tracks its underlying investment universe, providing investors exposure to companies with substantial growth potential.

Analyzing the correlation of Franklin Liberty Systematic Style Premia ETF (FLSW) is essential for investors looking to understand its behavior within the broader market. FLSW employs a systematic approach to style premia, which aims to capture returns from various investment styles. As a result, its correlation with traditional market indices may vary depending on market conditions. To gain a comprehensive view of FLSW's correlations and how it fits into a portfolio, investors can leverage ETF Insider's web app. This tool provides in-depth data and visualizations, making it easier to identify correlations and overlaps with other U.S. ETFs, aiding in strategic investment decisions.

The Franklin Liberty Systematic Style ETF (FLSW) spans across various sectors, offering investors a diversified approach to style investing. With holdings in both growth and value stocks, this ETF provides exposure to different segments of the market. Its sector allocation may vary over time, reflecting changes in market conditions and style performance trends, making it suitable for those seeking a flexible investment strategy that adapts to evolving market dynamics.

The exposure profile of the Franklin Liberty Systematic Style ETF (FLSW) is designed to capture a diverse range of investment opportunities across various market sectors and regions. FLSW aims to provide investors with exposure to a systematic investment strategy that evaluates stocks based on multiple factors, including dividend yield and risk-adjusted return, spanning large, medium, and small-sized companies. As of June 30, 2023, FLSW's underlying index comprised 149 constituents, reflecting market capitalizations ranging from $300 million to $289 billion.

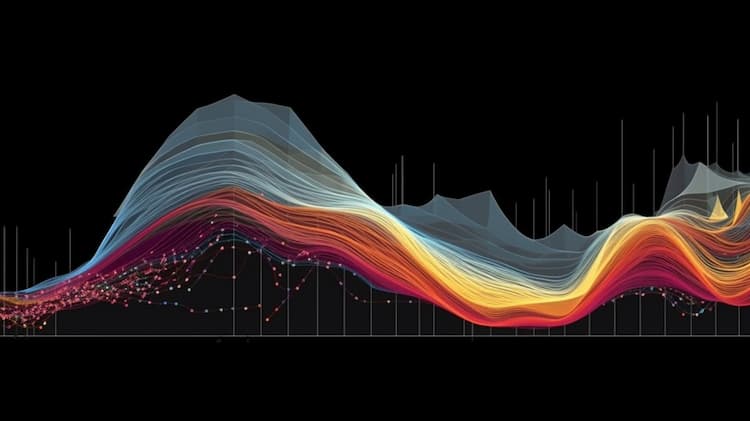

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

Discover the world of ETFs and delve into the specifics of FLSW ETF. Uncover the features and benefits of this unique investment vehicle, designed to cater to diverse financial goals.

The XBB ETF is a specialized investment fund that focuses on global companies in the relevant sectors. This exchange-traded fund offers investors exposure to a diverse range of innovative and cutting-edge companies engaged in advancements in the industry. Discover the potential growth opportunities and risks associated with investing in this dynamic sector through the XBB ETF.

Discover the top-performing NASDAQ Composite ETF that can help investors gain exposure to a diversified portfolio of tech-heavy companies listed on the NASDAQ exchange. This article delves into the features, performance, and key factors to consider when choosing the best NASDAQ Composite ETF for your investment goals, providing valuable insights to aid in your decision-making process.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.