FLTW ISSUER

The issuer of the iShares ESG Aware US Equity ETF (FLTW) is committed to offering socially responsible investment options. This ETF is designed to track the performance of the index, which includes equity securities issued by large capitalization companies in the United States that meet specific environmental, social, and governance (ESG) criteria. The issuer, in partnership with MSCI, ensures that the index components adhere to stringent ESG standards, making FLTW an attractive choice for investors seeking ethically conscious investment opportunities.

FLTW DIVIDEND

While the iShares MSCI USA ESG Select ETF (FLTW) primarily focuses on environmental, social, and governance (ESG) criteria for stock selection, it may provide investors with occasional dividend distributions. These dividends are influenced by the dividend policies and performance of the ESG-compliant companies within the fund's portfolio. Investors in FLTW may expect a blend of ESG-conscious investments and potential dividend returns, making it suitable for those looking to align their values with their investment goals.

FLTW TRACKING

The ALPS Logan Capital Innovation ETF (FLTW) seeks to track the Logan Capital Innovative Growth Index. This index is constructed with a focus on U.S. companies that demonstrate exceptional earnings growth potential driven by factors like pricing power, innovative technologies, and market dominance. FLTW primarily invests in large-cap equities listed on U.S. stock exchanges, with a strong emphasis on the information technology sector. The fund's investment strategy employs a meticulous bottom-up approach, combining macroeconomic analysis, fundamental research, and technical analysis to identify stocks that meet its stringent criteria for inclusion. FLTW's goal is to provide investors exposure to innovative companies poised for long-term growth within the U.S. equity market.

FLTW CORRELATION

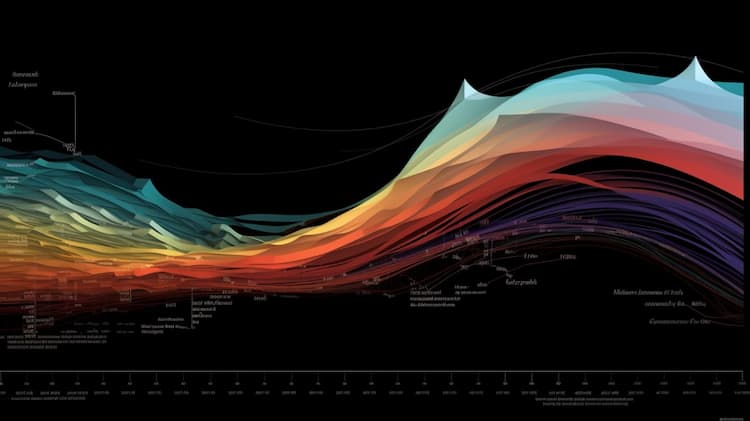

Analyzing the correlation of the Franklin LibertyQT U.S. Equity ETF (FLTW) is essential for investors seeking insights into its performance. FLTW's correlation with the broader U.S. equity market can help investors understand its behavior in different market conditions. Additionally, this ETF's correlation with specific sectors or assets can provide valuable information for portfolio diversification and risk management. To delve deeper into FLTW's correlations and gain a better understanding of its market dynamics, investors can utilize the ETF Insider web app. This tool offers a simple visualization and comprehensive data to assess correlations and identify overlaps with other U.S. ETFs, aiding in making informed investment decisions.

FLTW SECTOR

The American Century Focused Large Cap Value ETF (FLTW) primarily operates within the financial sector. This ETF seeks out opportunities among large-cap value stocks, with an emphasis on financial companies. By focusing on this sector, FLTW aims to capitalize on the potential for value-driven returns within the financial industry while providing investors with exposure to established and well-known companies in this space. It's important to note that sector-specific ETFs like FLTW may have a risk profile influenced by the performance of the chosen sector.

FLTW EXPOSURE

The Franklin FTSE Taiwan ETF (FLTW) provides investors with exposure to the vibrant and growing economy of Taiwan. This ETF aims to replicate the performance of the FTSE Taiwan RIC Capped Index, which includes a diverse range of Taiwanese companies listed on major U.S. exchanges. FLTW's exposure spans multiple sectors, with a particular emphasis on technology, manufacturing, and finance. By investing in FLTW, investors can participate in Taiwan's economic growth story and gain access to companies contributing to its technological innovations and global export prowess.