How does the FSBD ETF work?

The FSBD ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

FSBD issuer, which belongs to the Fidelity Group of Funds, operates with a commitment to environmental, social, and governance (ESG) principles. Managed by Fidelity Management & Research Company LLC, the fund typically invests at least 80% of its assets in debt securities deemed to possess favorable ESG characteristics. This selection process involves a meticulous evaluation of issuers' sustainability practices, considering factors such as carbon emissions, water management, diversity and inclusion policies, and governance structures. Utilizing a blend of proprietary and third-party data, the Adviser assesses issuers' ESG ratings and forwards-looking sustainability outlooks. Moreover, the fund emphasizes investments in securities that not only demonstrate positive ESG attributes but also deliver tangible environmental or social impact, such as providing clean water or promoting education. While focusing on investment-grade debt securities, FSBD also allocates a portion of assets to high yield and emerging market debt, aiming to maintain a risk profile akin to the Bloomberg MSCI U.S. Aggregate ESG Choice Bond Index. Additionally, the fund employs sustainable investing exclusion criteria to avoid industries deemed incompatible with its ESG objectives, while engaging in strategic leveraging transactions to adjust risk exposure and optimize investment opportunities across different asset classes and sectors.

FSBD Dividend, as part of the Fidelity Group of Funds, embodies a commitment to sustainable investing principles with a focus on generating income through dividend-paying securities. Managed by Fidelity Management & Research Company LLC, the fund invests primarily in debt securities that exhibit positive environmental, social, and governance (ESG) characteristics, aiming to allocate at least 80% of its assets accordingly. Through rigorous analysis of issuers' sustainability practices and ESG ratings, the fund seeks to identify opportunities that not only offer attractive dividend yields but also align with its ESG criteria. This comprehensive approach involves assessing factors such as carbon emissions, diversity and inclusion policies, and governance structures. FSBD Dividend strategically allocates assets across various debt securities, including investment-grade, high yield, and emerging market bonds, while adhering to a risk profile similar to the Bloomberg MSCI U.S. Aggregate ESG Choice Bond Index. Additionally, the fund employs exclusion criteria to avoid investments in industries incompatible with its sustainability goals and engages in leveraging transactions to optimize risk exposure and enhance income generation potential.

FSBD Tracking, a constituent of the Fidelity Group of Funds, epitomizes a commitment to tracking a designated benchmark while adhering to sustainable investing principles. Managed by Fidelity Management & Research Company LLC, the fund's primary objective is to mirror the performance of a specified index, such as the Bloomberg MSCI U.S. Aggregate ESG Choice Bond Index, while allocating at least 80% of its assets into debt securities that demonstrate positive environmental, social, and governance (ESG) characteristics. Employing a meticulous evaluation process, the fund assesses issuers' sustainability practices and ESG ratings, considering factors such as carbon emissions, diversity and inclusion policies, and governance structures. FSBD Tracking strategically invests across various debt securities, encompassing investment-grade, high yield, and emerging market bonds, to closely match the risk profile and return characteristics of its benchmark. Furthermore, the fund utilizes exclusion criteria to avoid investments in industries deemed incompatible with its sustainability objectives, ensuring alignment with responsible investment practices while delivering results that mirror its chosen index.

FSBD Correlation, an integral component of the Fidelity Group of Funds, is dedicated to managing correlation risk while upholding sustainable investing principles. Under the management of Fidelity Management & Research Company LLC, the fund focuses on mitigating correlation risk by strategically allocating assets across a diversified portfolio of debt securities. With a commitment to sustainability, FSBD Correlation invests at least 80% of its assets in bonds exhibiting positive environmental, social, and governance (ESG) characteristics. This approach involves a meticulous assessment of issuers' sustainability practices and ESG ratings, considering factors such as carbon emissions, diversity and inclusion policies, and governance structures. The fund strategically invests in various debt securities, including investment-grade, high yield, and emerging market bonds, aiming to manage correlation risk effectively while aligning with its chosen benchmark. Additionally, FSBD Correlation utilizes exclusion criteria to avoid investments in industries deemed incompatible with its sustainability goals, ensuring responsible investment practices while effectively managing correlation risk within the portfolio.

FSBD Sector, a pivotal entity within the Fidelity Group of Funds, is dedicated to sector-focused investing while prioritizing sustainable principles. Under the stewardship of Fidelity Management & Research Company LLC, the fund strategically allocates its assets across different sectors of the economy, emphasizing companies that demonstrate positive environmental, social, and governance (ESG) characteristics. With a commitment to sustainability, FSBD Sector invests at least 80% of its assets in debt securities that align with its ESG criteria, assessing issuers' sustainability practices and ESG ratings meticulously. This evaluation encompasses factors such as carbon emissions, diversity and inclusion policies, and governance structures. The fund's approach involves sector-specific analysis, seeking opportunities within sectors that exhibit strong ESG performance while avoiding those with sustainability concerns. FSBD Sector's investment strategy spans various sectors, including technology, healthcare, consumer goods, and energy, aiming to capitalize on sector-specific trends while adhering to responsible investment practices. Additionally, the fund employs exclusion criteria to steer clear of industries incompatible with its sustainability goals, ensuring that its sector-focused investments align with

FSBD Exposure, an integral part of the Fidelity Group of Funds, is dedicated to managing exposure while adhering to sustainable investing principles. Under the guidance of Fidelity Management & Research Company LLC, the fund strategically allocates its assets across a diversified portfolio of debt securities to optimize exposure to various market segments. With a strong commitment to sustainability, FSBD Exposure invests at least 80% of its assets in bonds exhibiting positive environmental, social, and governance (ESG) characteristics. This involves a rigorous evaluation of issuers' sustainability practices and ESG ratings, considering factors such as carbon emissions, diversity and inclusion policies, and governance structures. The fund's investment strategy spans different sectors, including technology, healthcare, consumer goods, and energy, aiming to capitalize on sector-specific trends while maintaining a balanced exposure across the portfolio. FSBD Exposure utilizes exclusion criteria to avoid investments in industries that do not align with its sustainability goals, ensuring responsible investment practices while effectively managing exposure within the portfolio.

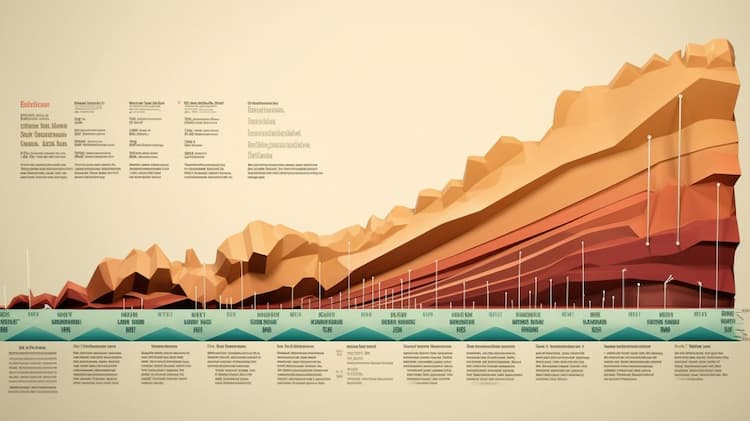

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

The FSBD ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

The ETF with Alphabet Inc. Class C and Illumina Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Alphabet Inc. Class C and Illumina Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

The ETF with Intuit Inc. and Cerner Corp. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Intuit Inc. and Cerner Corp. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.