GDMA ISSUER

The GDMA ETF (Exchange-Traded Fund) is an actively managed investment vehicle that seeks to capitalize on attractive risk-return opportunities across various asset classes. GDMA's portfolio managers employ both strategic and tactical approaches to asset allocation, making investment decisions based on their long-term macroeconomic outlook as well as short-term market conditions. The Fund's investments encompass a broad spectrum of global asset classes, including U.S. and foreign equities, currencies, bonds, real estate investment trusts (REITs), and commodities, with allocations subject to change over time. Empowered Funds, LLC serves as the Fund's investment adviser, while Gadsden, LLC acts as the non-discretionary sub-adviser, providing trade recommendations to the adviser. The portfolio managers employ a combination of fundamental analysis and quantitative methods, aiming to identify securities that offer value and align with the Fund's investment objectives. GDMA may also utilize derivatives, such as futures contracts and ETFs, to gain exposure to specific asset classes, potentially magnifying returns and risks. Additionally, the Fund may take short equity positions in overvalued asset classes, striving to benefit from price declines. Overall, GDMA's approach focuses on navigating the dynamic investment landscape to optimize returns while managing risk effectively.

GDMA DIVIDEND

While the GDMA ETF primarily focuses on actively managed asset allocation strategies, it also incorporates dividend distributions as part of its investment approach. Dividend eligibility within the fund is influenced by the selection of various asset classes, including U.S. equities, foreign securities, currencies, bonds, and real estate investment trusts (REITs), with the portfolio managers considering both fundamental analysis and quantitative methods in their investment decisions. The dividend distribution policies for GDMA Dividend may vary depending on the performance and outlook for each asset class or security. The fund's investment sub-adviser, Gadsden, assists in managing the portfolio, with a combination of strategic and tactical approaches. Dividend distributions are subject to the recommendations made by Gadsden and the portfolio managers, aiming to maximize returns and manage risk across a diverse range of asset classes and market conditions. Investors in GDMA Dividend can potentially benefit from both capital appreciation and dividend income, as the fund adapts its investment strategy to prevailing market dynamics.

GDMA TRACKING

Tracking the Global Diversified Macro Asset ETF's strategy involves an active management approach aimed at capitalizing on the most attractive combined risk/return opportunities across various asset classes, including U.S. equities, foreign securities, currencies, bonds, and real estate investment trusts (REITs). This ETF employs both strategic and tactical approaches to portfolio management, with the flexibility to invest globally and allocate assets dynamically based on macroeconomic factors. The fund utilizes a blend of fundamental analysis and quantitative methods, including a proprietary investment model, to guide its investment decisions. Additionally, it may utilize exchange-traded vehicles such as ETFs, futures contracts, and short equity positions to gain exposure to different asset classes, providing investors with a diversified and dynamic investment strategy.

GDMA CORRELATION

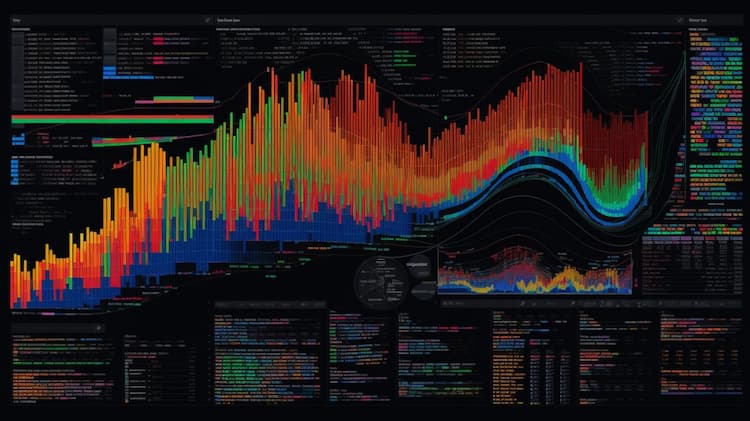

The correlation aspect of the GDMA ETF (Exchange-Traded Fund) is a critical factor in understanding its behavior within various asset classes. As an actively managed ETF, GDMA seeks to capitalize on attractive risk/return opportunities across a diverse range of investments, including U.S. equities, foreign securities, currencies, bonds, and real estate investment trusts (REITs). This strategic approach to asset allocation allows GDMA to have exposure to different asset classes, regions, and market capitalizations. Investors who are interested in analyzing the correlation of GDMA with other assets and sectors will find value in our tool, ETF Insider. With its web app and simple visualization tools, ETF Insider offers comprehensive and deep insights into the correlations of GDMA with various asset classes and sectors. It helps investors make informed decisions, identify trends, and assess the overlap between GDMA and other investment options. Whether you're seeking to diversify your portfolio, manage risk, or explore correlations in the ETF market, ETF Insider is your go-to resource for in-depth analysis and valuable insights into GDMA and other U.S. ETFs.

GDMA SECTOR

The GDMA Sector ETF is an actively managed exchange-traded fund (ETF) that employs a strategic and tactical approach to investing in a wide range of asset classes, including U.S. equities, foreign securities, currencies, bonds, and real estate investment trusts (REITs). The portfolio managers make allocation decisions based on their long-term macroeconomic view, with the flexibility to adjust investments in response to short-term market conditions. This approach may result in significant exposure to a single asset class or sector, and the fund may utilize both low-risk and high-risk asset classes. Additionally, GDMA Sector ETF may invest in other exchange-traded vehicles, including ETFs and derivatives, to gain exposure to various asset classes, and it may take short equity positions based on the Sub-Adviser's fundamental analysis. Investors should be aware that the fund's use of financial leverage and short positions can lead to increased portfolio volatility and risk.

GDMA EXPOSURE

The exposure of the GDMA ETF is a unique blend of strategic and tactical approaches across a wide range of asset classes and securities. GDMA, managed by Gadsden, offers investors exposure to various global asset classes, including U.S. equities, foreign securities, currencies, bonds, and real estate investment trusts (REITs). The fund''s managers use a combination of fundamental analysis and quantitative methods to identify investments, with a focus on potential high-income opportunities and superior risk-return profiles. This approach provides GDMA with the flexibility to invest in different sectors, regions, and market capitalizations, adapting its allocation based on the projected investment environment. Additionally, the fund may utilize derivatives, short equity positions, and exchange-traded vehicles to optimize its exposure and returns, making GDMA an intriguing option for those seeking diverse investment opportunities.