GLTR VS GDXJ

Compare the GLTR and GDXJ ETFs with our thorough analysis. Dive into the performance metrics, underlying assets, and investment strategies.

The ETFS Physical Precious Metals Basket Shares ETF (GLTR) is an exchange-traded fund incorporated in the USA. This fund seeks to mirror the price performance of a basket of physical precious metals, including gold, silver, platinum, and palladium, while accounting for associated expenses. The ETF provides investors with a practical and efficient means to invest in precious metals, offering exposure to these valuable commodities with limited credit risk.

The Aberdeen Standard Physical Precious Metals Basket Shares ETF (GLTR) is primarily designed to track the performance of a basket of physical precious metals, including gold, silver, platinum, and palladium. While the ETF's main focus is on replicating the metals' price movements, it may distribute dividends based on any income generated from its underlying holdings. Dividend distribution frequency and amounts, if any, can be influenced by factors such as changes in the prices of the constituent metals and the ETF's expenses. Investors seeking exposure to physical precious metals and potential dividend distributions might consider GLTR as part of their portfolio.

The Aberdeen Standard Physical Precious Metals Basket Shares ETF (GLTR) is designed to closely track the performance of a basket of physical precious metals, including gold, silver, platinum, and palladium. GLTR provides investors with a convenient and cost-effective way to gain exposure to the precious metals market without the challenges associated with owning physical metals directly. By aligning with the performance of these valuable commodities, GLTR serves as a valuable addition to portfolios seeking diversification and protection against market uncertainties.

The correlation analysis of the abrdn Physical Precious Metals Basket Shares ETF (GLTR) provides insights into its relationship with the prices of physical gold, silver, platinum, and palladium. Given its investment objective to reflect the performance of this precious metals basket, GLTR's correlation with these metals can be a crucial factor for investors assessing its potential role in their portfolios. For investors looking to delve deeper into correlation patterns and gain a comprehensive understanding of GLTR's behavior, the ETF Insider's web app offers a valuable tool. By visualizing correlations and overlaps, investors can make more informed decisions about including GLTR in their investment strategies.GLTR Sector

The Aberdeen Standard Physical Precious Metals Basket Shares ETF (GLTR) focuses on the precious metals sector, aiming to reflect the performance of a basket of physical gold, silver, platinum, and palladium. This ETF provides investors with an opportunity to participate in the precious metals market, offering exposure to a diverse range of valuable commodities. The concentration on precious metals within GLTR's sector allocation can serve as a hedge against economic uncertainties and currency fluctuations.GLTR Exposure

The exposure profile of the Aberdeen Standard Physical Precious Metals Basket Shares ETF (GLTR) centers around providing investors with a straightforward avenue to participate in the performance of a basket of physical precious metals, including gold, silver, platinum, and palladium. As a result, GLTR offers a means for investors to gain exposure to the dynamics of the precious metals market, hedging against potential economic uncertainties and diversifying their portfolios. For investors looking to tap into the potential value and resilience of precious metals, GLTR's exposure offers a valuable pathway.

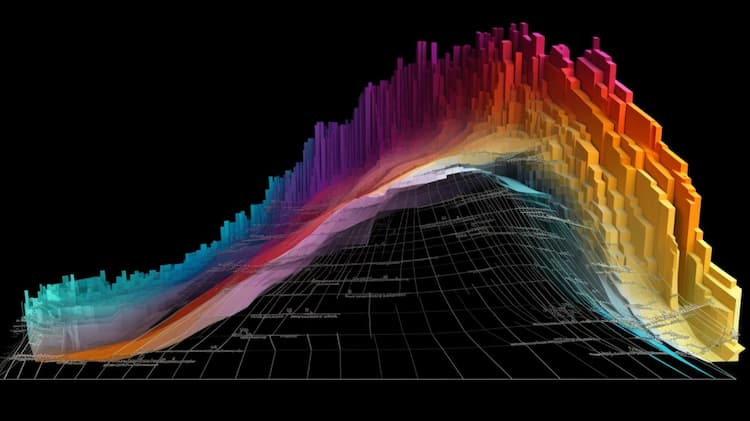

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

Compare the GLTR and GDXJ ETFs with our thorough analysis. Dive into the performance metrics, underlying assets, and investment strategies.

Compare the GLTR and GDX ETFs with our thorough analysis. Dive into the performance metrics, underlying assets, and investment strategies.

The GLTR ETF, or "Physical Precious Metals Basket ETF," is a specialized investment fund that offers exposure to a diversified basket of physical precious metals. This article explores the composition of the GLTR ETF, the precious metals it includes, and the potential benefits of holding a diversified mix of precious metals as a hedge against economic uncertainties and inflation. Investors can gain insights into how the GLTR ETF operates and its role in a well-balanced investment strategy.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.