CNDA VS HEWC: Capitalization and Strategy

CNDA and HEWC are both ETFs that focus on Canadian equities. However, they differ in their approach due to currency hedging. Read our article.

The iShares S&P/TSX 60 Index ETF (HEWC) is a fund that prioritizes stability and consistency in its investment strategy. According to its sources, the fund aims to allocate at least 80% of its assets to the component securities and other instruments of its underlying index. This underlying index is meticulously designed to gauge the performance of the large- and mid-capitalization segments within the Canadian equity market. Notably, the fund adopts a proactive approach to manage currency risk, as it hedges the inherent currency risks associated with the securities in the underlying index to the U.S. dollar on a monthly basis. By focusing on assets with economic characteristics substantially identical to those of the underlying index, HEWC aims to provide investors with a reliable and balanced exposure to the Canadian equity market while mitigating the impact of currency fluctuations.

The iShares S&P/TSX 60 Index ETF (HEWC) is known for its dividend distribution strategy, providing investors with a source of income in addition to potential capital appreciation. The fund typically invests at least 80% of its assets in the component securities and instruments of its underlying index, which is designed to measure the performance of the large- and mid-capitalization segments of the Canadian equity market. HEWC's dividend payments are influenced by the performance of the underlying securities, reflecting the dividend yields of the companies included in the index. Investors in HEWC can benefit from regular income streams, making it an attractive option for those seeking a combination of capital growth and dividend income within the Canadian equity market. As with any investment, potential investors should carefully review the fund's dividend history, policies, and market conditions to make informed decisions based on their financial goals and risk tolerance.

The iShares S&P/TSX 60 Index ETF (HEWC) is recognized for its commitment to accurately tracking the performance of its underlying index. With the objective of mirroring the large- and mid-capitalization segments of the Canadian equity market, HEWC diligently invests at least 80% of its assets in the component securities and other instruments of the specified index. The fund employs a tracking strategy that aims to replicate the economic characteristics of its benchmark index, ensuring a close correlation between the fund's returns and the index's performance. This meticulous tracking approach allows investors in HEWC to gain exposure to the Canadian equity market with a high degree of accuracy. It is essential for investors to monitor the fund's tracking error and other performance metrics to assess the effectiveness of HEWC in delivering results consistent with its underlying index.

The iShares S&P/TSX 60 Index ETF (HEWC) demonstrates a strong correlation with its underlying index, emphasizing its commitment to accurately reflecting the performance of the large- and mid-capitalization segments of the Canadian equity market. By investing at least 80% of its assets in the component securities and other instruments of its benchmark index, HEWC seeks to maintain a close alignment between its returns and the index's movements. This commitment to correlation is crucial for investors seeking to replicate the market exposure provided by the underlying index. Monitoring the correlation coefficient over time can offer insights into the fund's ability to effectively track the index, providing investors with confidence in the reliability of HEWC as a tool for gaining exposure to the Canadian equity market and managing investment risk.

The iShares S&P/TSX 60 Index ETF (HEWC) offers investors exposure to a diversified range of sectors within the Canadian equity market. As a fund designed to track the performance of the S&P/TSX 60 Index, HEWC invests at least 80% of its assets in the component securities and other instruments of this benchmark index. The S&P/TSX 60 Index itself represents the large- and mid-capitalization segments of the Canadian market, encompassing various sectors such as finance, energy, materials, and technology. HEWC's sector allocation is influenced by the composition of the underlying index, providing investors with a broad and comprehensive representation of the Canadian economy. This diversification can be beneficial for investors seeking exposure to multiple sectors within a single investment vehicle, allowing for a balanced and well-rounded portfolio approach. It is advisable for investors to assess the specific sectoral composition of both HEWC and the underlying index to align their investment strategy with their risk tolerance and financial objectives.

The iShares S&P/TSX 60 Index ETF (HEWC) offers investors a focused exposure to the Canadian equity market, specifically targeting the large- and mid-capitalization segments. With a mandate to invest at least 80% of its assets in the component securities and other instruments of its underlying index, HEWC provides a comprehensive representation of the Canadian stock market. Investors in HEWC gain exposure to a diverse range of sectors, including finance, energy, materials, and technology, as dictated by the composition of the S&P/TSX 60 Index. Furthermore, the fund's commitment to monthly hedging of currency risks ensures that the exposure is not only broad but also managed in consideration of fluctuations in currency values, particularly against the U.S. dollar. HEWC's exposure aligns with the economic characteristics of its benchmark index, providing investors with a reliable instrument to capture the performance of the Canadian equity market while mitigating certain risks. Investors looking for targeted exposure to the Canadian market may find HEWC a suitable option for building a well-rounded investment portfolio.

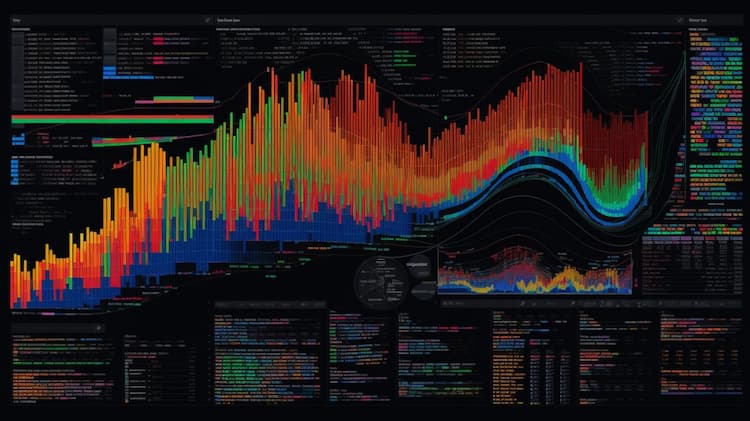

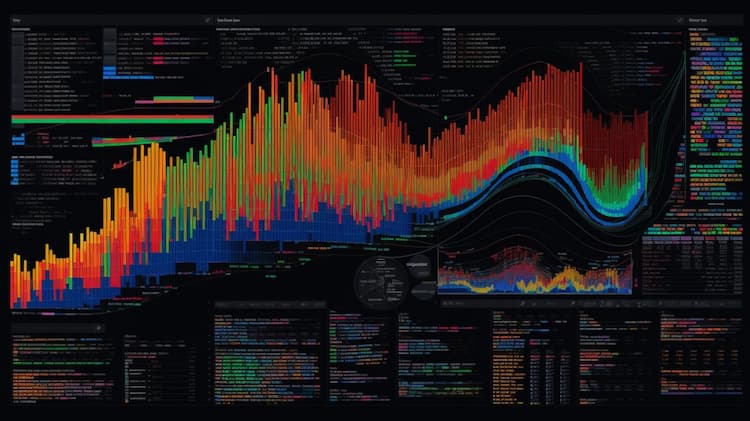

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

CNDA and HEWC are both ETFs that focus on Canadian equities. However, they differ in their approach due to currency hedging. Read our article.

EWC VS hewc are specialized investment funds that focus on a diverse range of sectors in the financial market. these exchange-traded funds offer investors exposure to various industries and companies, presenting potential growth opportunities and risks. it's essential to understand the underlying assets and strategies of these etfs before considering an investment.

FXC VS hewc are specialized investment funds that focus on a diverse range of sectors in the financial market. these exchange-traded funds offer investors exposure to various industries and companies, presenting potential growth opportunities and risks. it's essential to understand the underlying assets and strategies of these etfs before considering an investment.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.