GLTR VS GOEX

Compare the GLTR and GOEX ETFs with our thorough analysis. Dive into the performance metrics, underlying assets, and investment strategies.

The iShares U.S. Consumer Focused ETF (IEDI) is managed by BlackRock, one of the world's largest and most prominent asset management firms. BlackRock, founded in 1988, has a strong track record of providing innovative investment solutions to a diverse range of investors. IEDI is designed to offer exposure to U.S. listed common stocks of companies in the consumer discretionary spending sector. The fund utilizes sophisticated data analysis tools, including machine learning and natural language processing, to identify and allocate investments based on a proprietary classification system. This forward-looking approach allows IEDI to dynamically adapt to evolving business models and consumer trends, making it a unique choice for investors seeking targeted exposure to the consumer-focused sector.

The iShares U.S. Consumer Focused ETF (IEDI) primarily aims to invest in U.S. listed common stocks of consumer discretionary spending companies. While its primary focus is on capital appreciation, IEDI reflects the dividend distribution of the underlying companies within its portfolio. The ETF typically distributes dividends on a quarterly basis, and eligibility for these dividends is determined by the individual dividend policies and performances of the constituent companies. IEDI's allocation rules are designed to target increased exposure to companies with a greater proportion of consumer spending revenues and consumer goods and services production in the U.S. relative to its proprietary classification system, known as the Consumer Discretionary Spending Evolved Sector. Investors looking for exposure to consumer-focused companies with potential dividend income may find IEDI suitable for their investment goals.

The iShares Evolved U.S. Discretionary Spending ETF (IEDI) is meticulously designed to track the performance of the S&P U.S. Discretionary Spending Select Industry Index. IEDI strategically invests in a diverse portfolio of U.S. discretionary spending-related stocks, utilizing an evolved methodology to adapt to changes in the sector. By closely aligning with the index, the ETF aims to offer investors exposure to companies within the discretionary spending sector, serving as a tool for those seeking to gauge the performance of this segment within the U.S. equity market. IEDI's commitment to effective tracking and its evolved approach enhance its appeal for investors interested in discretionary spending trends.

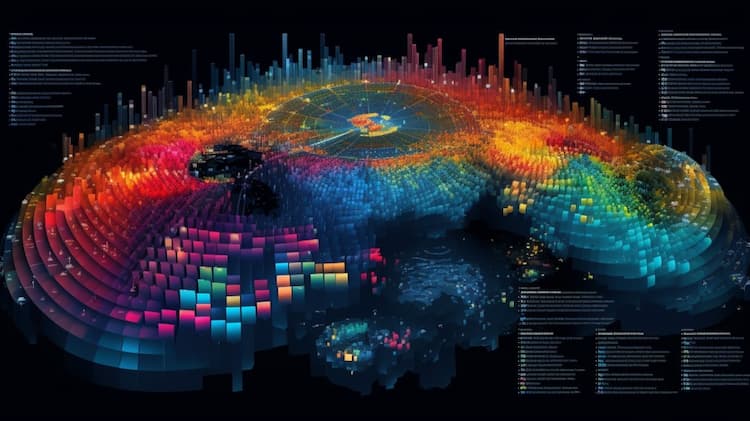

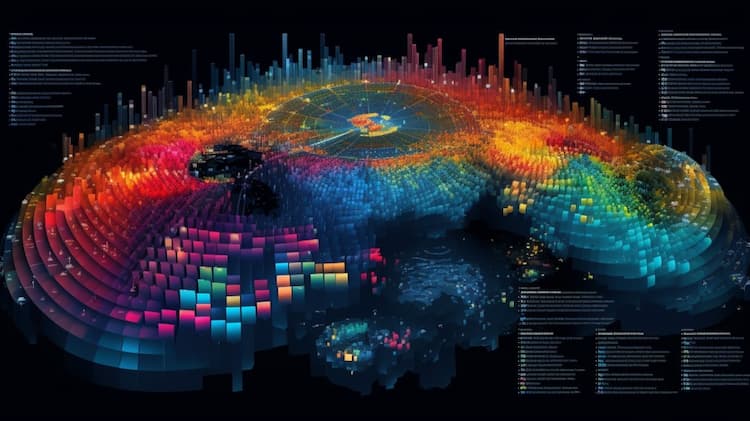

The correlation aspect of the iShares U.S. Consumer Focused ETF focuses on its relationship with the performance of large-, mid-, and small-cap consumer discretionary spending companies in the United States. Given its investment objective, this ETF is expected to exhibit a strong correlation with the Consumer Discretionary Spending Evolved Sector, making it a valuable tool for investors looking to gain exposure to this sector. To delve deeper into these correlations and explore the overlap with other assets, you can use our ETF Insider web app, which provides comprehensive data and visualization tools for all US ETFs, aiding in better-informed investment decisions.

The iShares U.S. Consumer Focused ETF (IEDI) primarily focuses on the consumer discretionary spending sector. This ETF seeks to invest at least 80% of its net assets in U.S. listed common stock of large, mid, and small-capitalization companies within the Consumer Discretionary Spending Evolved Sector. This sector includes companies with significant consumer spending revenues and consumer goods and services production in the U.S., as determined by a proprietary classification system that utilizes data analysis tools, machine learning, natural language processing (NLP), and clustering algorithms.

The exposure characteristic of the iShares U.S. Consumer Focused ETF (IEDI) centers around investments in U.S. listed common stocks of large, mid-, and small-capitalization consumer discretionary spending companies. IEDI''s investment strategy aims to target increased exposure to U.S. companies with a greater proportion of consumer spending revenues and consumer goods and service production in the U.S. relative to the broader Consumer Discretionary Spending Evolved Sector. The fund utilizes a forward-looking classification system that employs data analysis tools, including machine learning and natural language processing, to allocate companies to sectors, allowing for multi-dimensional classification. IEDI offers investors the opportunity to gain exposure to the dynamic consumer discretionary sector with a focus on companies aligned with U.S. consumer spending trends.

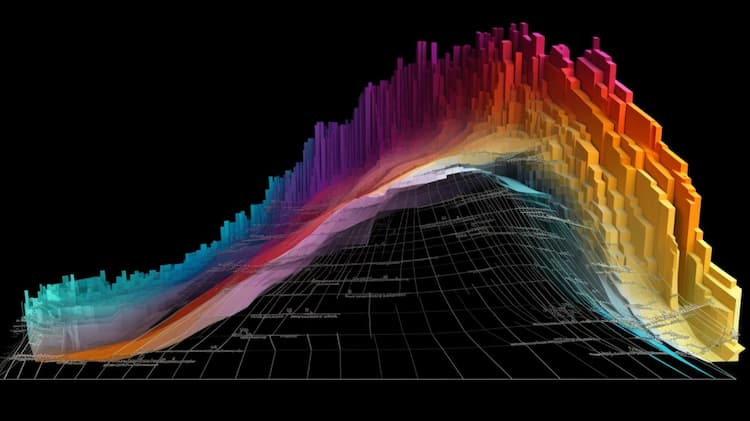

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

Compare the GLTR and GOEX ETFs with our thorough analysis. Dive into the performance metrics, underlying assets, and investment strategies.

The IEDI ETF (International Emerging Digital Innovators Exchange-Traded Fund) is a dynamic investment instrument that targets promising and innovative digital companies in emerging markets across the globe. This ETF provides investors with a unique opportunity to participate in the rapid growth of tech-savvy startups and tech giants from developing economies, tapping into the potential of the digital revolution in these regions. Explore how the IEDI ETF harnesses the power of digital innovation and its role in shaping the future of emerging markets.

Compare the GLTR and IAU ETFs with our thorough analysis. Dive into the performance metrics, underlying assets, and investment strategies.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.