How does the WBIL ETF work?

The WBIL ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

The John Hancock Multifactor Large Cap ETF (JHML) is managed by John Hancock Investment Management LLC. This issuer has a strong reputation for its multifactor investing approach, which involves a rules-based process to select and weight securities in the JHML ETF. They aim to comprise a subset of securities in the U.S.

The John Hancock Multifactor Large Cap ETF (JHML) focuses on replicating the performance of its underlying index, which is developed and managed by Dimensional Fund Advisors LP. This ETF invests at least 80% of its net assets in securities that constitute the index, which aims to include a subset of U.S. stocks with larger market capitalizations. The selection and weighting of securities in the index follow a multifactor, rules-based approach, taking into account factors such as market capitalization, relative price, and profitability.

Tracking the Dimensional U.S. Large Cap Index is the primary objective of the JHancock Multifactor Large Cap ETF (JHML). JHML typically invests at least 80% of its net assets in securities that make up its underlying index, which is managed by Dimensional Fund Advisors LP. The index focuses on a subset of U.S. stocks issued by companies with larger market capitalizations than the 801st largest U.S. company during reconstitution. This ETF follows a multifactor investment approach, considering factors such as market capitalization, relative price, and profitability to determine the weights of individual securities within the index. JHML's semiannual reconstitution and rebalancing process aims to provide investors with exposure to a diversified portfolio of large-cap U.S. stocks that closely mirrors the performance of the Dimensional U.S. Large Cap Index.

The correlation aspect of the John Hancock Multifactor Large Cap ETF (JHML) is important for investors looking to understand its performance in relation to the broader U.S. equity market. JHML follows a multifactor investing approach, aiming to replicate the performance of a subset of large-cap U.S. companies. While the specific correlation with the overall market may vary, JHML's multifactor strategy involves factors like market capitalization, relative price, and profitability, which can influence its correlation with various sectors and assets. To delve deeper into JHML's correlations and uncover valuable insights, investors can utilize the ETF Insider web app, offering comprehensive data and visualizations to analyze correlations and identify potential overlaps within their portfolios.

The John Hancock Multifactor Large Cap ETF (JHML) primarily focuses on the large-cap segment of the U.S. equity market. This ETF seeks to replicate the performance of the John Hancock Dimensional Large Cap Index, which is designed to include a subset of securities from the U.S. Universe with market capitalizations larger than that of the 801st largest U.S. company. JHML utilizes a multifactor investing approach, considering factors such as market capitalization, relative price, and profitability to select and weight securities within the index. The ETF may concentrate its investments in specific industries or groups of industries, aligning with the index's sector composition. This strategy aims to offer investors exposure to large-cap companies with potential for enhanced performance while maintaining a diversified approach within the sector.

The exposure characteristic of the John Hancock Multifactor Large Cap ETF (JHML) is centered around the U.S. large-cap equity market. JHML seeks to replicate the performance of the Dimensional U.S. Large Cap ETF Index, which is designed to include a subset of U.S. companies with market capitalizations larger than that of the 801st largest U.S. company at the time of reconstitution. This approach employs multifactor investing, factoring in market capitalization, relative price, and profitability to determine the weightings of individual securities within the index. Investors looking for exposure to established, large-cap U.S. companies will find JHML''s strategy appealing. The ETF''s underlying index undergoes semiannual reconstitution and rebalancing, ensuring that it reflects changes in the market landscape over time. JHML aims to closely track the index''s performance and may concentrate its investments in sectors or industries that align with the index''s composition. For those seeking a transparent and rules-based approach to large-cap U.S. equity exposure, JHML provides an investment vehicle worth considering.

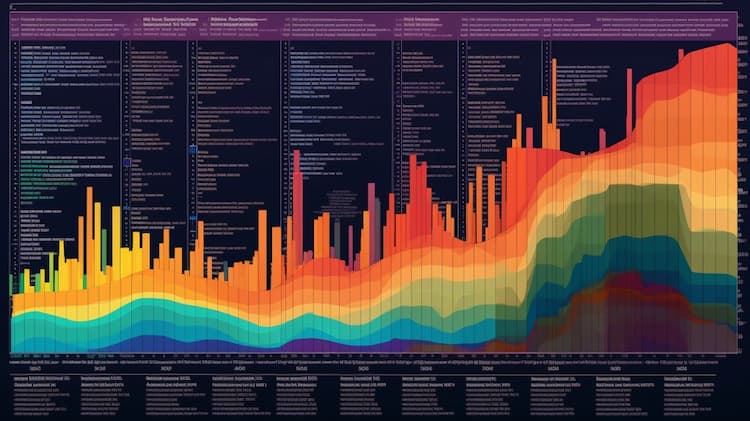

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

The WBIL ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

The JHML ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

The FBCG ETF is a specialized investment fund that focuses on global companies in the relevant sectors. This exchange-traded fund offers investors exposure to a diverse range of innovative and cutting-edge companies engaged in advancements in the industry. Discover the potential growth opportunities and risks associated with investing in this dynamic sector through the FBCG ETF.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.