How does the KEMQ ETF work?

The KEMQ ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

Krane Funds Advisors, LLC, the issuer of KEMQ, follows a disciplined investment approach outlined in its prospectus. Primarily, the fund seeks to invest at least 80% of its net assets in instruments mirroring its Underlying Index, which consists of the top 50 companies by market capitalization deriving the most revenue from Emerging Markets. These companies are predominantly in the consumer or technology sectors, as classified by the FactSet Revere Business Industry Classification system. The Index, managed by Solactive AG, excludes stocks primarily listed on the Shanghai or Shenzhen Stock Exchanges, as well as over-the-counter traded stocks. While the fund may allocate up to 20% of its assets to non-index instruments, including derivatives and other investment companies, it aims to closely track the performance of its Underlying Index. Notably, the fund may include China-related securities such as A-Shares, B-Shares, N-Shares, P-Chips, Red Chips, and S-Chips, subject to certain conditions. As of May 31, 2023, the Underlying Index consisted of companies with market capitalizations ranging from approximately $508 million to $547.6 billion, with China and South Korea being the most represented markets. With a quarterly rebalancing schedule, the Fund's concentration typically reflects that of the Underlying Index, which as of May 31, 2023, indicated significant holdings in the Communication Services and Consumer Discretionary sectors.

KEMQ, the Krane Funds Advisors, LLC dividend policy reflects its commitment to generating returns for investors through its investment strategies. As an exchange-traded fund (ETF), KEMQ may distribute dividends to shareholders derived from the income earned from the underlying securities in its portfolio. The fund primarily focuses on investing in emerging market companies in the consumer and technology sectors, as outlined in its investment strategy. Consequently, the dividend yield of KEMQ is influenced by the dividend-paying behavior of the companies within its portfolio, as well as market conditions and economic factors affecting emerging markets. Shareholders can expect periodic dividend distributions, although the amount and frequency may vary based on the performance of the underlying securities and the fund's investment objectives. Investors seeking exposure to emerging market dividends may find KEMQ's dividend policy and investment approach appealing.

KEMQ, managed by Krane Funds Advisors, LLC, aims to closely track the performance of its underlying index, which consists of the 50 largest companies by market capitalization deriving the most revenue from emerging markets, particularly in the consumer and technology sectors. While the fund reserves the right to replicate the underlying index, it typically utilizes representative sampling to achieve its tracking objectives. Representative sampling involves investing in a selection of securities that collectively exhibit similar characteristics to the index, thereby providing investors with exposure to the broader market while managing costs and mitigating risks associated with full replication. Through diligent portfolio management and strategic investment decisions, KEMQ endeavors to deliver returns that closely mirror those of its benchmark index, ensuring investors have access to the potential growth opportunities offered by emerging market equities.

KEMQ, under the management of Krane Funds Advisors, LLC, is subject to various market dynamics, including correlations with other financial instruments and market indices. As an exchange-traded fund (ETF) focused on emerging market equities in the consumer and technology sectors, KEMQ's correlation may be influenced by factors such as sector performance, global economic conditions, and investor sentiment towards emerging markets. The fund's correlation with broader market indices, such as global equity benchmarks or regional emerging market indices, may fluctuate over time based on changes in market conditions and underlying portfolio composition. While KEMQ seeks to deliver returns that closely track its underlying index, its correlation with other assets may vary, providing investors with diversification benefits within their portfolios. Monitoring KEMQ's correlation with relevant benchmarks and asset classes can aid investors in assessing its effectiveness as a diversification tool and understanding its risk-return profile in the context of broader market movements.

KEMQ, managed by Krane Funds Advisors, LLC, exhibits a sector focus primarily on emerging market companies within the consumer and technology sectors. This strategic emphasis aligns with the fund's investment objective of capitalizing on the growth potential offered by these dynamic sectors in emerging markets. By concentrating its holdings in companies operating in consumer-driven and technology-driven industries, KEMQ aims to capture opportunities arising from evolving consumer preferences, technological advancements, and increasing digitalization across emerging market economies. This sector-focused approach allows the fund to provide investors with targeted exposure to sectors poised for significant growth while navigating the diverse landscape of emerging market equities. Additionally, by emphasizing sectors that are integral to the long-term development of emerging markets, KEMQ seeks to deliver competitive returns and capitalize on the transformative trends shaping these economies.

KEMQ, managed by Krane Funds Advisors, LLC, offers investors exposure to the vibrant landscape of emerging market equities, with a particular emphasis on companies operating within the consumer and technology sectors. The fund's investment strategy targets the 50 largest companies by market capitalization that derive the most revenue from emerging markets, providing a diversified portfolio that reflects the economic dynamism and growth potential of these regions. Through its exposure to emerging market equities, KEMQ seeks to capitalize on various secular trends, including rising consumer consumption, technological innovation, and increasing digitalization, which are driving economic expansion and corporate profitability in emerging markets. This exposure enables investors to participate in the growth opportunities presented by rapidly developing economies while managing risks associated with investing in these markets. By focusing on sectors poised for robust growth and selecting companies with strong fundamentals and growth prospects, KEMQ aims to deliver attractive returns to investors seeking exposure to emerging market equities.

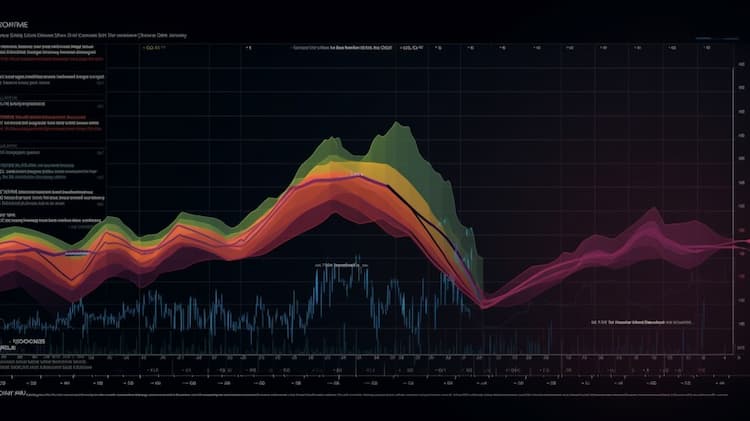

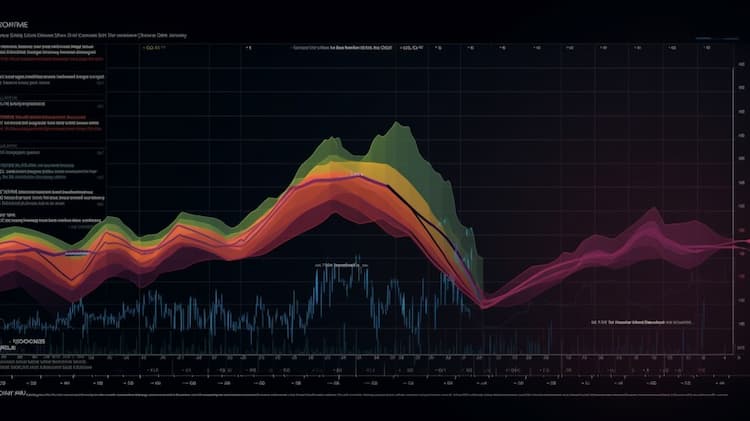

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

The KEMQ ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

Explore the top BNY Mellon Exchange-Traded Funds (ETFs) and unlock a world of investment possibilities. From diversified portfolios to specialized sectors, our article highlights the best BNY Mellon ETFs that offer excellent growth potential, stability, and a track record of success. Gain valuable insights into these funds to make informed investment decisions and optimize your portfolio.

The TRTY ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.