What is the LTPZ ETF ?

Discover the world of ETFs and dive into the LTPZ ETF in this informative article. Learn about the features, benefits, and potential advantages of investing in this specific exchange-traded fund.

The issuer of LTPZ (PIMCO 15+ Year US TIPS Index ETF) is Pacific Investment Management Company LLC (PIMCO). PIMCO manages the fund's investments, aiming to track the ICE BofA 15+ Year US Inflation-Linked Treasury Index by investing primarily in Treasury Inflation-Protected Securities (TIPS) with at least 15 years to maturity. The fund may also invest in other fixed income instruments and utilize derivative instruments to achieve its investment objective.

This fund aims to provide attractive dividends by investing primarily in Treasury Inflation-Protected Securities (TIPS) with over 15 years to maturity. Managed by PIMCO, it may also utilize fixed income instruments and derivatives while closely tracking the ICE BofA 15+ Year US Inflation-Linked Treasury Index. The strategy focuses on income earned from investments and potential capital appreciation driven by changes in real interest rates and inflation.

The LTPZ fund aims to achieve its investment objective by primarily investing in securities that closely mirror the ICE BofA 15+ Year US Inflation-Linked Treasury Index. This index includes Treasury Inflation-Protected Securities (TIPS) with over 15 years to maturity, providing exposure to inflation-linked returns. The fund uses a representative sampling strategy to approximate the index's composition, potentially reducing active management risks while seeking to match the index's performance.

The investment strategy of LTPZ, focused on tracking the ICE BofA 15+ Year US Inflation-Linked Treasury Index, involves investing in a portfolio of Component Securities and other Fixed Income Instruments. The Fund aims to maintain a correlation with its Underlying Index by utilizing a representative sampling strategy. This strategy may result in some deviation from the index's performance due to variations in proportions. The Fund's use of derivatives and investment techniques contributes to its total return objective, driven by income and capital appreciation from interest rate changes and inflation-linked bonds.

The LTPZ ETF primarily focuses on the Fixed Income Instruments sector, aiming to achieve its investment objective by investing at least 80% of its assets in component securities of the ICE BofA 15+ Year US Inflation-Linked Treasury Index. These instruments include bonds and debt securities issued by various U.S. and non-U.S. public- or private-sector entities. The ETF may also invest in derivative instruments, options, futures contracts, or swap agreements, while aiming to track its underlying index's average portfolio maturity closely.

The PIMCO LTPZ Fund (LTPZ) aims to achieve its objective by investing at least 80% of its assets in component securities of the ICE BofA 15+ Year US Inflation-Linked Treasury Index. The fund's remaining assets are allocated to fixed income instruments not included in the index but aligned with its tracking, as well as cash, short-term instruments, and derivatives. The fund's exposure closely mirrors the average maturity of the index, composed mainly of Treasury Inflation-Protected Securities (TIPS) with 15+ years to maturity, offering protection against inflation and income potential.

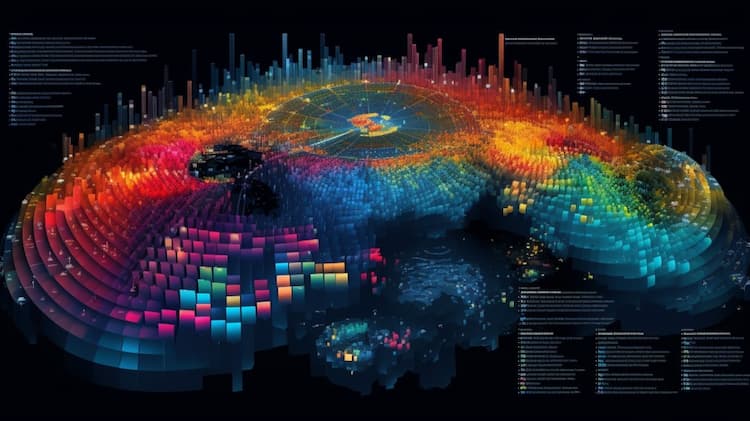

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

Discover the world of ETFs and dive into the LTPZ ETF in this informative article. Learn about the features, benefits, and potential advantages of investing in this specific exchange-traded fund.

The MEDX ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

Discover the DRN ETF and the FFTG ETF, two prominent investment vehicles in the financial market. Learn about their features, objectives, and potential benefits as popular choices for investors seeking exposure to specific sectors or strategies.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.