How does the FPFD ETF work?

The FPFD ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

The Global X Millennials Thematic ETF (MILN) is managed by Global X Management Company LLC. MILN seeks to replicate the performance of the Indxx Millennials Thematic Index, focusing on U.S. listed companies that provide exposure to millennial generation consumption trends.

While the Global X Millennials Thematic ETF (MILN) primarily focuses on tracking the Indxx Millennials Thematic Index, it's worth noting its dividend distribution policy. MILN's dividend distributions typically align with the underlying index's constituent companies' dividend policies and performances. These distributions are made on a periodic basis, and MILN investors can expect them to be influenced by the individual dividend practices of the companies within the thematic index. Though MILN is designed to capture millennial generation consumption trends, its dividend returns may vary based on the dividend policies of the included companies, which may not always prioritize dividend payments.

Tracking the Indxx Millennials Thematic Index is the primary objective of the MILN ETF (Exchange-Traded Fund). MILN allocates over 80% of its total assets to securities included in the Indxx Millennials Thematic Index, which focuses on U.S. listed companies providing exposure to millennial generation consumption trends. This index identifies and includes companies that either derive a significant portion of their revenue from key spending categories like Social and Entertainment, Clothing and Apparel, Travel and Mobility, Food/Restaurants and Consumer Staples, Financial Services and Investments, Housing and Home Goods, Education and Employment, and Health and Fitness, or have stated their primary business in these categories. The ETF aims to mirror the index's performance by adopting a passive investment approach, seeking to achieve a correlation of over 95% with the Underlying Index, before fees and expenses.

The correlation aspect of the Global X Millennials Thematic ETF (MILN) is essential in understanding its performance in relation to the millennial generation's consumption trends. As MILN seeks to track the Indxx Millennials Thematic Index, its correlation with companies reflecting millennial preferences and spending habits is expected to be high. This strong correlation makes MILN a valuable tool for investors looking to capitalize on millennial consumer trends, providing insights into the performance of companies catering to this demographic.

The Global X Millennials Thematic ETF (MILN) focuses on capturing the investment potential of companies associated with millennial generation consumption trends. These trends encompass a broad spectrum, including Social and Entertainment, Clothing and Apparel, Travel and Mobility, Food/Restaurants, Financial Services, Housing, Education, and Health and Fitness. By investing in companies that cater to the spending habits and preferences of millennials, this ETF provides investors with exposure to a diverse range of industries that are aligned with the evolving consumer landscape. However, it's important to note that the ETF may have significant concentration in specific sectors, particularly consumer discretionary, which can influence its risk profile and performance.

The exposure characteristic of the Global X Millennials Thematic ETF (MILN) is centered around capturing the investment potential of companies linked to millennial generation consumption trends. The ETF tracks the Indxx Millennials Thematic Index, which is composed of U.S. listed companies that have significant exposure to various spending categories relevant to millennials, such as Social and Entertainment, Clothing and Apparel, Travel and Mobility, Food/Restaurants and Consumer Staples, Financial Services and Investments, Housing and Home Goods, Education and Employment, and Health and Fitness. By offering exposure to these segments of the market, MILN allows investors to tap into the evolving consumer preferences and behaviors of the millennial generation.

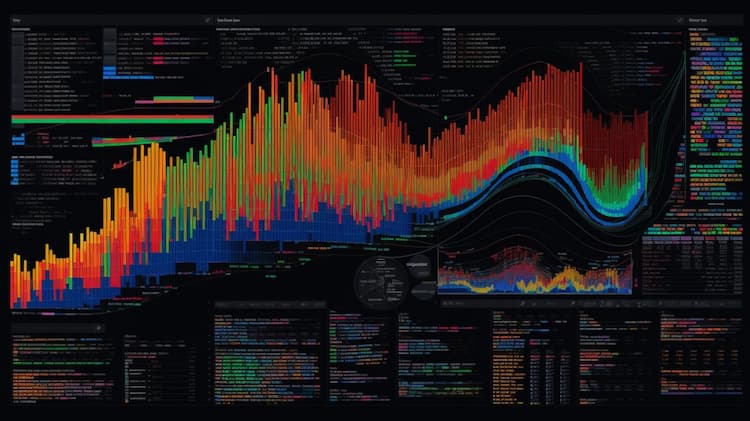

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

The FPFD ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

Compare the PHYG and PHYS ETFs with our thorough analysis. Dive into the performance metrics, underlying assets, and investment strategies to see how they stack up against each other. Whether you're a seasoned investor or just getting started, our comparison provides valuable insights to guide your investment decisions.

The MILN ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.