GDXJ VS GDX

Compare the GDXJ and GDX ETFs with our thorough analysis. Dive into the performance metrics, underlying assets, and investment strategies.

The MMSC ETF, formally known as the Multi-Manager Small Cap Growth ETF, is managed by First Trust Advisors L.P. This ETF's primary focus is to invest at least 80% of its net assets in equity securities issued by small capitalization companies, as defined by the Russell 2000® Growth Index. To achieve this objective, the MMSC ETF employs a multi-manager approach, blending the expertise of leading asset management firms, Driehaus Capital Management LLC (DCM), and Stephens Investment Management Group, LLC (SIMG). Each sub-advisor brings its unique investment philosophy and strategy to the ETF, providing diversified expertise in the small capitalization growth segment of the equity market.

While the MMSC ETF primarily seeks to track the performance of the broader market, it does offer some dividend potential. Dividends from MMSC are typically distributed on a quarterly basis, subject to the dividend policies and financial performance of the underlying constituents. Investors in MMSC can expect a mix of capital appreciation and potential dividend income, making it a well-rounded investment option for those looking to participate in both aspects of the market.

The MMSC ETF, or Multi-Manager Small Cap Tracking ETF, primarily focuses on tracking the performance of small-capitalization companies within the equity market. This ETF invests at least 80% of its net assets in equity securities issued by small-cap companies, which are defined as those companies falling within the market capitalization range of the Russell 2000® Growth Index. As of November 30, 2022, this index ranged from $23 million to $10,678 million in market capitalization. The fund employs a multi-manager approach, utilizing the expertise of various asset management firms, including Driehaus Capital Management LLC (DCM) and Stephens Investment Management Group, LLC (SIMG), each with its unique investment philosophy. DCM emphasizes strong fundamentals and takes environmental, social, and governance (ESG) factors into account, while SIMG leverages behavioral finance principles to identify companies with superior growth prospects, categorizing them as Earnings Catalyst or Core Growth. This multi-manager strategy allows the MMSC ETF to effectively align with the small-cap growth segment of the equity market, providing investors with diversified exposure to this investment category.

The correlation aspect of the First Trust Multi-Manager Sm Cap Opportunities ETFplays a crucial role in understanding its behavior in relation to the broader U.S. small capitalization growth equity market. Since

The MMSC ETF provides investors with exposure to a specific sector, which is essential to understand for portfolio diversification and risk management. Depending on its underlying index, MMSC might focus on industries ranging from technology to healthcare or financials. Investors interested in MMSC should delve deeper into its holdings to grasp its sectoral concentration and the potential opportunities and risks associated with that sector.

The exposure characteristic of the MMSC ETF (MegaMarket Small Cap ETF) is centered around its investment objective, which is to track the performance of the Nasdaq Victory US Small Cap High Dividend 100 Volatility Weighted Index. This index focuses on the small-cap segment of the U.S. equity market with an emphasis on dividend yield and volatility weighting. The index selection process begins with the Nasdaq Victory US Small Cap 500 Volatility Weighted Index, which comprises the 500 largest U.S. companies with market capitalizations of less than $3 billion and positive earnings. From this universe, the index identifies the top 100 highest dividend-yielding stocks and weights them based on their daily standard deviation (volatility) of price changes over the last 180 trading days. This strategy aims to provide investors with exposure to a diversified portfolio of small-cap stocks while controlling for individual security risk and emphasizing dividend income.

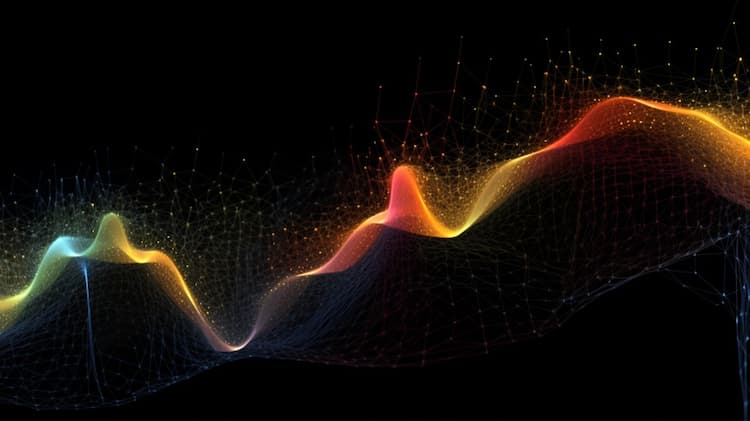

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

Compare the GDXJ and GDX ETFs with our thorough analysis. Dive into the performance metrics, underlying assets, and investment strategies.

The MMSC ETF is a specialized investment fund that focuses on global companies in the relevant sectors. This exchange-traded fund offers investors exposure to a diverse range of innovative and cutting-edge companies engaged in advancements in the industry. Discover the potential growth opportunities and risks associated with investing in this dynamic sector through the MMSC ETF.

Discover the world of Exchange-Traded Funds (ETFs) and unravel the mystery behind the BNDX ETF. This article delves into the essence of ETFs and sheds light on the specific features and characteristics of the BNDX ETF. Gain valuable insights into this popular investment vehicle and its potential benefits for investors.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.