AGG VS IJH: A Comparison of ETFs

Choosing between AGG and IJH boils down to your investment goals, risk tolerance, and market outlook. Both ETFs have their pros and cons.

The NetLease Corporate Real Estate ETF is managed by Fundamental Income Strategies, LLC, the Index Provider. This ETF utilizes a passive management approach to track the performance of the Fundamental Income Net Lease Real Estate Index, which measures the net lease real estate sector's performance in the U.S. equity market. Net lease real estate involves tenants covering taxes, fees, and maintenance costs, in addition to rent, making it a unique sector within the real estate industry. The Index is composed of U.S.-listed equity securities of companies deriving at least 85% of their earnings or revenues from real estate operations in the net lease real estate sector, including real estate investment trusts (REITs). It is rebalanced quarterly, and as of June 1, 2023, consisted of 22 securities, with the three largest being Stag Industrial Inc., National Retail Properties Inc., and Realty Income Corporation. The NetLease Corporate Real Estate ETF aims to provide investors with exposure to this specialized segment of the real estate market while maintaining a focus on diversification and liquidity.

The NETLease Corporate Real Estate ETF (NETL) offers investors an opportunity to benefit from the passive management approach that tracks the performance of the Fundamental Income Net Lease Real Estate Index. This index focuses on the net lease real estate sector of the U.S. equity market, encompassing companies that derive at least 85% of their earnings or revenues from real estate operations in this sector, including real estate investment trusts (REITs). NETL's dividend distributions are influenced by the individual dividend policies and performances of its constituent companies. While the primary objective of NETL is to replicate the index, investors may still expect periodic dividend distributions as a result of the real estate sector's inherent income-producing nature.

Tracking the performance of the Bloomberg Barclays 1-3 Year U.S. Treasury Bond Index is the central focus of the NETLease Corporate Real Estate ETF (NETL). NETL invests in a diversified portfolio of short-term U.S. Treasury bonds, aiming to closely align with the index's composition. This strategic approach allows NETL to provide investors with exposure to short-term government debt, offering potential income and stability in a well-defined segment of the fixed-income market. NETL's commitment to effectively tracking its benchmark makes it a compelling choice for investors seeking a conservative fixed-income option.

The correlation aspect of the NetLease Corporate Real Estate ETF (NETL) is a key factor for investors looking to understand its performance in relation to the net lease real estate sector of the U.S. equity market. Given that NETL tracks the Fundamental Income Net Lease Real Estate Index, it exhibits a strong correlation with the performance of companies in this sector, particularly those engaged in net lease real estate operations. This correlation can provide valuable insights for investors seeking exposure to the real estate market with a focus on net lease properties. If you want to delve deeper into NETL's correlations and explore its overlap with other assets, ETF Insider's web app offers a user-friendly tool for visualizing and analyzing these relationships, helping you make informed investment decisions.

The NetLease Corporate Real Estate ETF (NETL) primarily focuses on the net lease real estate sector of the U.S. equity market. Net lease real estate involves commercial properties where tenants are responsible for paying taxes, fees, and maintenance costs in addition to rent. This ETF invests in U.S.-listed equity securities of companies deriving at least 85% of their earnings or revenues from real estate operations in this sector, including real estate investment trusts (REITs). As of June 1, 2023, the ETF consisted of 22 securities, with a notable allocation to companies like Stag Industrial Inc., National Retail Properties Inc., and Realty Income Corporation. NETL offers investors exposure to the real estate sector with a specific focus on net lease properties, potentially offering stable income through rental payments and long-term leases. However, investors should be aware that the ETF may carry some concentration risk due to its sector-specific focus.

The NetLease Corporate Real Estate ETF (NETL) focuses on tracking the performance of the net lease real estate sector in the U.S. equity market. NETL employs a passive management approach, seeking to replicate the Fundamental Income Net Lease Real Estate Index. This index comprises U.S.-listed equity securities of companies that derive at least 85% of their earnings or revenues from real estate operations in the net lease real estate sector. The index includes diversified and non-diversified companies, with a significant portion of its constituents being real estate investment trusts (REITs). The ETF''s investment strategy primarily targets corporate real estate companies, which earn a majority of their revenue from owning or managing real estate properties or are structured as REITs. NETL may replicate the index or use a representative sampling strategy, investing in a sample of index securities that closely resemble the overall characteristics of the index. The fund is expected to concentrate its assets in the real estate sector and is considered non-diversified, allowing for a higher allocation to a single issuer or a smaller number of issuers.

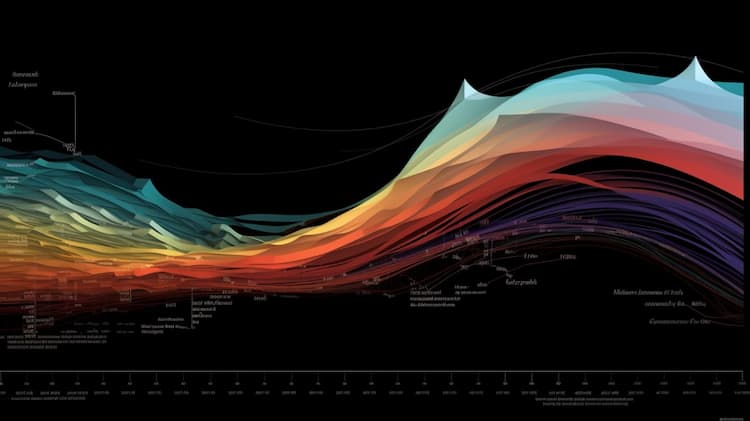

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

Choosing between AGG and IJH boils down to your investment goals, risk tolerance, and market outlook. Both ETFs have their pros and cons.

The NETL ETF (Next-Generation Energy Technologies ETF) is an innovative investment vehicle designed to capture the potential of emerging energy technologies. This ETF offers investors exposure to companies involved in renewable energy, energy storage, electric vehicles, and other cutting-edge advancements in the energy sector. With a focus on sustainability and the transition to cleaner energy sources, the NETL ETF presents an opportunity for investors seeking to support and benefit from the future of the energy industry.

Discover the top Distillate ETFs that offer investors exposure to the growing distillate industry. These ETFs provide a diversified portfolio of companies involved in the production, refining, and distribution of various distillate products such as gasoline, diesel, and jet fuel. Explore the article to find out which Distillate ETFs are worth considering for potential investment opportunities.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.