How does the SANE ETF work?

The SANE ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

Noble-Impact Capital LLC is the issuer of the actively-managed exchange-traded fund (ETF), which seeks to achieve its investment objective by purchasing long positions in securities expected to increase in price and/or taking short positions in securities expected to decline in price. The Fund's net exposure is actively managed by Noble-Impact Capital LLC, reflecting their views on changing macroeconomic factors, market conditions, and economic trends. The Sub-Adviser identifies securities for both long and short positions based on top-down and bottoms-up analyses, and the Fund's performance is heavily reliant on their investment decisions.

While the NOPE ETF focuses on actively managing its investment strategy by taking both long and short positions in securities, its approach to dividends differs from traditional income-focused ETFs. This actively-managed ETF does not prioritize dividend distributions as its primary objective. Instead, the ETF aims to achieve its investment objective by buying securities expected to increase in price and shorting securities expected to decline. Consequently, dividend eligibility and distribution within this ETF are primarily driven by the overall performance of its portfolio holdings, which can vary based on market conditions and the Sub-Adviser's macroeconomic views. Investors considering NOPE ETF should be aware that dividend payouts may not be as consistent or significant as in other income-focused ETFs, as the fund's primary goal is capital appreciation rather than dividend income.

Tracking the Noble-Impact Capital Long/Short ETF involves an actively-managed approach. This ETF seeks to achieve its investment objective by taking long positions in securities expected to increase in price and short positions in securities expected to decline in price. The fund's net exposure can vary from 100% short to 150% long, reflecting the Sub-Adviser's views on macroeconomic factors such as market conditions, economic trends, and geopolitical conditions. The Sub-Adviser employs both top-down and bottom-up analyses to identify long and short positions, aiming to capitalize on favorable sector/industry tailwinds and mitigate unfavorable headwinds. This actively managed strategy results in a dynamic portfolio makeup, with investments in U.S. and international large, mid, and small-cap companies, as well as the use of leverage for increased exposure.

The correlation aspect of the NOPE ETF (Exchange-Traded Fund) is relatively unknown due to the limited available information on its underlying assets and strategy. However, investors may speculate that NOPE's performance may be linked to its strategy of purchasing long positions in securities expected to increase in price while taking short positions in securities expected to decline in price. This actively-managed ETF's net exposure can range from 100% short to 150% long, making it a potentially flexible tool for investors with varying market views.

The NOPE Sector ETF is an actively-managed exchange-traded fund (ETF) that utilizes both long and short positions in securities to achieve its investment objectives. The fund's investment strategy is broad and dynamic, with the fund's net exposure ranging from 100% short to 150% long based on the views of its investment sub-adviser, Noble-Impact Capital, LLC. The Sub-Adviser's investment decisions are driven by macroeconomic factors, including market conditions, economic trends, geopolitical events, and economic cycles, which influence the fund's target net exposure. The fund's long positions encompass a variety of asset classes, including equity securities, ETFs, depositary receipts, and more, while its short positions aim to capitalize on companies with weak fundamentals, poor management, and unfavorable industry headwinds. This ETF's non-diversified status under the Investment Company Act of 1940 allows for a more concentrated approach to investment, emphasizing market conditions and tactical asset allocation.

The exposure characteristic of the NOPE ETF is unique in its actively managed approach. The fund, managed by Noble-Impact Capital, LLC, seeks to achieve its investment objective by actively selecting long and short positions in securities. The fund''s net exposure can range from 100% short to 150% long, reflecting the Sub-Adviser''s views on macroeconomic factors. This strategy allows investors to potentially profit from both rising and falling markets, making it suitable for those who seek active and dynamic investment opportunities. For a more in-depth analysis of the NOPE ETF''s exposure and correlations, consider using ETF Insider''s web app, which provides comprehensive data and visualization tools for US ETFs.

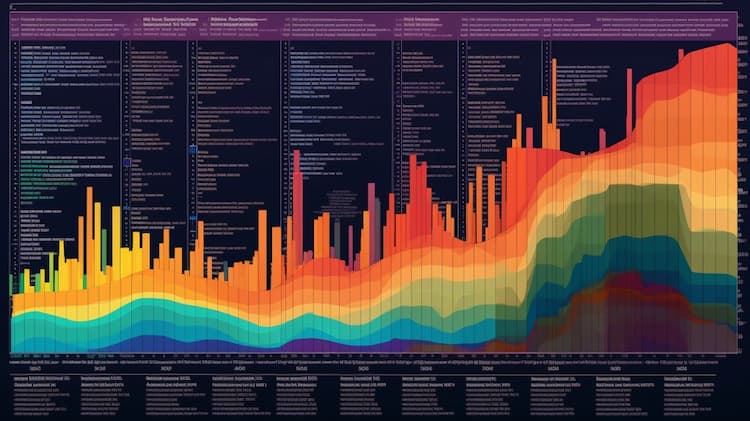

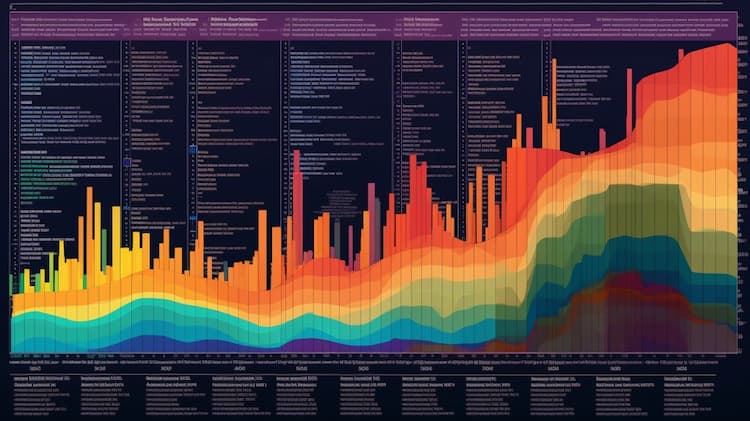

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

The SANE ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

The ONEQ ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

The ETF with Vertex Pharmaceuticals Inc. and Cintas Corp. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Vertex Pharmaceuticals Inc. and Cintas Corp. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.