HYG VS LQD

Compare the HYG and LQD ETFs with our thorough analysis. Dive into the performance metrics, underlying assets, and investment strategies.

The issuer of the Nuveen ESG Small-Cap ETF (NUSC) is Nuveen Investments, a leading investment management company with a focus on responsible investing and sustainability. NUSC aims to track the performance of the MSCI USA Small Cap Extended ESG Focus Index, which includes small-capitalization companies listed on U.S. exchanges that meet specific environmental, social, and governance (ESG) criteria. Nuveen's commitment to ESG principles and their partnership with MSCI ESG Research, Inc. reflect in the selection process and composition of NUSC's underlying index, making it an attractive choice for investors seeking exposure to socially responsible small-cap companies in the U.S. market.

The Northern Trust FlexShares ESG US Small Cap Index Fund (NUSC) focuses on tracking the investment results of the ESG-screened US Small Cap Index. While dividends might not be the primary emphasis, NUSC's dividend distribution aligns with the underlying index's constituent companies' dividend policies and performances. This ETF offers exposure to environmentally and socially responsible small-cap companies and their dividend distributions, promoting both sustainable investing and potential returns for investors.

The NUSC ETF, or NuShares ESG Small-Cap ETF, stands out in the investment landscape as it tracks the performance of the TIAA ESG USA Small-Cap Index. This index is comprised of small-cap companies in the U.S. market that meet certain environmental, social, and governance (ESG) criteria, aligning the investment strategy with ethical considerations. The rise in popularity of ESG investments underscores the growing demand for financial vehicles that not only aim for financial returns but also consider the broader societal and environmental impact of businesses. In this context, NUSC offers investors an opportunity to diversify their portfolios while aligning their investments with values that prioritize sustainability and ethical business practices.

Understanding the correlation of the Nuveen ESG Small-Cap ETF (NUSC) is vital for gauging its performance in relation to the broader U.S. small-cap equity market. Given that NUSC focuses on small-cap companies adhering to certain environmental, social, and governance (ESG) criteria, its correlation with similar ESG-focused ETFs and small-cap indices can offer insights into sustainable investing trends. Investors seeking to analyze NUSC's correlation with other assets can utilize tools like ETF Insider's web app to access comprehensive data and visualizations, allowing them to make well-informed decisions and uncover correlations with ease.NUSC Sector

The NuShares ESG Small-Cap ETF (NUSC) focuses on investing in small-capitalization companies in the U.S. market that meet certain environmental, social, and governance (ESG) criteria. The ETF aims to track the performance of the MSCI USA Small Cap ESG Focus Index, which selects companies based on their ESG performance scores and ranks them within their respective sectors. This sector-focused approach ensures that NUSC provides exposure to small-cap companies demonstrating strong ESG practices while also diversifying across various industries.NUSC Exposure

The exposure profile of the NuShares ESG Small-Cap ETF (NUSC) is centered around the small-cap segment of the U.S. equity market while incorporating environmental, social, and governance (ESG) criteria. By tracking the performance of the MSCI USA Small Cap Extended ESG Focus Index, NUSC provides investors with a unique opportunity to engage with companies that emphasize responsible practices. Our tool, ETF Insider, serves as a valuable resource to explore NUSC's exposure characteristics, offering comprehensive data through its web app and visualization tools. With features that reveal overlaps, correlations, and other insightful information, ETF Insider enhances investors' ability to delve into the exposure dynamics of various U.S. ETFs.

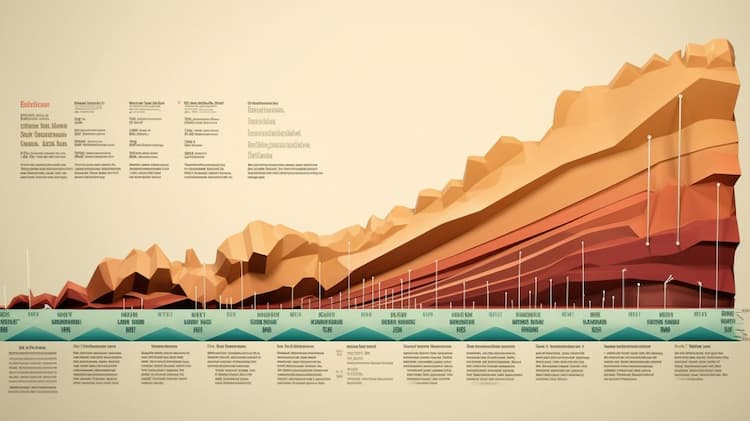

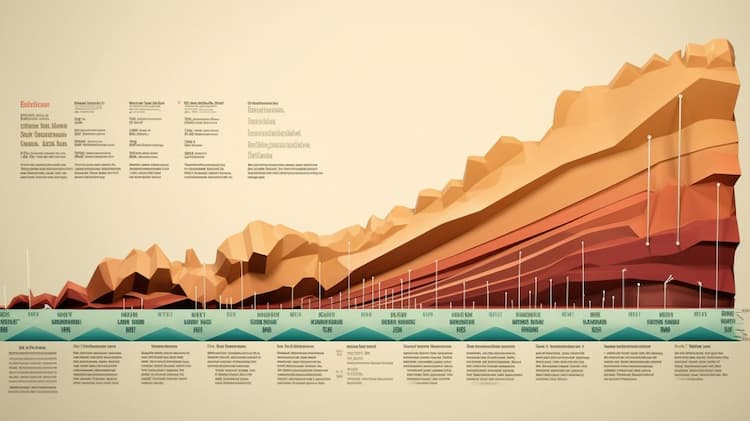

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

Compare the HYG and LQD ETFs with our thorough analysis. Dive into the performance metrics, underlying assets, and investment strategies.

We'll conduct a comprehensive comparison between two prominent ETFs: ECH (iShares MSCI Chile ETF) and ARGT (Global X MSCI Argentina ETF).

The NUSC ETF, or Nuveen ESG Small-Cap ETF, is an exchange-traded fund that focuses on providing investors with exposure to small-cap companies that meet specific environmental, social, and governance (ESG) criteria. This ETF seeks to invest in companies that demonstrate strong sustainability practices, social responsibility, and ethical governance, making it an attractive option for investors who prioritize both financial returns and positive impact. By investing in the NUSC ETF, investors can align their portfolios with their values while potentially benefiting from the growth potential of small-cap companies committed to ESG principles.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.