5 Key Differences between S&P 500 Mutual Funds and ETFs

The five core differences between S&P 500 Mutual Funds and ETFs with the goal of helping you make an informed investment decision.

The Pacer Structured Outcome Strategy ETF (PSMJ) employs a unique investment approach utilizing Flexible Exchange Options (FLEX Options) to track the performance of the SPDR® S&P 500® ETF Trust, its Underlying ETF. Operating under a structured outcome strategy, PSMJ aims to provide predetermined investment outcomes over an approximate one-year Investment Period, characterized by a Buffer against potential Underlying ETF losses and a Cap on returns. Through FLEX Options, the fund offers investors various scenarios: matching upside participation with the Underlying ETF's appreciation up to the Cap, providing a flat return if the Underlying ETF declines within the Buffer, and mitigating losses by protecting against the first 15% of Underlying ETF losses. However, investors should note that the Fund's position relative to the Cap and Buffer can influence results, particularly if shares are acquired during an Investment Period or if the Fund's value deviates from the Initial Fund Value. With each new Investment Period, the Fund resets its strategy, adapting to prevailing market conditions. While offering potential benefits, investors should carefully assess the Fund's Cap and Buffer levels before investing, recognizing the Fund's non-diversified classification under the Investment Company Act of 1940.

PSMJ Dividend, a component of the Pacer Structured Outcome Strategy ETF, offers investors an opportunity to participate in a unique investment strategy designed to provide consistent income generation alongside the benefits of structured outcome investing. By leveraging Flexible Exchange Options (FLEX Options) tied to the performance of the SPDR® S&P 500® ETF Trust, PSMJ Dividend aims to provide investors with a steady stream of dividends while also seeking to mitigate downside risks through its structured outcome approach. Through careful management and strategic use of FLEX Options, PSMJ Dividend endeavors to deliver reliable dividend payments to investors, enhancing portfolio income potential while maintaining a focus on risk management. As a part of the Pacer ETF lineup, PSMJ Dividend offers investors a differentiated approach to income generation within the context of structured outcome investing, catering to those seeking both dividend income and downside protection in their investment strategy.

PSMJ Tracking, an integral component of the Pacer Structured Outcome Strategy ETF, provides investors with a sophisticated approach to tracking the performance of the SPDR® S&P 500® ETF Trust. Leveraging Flexible Exchange Options (FLEX Options), PSMJ Tracking aims to closely mirror the movements of its Underlying ETF while offering downside protection and predefined outcome parameters. This innovative strategy allows investors to potentially benefit from the appreciation of the Underlying ETF while mitigating the impact of market downturns. By employing a structured outcome approach, PSMJ Tracking seeks to provide investors with a transparent and efficient means of gaining exposure to the broader equity market, offering a balance between risk and return. As part of the Pacer ETF family, PSMJ Tracking caters to investors looking for a dynamic yet disciplined approach to tracking the performance of the S&P 500® Index, ensuring alignment with their investment objectives and risk tolerance.

PSMJ Correlation, an essential element of the Pacer Structured Outcome Strategy ETF, introduces investors to a strategic tool for managing portfolio correlations with the SPDR® S&P 500® ETF Trust. By utilizing Flexible Exchange Options (FLEX Options), PSMJ Correlation aims to provide investors with a means to adjust their portfolio's correlation to the performance of the Underlying ETF. This innovative strategy enables investors to potentially mitigate excessive correlation risks while maintaining exposure to the broader equity market. Through its structured outcome approach, PSMJ Correlation seeks to offer investors a dynamic means of aligning their portfolio's correlation with their investment objectives and risk preferences. As part of the Pacer ETF family, PSMJ Correlation caters to investors seeking a sophisticated approach to managing portfolio correlations, ensuring greater diversification and risk management capabilities within their investment strategies.

PSMJ Sector, a vital component of the Pacer Structured Outcome Strategy ETF, introduces investors to a specialized tool for navigating sector-specific investment opportunities within the SPDR® S&P 500® ETF Trust. By harnessing Flexible Exchange Options (FLEX Options), PSMJ Sector aims to provide investors with targeted exposure to specific sectors while also offering downside protection and predetermined outcome parameters. This innovative strategy allows investors to potentially capitalize on the performance of individual sectors while mitigating broader market risks. Through its structured outcome approach, PSMJ Sector seeks to offer investors a dynamic means of accessing sector-specific opportunities aligned with their investment objectives and risk profiles. As part of the Pacer ETF family, PSMJ Sector caters to investors seeking a sophisticated approach to sector investing, ensuring alignment with their portfolio goals and risk tolerance.

PSMJ Exposure, a pivotal facet of the Pacer Structured Outcome Strategy ETF, provides investors with a strategic avenue to gain exposure to the SPDR® S&P 500® ETF Trust while mitigating downside risks. Leveraging Flexible Exchange Options (FLEX Options), PSMJ Exposure aims to offer investors a means of accessing the broader equity market's performance while providing predefined outcome parameters and potential protection against market downturns. This innovative strategy enables investors to participate in the market's upside potential while limiting their exposure to downside risks through a structured outcome approach. By aligning with the Pacer ETF family, PSMJ Exposure caters to investors seeking a disciplined and transparent method of gaining exposure to the S&P 500® Index, ensuring their investment objectives are met while managing risk effectively.

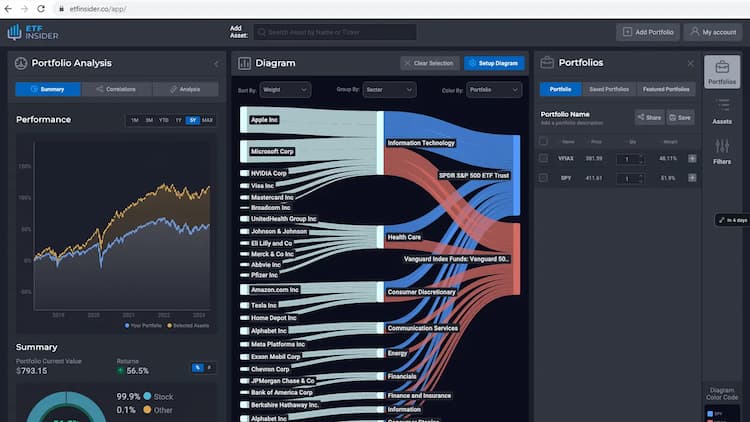

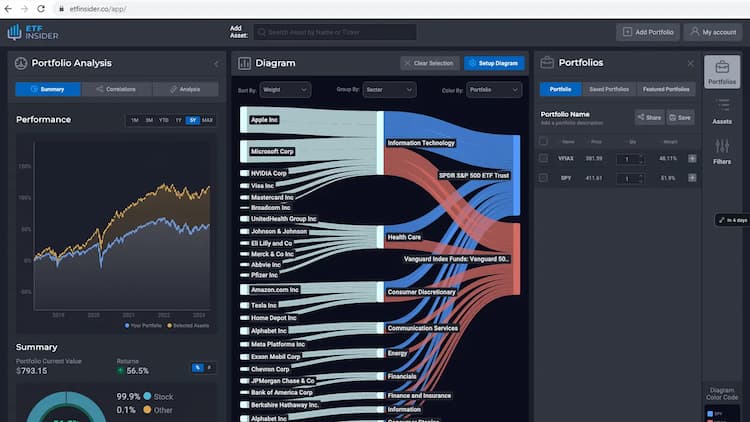

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

The five core differences between S&P 500 Mutual Funds and ETFs with the goal of helping you make an informed investment decision.

The PSMJ ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

We will conduct a comprehensive comparison between two prominent ETFs: EIS (iShares MSCI Israel ETF) and ITEQ (BlueStar Israel Technology ETF).

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.