BND Vs TIP: Sectors and Top Holdings

The BND and TIP ETFs offer investors unique opportunities to tap into the bond market with different focuses and strategies. consider using ETF Insider.

Franklin Templeton Investments' PULT issuer offers investors a unique opportunity to engage in a diversified short-duration portfolio of fixed-income securities. This portfolio encompasses investment-grade money market instruments and other fixed-income securities, including U.S. dollar-denominated foreign securities, carefully selected by Putnam Management, the fund's investment manager. Putnam Management prioritizes companies or issuers that align with pertinent environmental, social, or governance (ESG) criteria on a sector-specific basis. By emphasizing ESG principles, the fund aims to not only achieve financial returns but also contribute positively to broader societal and environmental objectives. This strategy underscores Franklin Templeton Investments' commitment to responsible investing practices, catering to investors seeking both financial performance and alignment with their ethical values.

PULT Dividend, managed by Franklin Templeton Investments, presents investors with an avenue to participate in a dividend-focused investment strategy. This fund specializes in constructing a diversified portfolio of income-generating assets, primarily comprising dividend-paying stocks and other income-oriented securities. Leveraging Franklin Templeton's expertise in research and portfolio management, PULT Dividend seeks to identify companies with a history of stable dividend payouts and potential for future dividend growth. By emphasizing dividends, the fund aims to provide investors with a steady stream of income while also capitalizing on the long-term wealth-building potential of dividend-paying equities. PULT Dividend's approach caters to income-oriented investors seeking to enhance their portfolio's yield without sacrificing the potential for capital appreciation.

PULT Tracking, overseen by Franklin Templeton Investments, offers investors a strategic approach to tracking specific market indices or benchmarks. This fund is designed to replicate the performance of a chosen index by investing in a diversified portfolio of securities that closely mirrors the index's composition and weightings. Utilizing advanced tracking techniques and sophisticated portfolio management strategies, PULT Tracking aims to minimize tracking error and efficiently capture the returns of the targeted index. Investors looking to gain exposure to a particular market segment or asset class can benefit from the simplicity and transparency offered by PULT Tracking, as it provides a cost-effective and hassle-free way to passively invest in the desired market index. With Franklin Templeton's track record of expertise in index tracking strategies, PULT Tracking offers investors a reliable vehicle to achieve their investment objectives with precision and efficiency.

PULT Correlation, managed by Franklin Templeton Investments, caters to investors seeking to manage portfolio risk by employing correlation-based strategies. This fund focuses on constructing a portfolio of assets with low correlations to traditional equity and fixed-income markets, aiming to provide diversification benefits and potentially reduce overall portfolio volatility. Leveraging sophisticated quantitative models and risk management techniques, PULT Correlation identifies assets that exhibit low correlation with each other and with broader market indices. By strategically allocating across asset classes, geographic regions, and sectors, the fund seeks to enhance risk-adjusted returns and mitigate the impact of market downturns. PULT Correlation offers investors a systematic approach to building resilient portfolios that can better withstand market turbulence and deliver more stable long-term performance.

PULT Sector, managed by Franklin Templeton Investments, is tailored for investors seeking targeted exposure to specific sectors of the economy. This fund strategically allocates its assets across various industry sectors, aiming to capitalize on sector-specific opportunities while managing associated risks. Utilizing thorough sector analysis and fundamental research, PULT Sector identifies sectors poised for growth or undervaluation, allowing investors to participate in sector rotations and capitalize on emerging trends. Whether investors seek to overweight sectors showing strength or diversify away from sectors facing headwinds, PULT Sector offers a flexible and dynamic approach to sector investing. With Franklin Templeton's expertise in sector analysis and portfolio management, PULT Sector provides investors with the tools to tailor their portfolios to align with their sector-specific investment convictions and objectives.

PULT Exposure, managed by Franklin Templeton Investments, is designed for investors seeking broad market exposure across various asset classes and geographies. This fund aims to provide diversified exposure to equities, fixed income, and other alternative asset classes, allowing investors to capture opportunities while managing risk. Leveraging Franklin Templeton's global research capabilities and asset allocation expertise, PULT Exposure dynamically adjusts its portfolio to reflect changing market conditions and economic outlooks. Whether investors seek to capitalize on global growth trends, hedge against inflation, or seek income generation, PULT Exposure offers a flexible and comprehensive solution. With a focus on risk management and asset allocation, the fund provides investors with a well-diversified portfolio that aims to deliver attractive risk-adjusted returns over the long term.

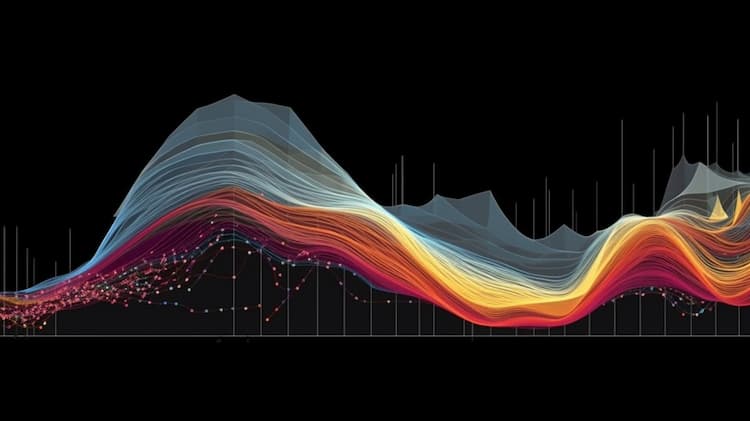

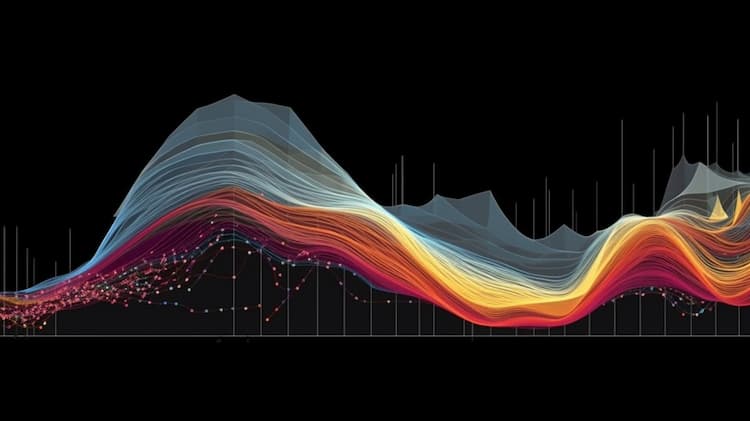

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

The BND and TIP ETFs offer investors unique opportunities to tap into the bond market with different focuses and strategies. consider using ETF Insider.

The PULT ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

The BSJQ ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.