How does the POTX ETF work?

The POTX ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

The VanEck Real Asset Allocation ETF (RAAX) is managed by VanEck, a global investment manager with a long-standing reputation for providing innovative investment strategies. Launched to the market, RAAX offers investors exposure to real assets, including commodities, real estate, natural resources, and infrastructure, through a diversified portfolio of exchange-traded products (ETPs). Utilizing a proprietary quantitative investment process, VanEck aims to maximize real returns while mitigating downside risk, making RAAX an attractive option for investors seeking to navigate various market conditions and hedge against inflation.

While the RAAX ETF primarily focuses on real assets, including commodities, real estate, and infrastructure, it may distribute dividends to investors. These distributions are influenced by the performance and dividend policies of the underlying assets, which include domestic and foreign equity and debt securities, master limited partnerships (MLPs), and commodities. RAAX aims to provide investors with real returns adjusted for inflation while managing downside risk, and its dividend distributions may reflect the income generated from its diverse portfolio holdings.

Tracking the dynamic world of real assets, the RAAX ETF employs an actively managed strategy focused on maximizing real returns while mitigating downside risk during market declines. The fund primarily invests in exchange-traded products providing exposure to various real assets such as commodities, real estate, natural resources, and infrastructure. Through a proprietary quantitatively driven investment process, RAAX assesses multiple indicators including equity and commodity price trends, volatility, and asset correlations to guide asset allocation decisions. With the flexibility to invest in a diverse range of domestic and foreign equity and debt securities, master limited partnerships (MLPs), and commodities, RAAX aims to capture opportunities in the real asset space while managing risk effectively for investors.

The correlation aspect of the RAAX: VanEck Vectors Real Asset Allocation ETF (RAAX) is essential in understanding its behavior concerning real assets, including commodities, real estate, and infrastructure. As an actively managed ETF, RAAX seeks to maximize real returns while managing downside risk during market declines, making its correlation with various asset classes crucial for portfolio diversification.

The RAAX ETF focuses on real assets, including commodities, real estate, natural resources, and infrastructure. It achieves this by primarily investing in exchange-traded products (ETPs) that provide exposure to such assets, including equity and debt securities, master limited partnerships (MLPs), and commodities. The ETF's objective is to maximize real returns while mitigating downside risk during sustained market declines. Employing a proprietary quantitatively driven investment process, the fund considers various indicators such as equity and commodity price trends, volatility, and asset price correlations to guide its asset allocation decisions. By providing access to real assets, the RAAX ETF offers investors a way to diversify their portfolios and potentially hedge against inflation.

The investment objective of the Pacer Real Asset Allocation ETF (RAAX) is to provide exposure to real assets through a diverse portfolio. RAAX primarily invests in exchange-traded products (ETPs) covering domestic and foreign equities, debt securities, master limited partnerships (MLPs), and commodities. These real assets encompass commodities like gold, real estate, natural resources, and infrastructure, as well as companies with significant ties to such assets or their production. RAAX's actively managed approach aims to maximize real returns while mitigating downside risks, utilizing quantitative indicators such as equity and commodity price trends, volatility, and asset correlations to guide asset allocation decisions. Investors seeking exposure to the diverse realm of real assets can utilize RAAX to gain access to this segment of the market.

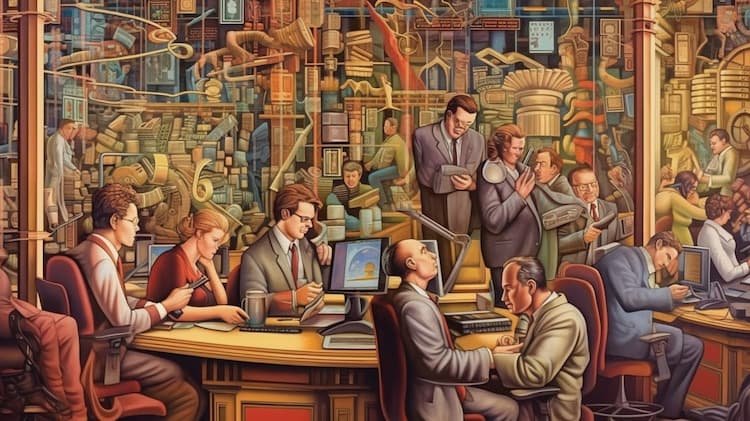

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

The POTX ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

The ETF with Costco Wholesale Corp. and Gilead Sciences Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Costco Wholesale Corp. and Gilead Sciences Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

The ETF with QUALCOMM Inc. and Monster Beverage Corp. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of QUALCOMM Inc. and Monster Beverage Corp. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.