The best Precious Metals and Gems ETFs

Discover ETFs that can help you tap into the potential of these Precious Metals and Gems valuable resources and diversify your investment portfolio.

The issuer of the REC ETF, which focuses on environmental, social, and governance (ESG) criteria, is committed to sustainable investing. They employ an indexing investment approach and track the performance of the Index, which comprises equity securities issued by large capitalization companies listed on U.S. exchanges meeting specific ESG criteria. The issuer's dedication to ESG principles underscores their aim to provide investors with an avenue to invest in companies that align with responsible and ethical practices, reflecting a growing trend in the investment world towards sustainability and responsible investing.

The issuer of the REC Dividend ETF places a strong emphasis on delivering consistent dividend income to investors. This ETF focuses on selecting and holding dividend-paying stocks within a specific investment universe. Dividends from the underlying holdings are typically distributed to investors on a regular basis, providing them with a reliable source of income. While the primary objective of the ETF may be income generation, it also offers exposure to potential capital appreciation through its dividend-paying stock selection.

Tracking companies that focus on innovation and earnings growth is central to the investment strategy of the REC Innovation ETF. REC primarily invests in U.S. large-capitalization equity securities traded on U.S. exchanges, seeking companies that employ innovative technologies and ideas to gain a competitive edge. The ETF's investment process combines macroeconomic analysis, fundamental research, and technical analysis to select stocks that demonstrate strong growth potential, often through market expansion opportunities, pricing power, strong balance sheets, and barriers to entry. REC's portfolio is designed to provide exposure to innovative companies driving earnings growth within the U.S. market, making it an appealing choice for investors seeking to capitalize on innovation-driven stock performance.

Understanding the correlation dynamics of the REC ETF can provide valuable insights for investors. While the specific correlation data for this ETF may vary, correlations with relevant market indices, industries, or assets can impact its performance. For detailed and up-to-date correlation information, investors can turn to ETF Insider's web app. With its user-friendly visualization tools, ETF Insider enables investors to explore correlations, identify overlaps, and make more informed decisions when incorporating the REC ETF into their portfolios.

The Invesco Solar ETF (TAN) primarily operates within the renewable energy sector. TAN seeks to track the MAC Global Solar Energy Index, which includes companies engaged in various aspects of solar energy production and technology. As the world shifts towards cleaner and more sustainable energy sources, the renewable energy sector, and consequently, TAN, offers investors an opportunity to participate in the growth of solar energy technologies and infrastructure development.

The exposure profile of the REC ETF highlights its strategy of targeting companies with strong income potential and superior risk-return profiles across various sectors and market capitalizations. REC, which tracks the proprietary Underlying Index compiled and maintained by Zacks Investment Research, Inc., invests in a diverse range of domestic and international companies listed on major U.S. exchanges. This approach allows investors to access a broad spectrum of assets, including stocks of large, medium, and small-sized companies, ADRs, real estate investment trusts (REITs), master limited partnerships (MLPs), closed-end funds, and traditional preferred stocks. The REC ETF offers a comprehensive view of the market, making it a valuable addition to a well-diversified investment portfolio.

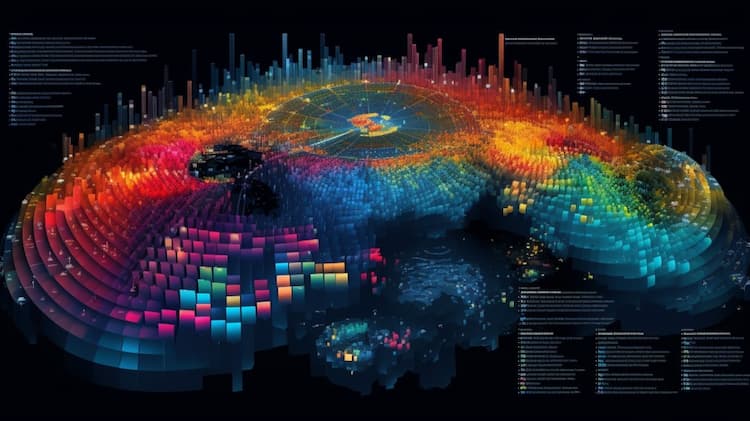

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

Discover ETFs that can help you tap into the potential of these Precious Metals and Gems valuable resources and diversify your investment portfolio.

Discover the top-performing Precious Metals Mining ETFs that offer investors exposure to the lucrative world of precious metals mining. From gold and silver to platinum and palladium, these ETFs provide a diversified portfolio of mining companies, allowing investors to capitalize on the potential growth and stability of the precious metals market. Whether you're a seasoned investor or a newcomer to the sector, this article will guide you through the best options available.

Discover the top Precious Metals Mining ETFs in the United States that offer attractive investment opportunities. This article explores the performance, holdings, and key features of these ETFs, empowering investors with valuable insights to make informed decisions in the precious metals mining sector.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.