What is the RJA ETF ?

Learn about ETFs and explore the RJA ETF in this comprehensive article. Discover the key features and benefits of ETF investing, along with a specific focus on the RJA ETF and its potential implications for investors.

The issuer of the Elements Rogers International Commodity Index Agriculture Total Return ETN (RJA) is known for its commitment to providing investors with exposure to the agricultural commodity sector. With a focus on agricultural futures contracts, this issuer offers a unique investment opportunity for those seeking to diversify their portfolios in the world of commodities. Investors can tap into the global agricultural market thanks to the expertise and innovative approach of the RJA issuer.

The iPath Rogers Commodity Index Total Return ETN (RJA) is designed to offer investors exposure to a broad range of commodities by tracking the Rogers International Commodity Index - Total Return. This ETN provides a unique approach to diversification by including commodities such as energy, agriculture, and metals. As an exchange-traded note, RJA offers potential for returns based on the performance of the underlying index, making it an interesting choice for investors interested in commodities.

The Elements Rogers International Commodity Index Agriculture Total Return ETF, or RJA, focuses its tracking efforts on the Rogers International Commodity Index Agriculture Total Return. This index encompasses various agricultural commodities, such as grains, oilseeds, livestock, and soft commodities like coffee and cotton. RJA's investment strategy involves holding a diverse range of futures contracts on these agricultural commodities, striving to mirror the performance of the underlying index. Investors interested in agricultural commodities often turn to RJA for exposure to this vital sector of the global economy.

Correlation analysis of the ELEMENTS Rogers International Commodity Index Agriculture Total Return (RJA) ETF reveals its relationship with various agricultural commodities and their market dynamics. As an ETF designed to track the performance of the Rogers International Commodity Index Agriculture Total Return, RJA's correlation with agricultural markets is a key factor for investors seeking exposure to this sector. Understanding these correlations helps investors make informed decisions about their agricultural commodity investments. For in-depth analysis and visualization of RJA's correlations with different assets, ETF Insider's web app offers valuable insights and tools, facilitating a comprehensive view of how this ETF aligns with broader market trends and diversification opportunities.

The ELEMENTS Rogers International Commodity Index - Agriculture Total Return ETN (RJA) focuses on the agricultural commodities sector. This exchange-traded note aims to track the performance of the Rogers International Commodity Index - Agriculture Total Return, which includes a variety of agricultural commodities such as grains, livestock, and soft commodities. Investors in RJA seek exposure to the potential returns and risks associated with the global agricultural markets, which can be influenced by factors like weather conditions, supply and demand dynamics, and global economic trends.

The ELEMENTS Rogers International Commodity Index - Agriculture Total Return ETN (RJA) provides investors exposure to the performance of a broad basket of agricultural commodities. This exchange-traded note seeks to replicate the performance of the Rogers International Commodity Index - Agriculture Total Return, which includes various agricultural commodities like corn, wheat, soybeans, sugar, and more. Investors looking to diversify their portfolio by gaining exposure to the agricultural commodities market may find RJA to be a valuable addition, as it captures the potential fluctuations in this essential sector of the global economy.

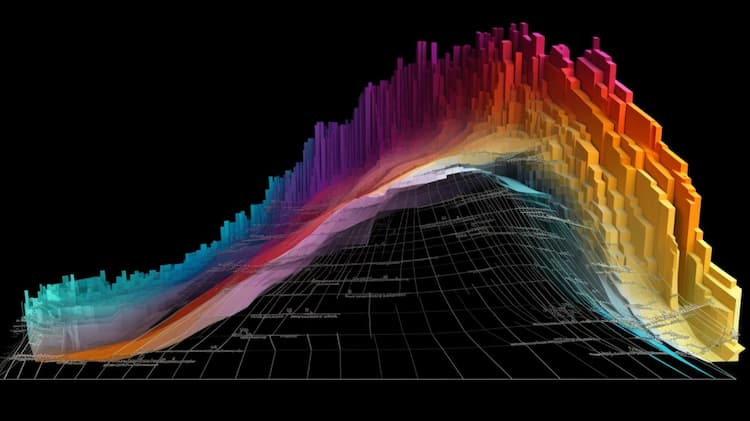

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

Learn about ETFs and explore the RJA ETF in this comprehensive article. Discover the key features and benefits of ETF investing, along with a specific focus on the RJA ETF and its potential implications for investors.

Discover the top-performing IBEX 35 ETF that offers investors exposure to the 35 most liquid and largest companies listed on the Spanish stock market. This article compares various IBEX 35 ETF options, assessing their performance, expense ratios, and tracking accuracy to help investors make an informed decision and find the best ETF for their investment goals in the Spanish market.

The ICLO ETF is a specialized investment fund that focuses on global companies in the relevant sectors. This exchange-traded fund offers investors exposure to a diverse range of innovative and cutting-edge companies engaged in advancements in the industry. Discover the potential growth opportunities and risks associated with investing in this dynamic sector through the ICLO ETF.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.