CIBR vs ROBO: Capitalization and Strategy

CIBR and ROBO are ETFs that target different but increasingly relevant sub-sectors within the broad technology industry. ETF Insider empowers investors.

The issuer of the ROBO ETF, known as ROBO Global, is a leading provider of investment solutions focused on robotics, automation, and artificial intelligence (AI) technologies. Established in 2013, ROBO Global is at the forefront of identifying and capitalizing on the transformative potential of robotics and AI in various industries. The ROBO ETF reflects their commitment to providing investors with exposure to companies driving innovation in automation, making it a go-to choice for those seeking to participate in the growth of the robotics and AI sectors. With a dedicated team of experts and a rigorous research methodology, ROBO Global continues to shape the future of investment opportunities in disruptive technologies.

The ROBO Global Robotics and Automation Index ETF (ROBO) offers investors the opportunity to benefit from dividend distributions despite its primary focus on technology and automation companies. Dividends from ROBO are typically distributed on a quarterly basis, aligning with the dividend policies and performances of the constituent companies within the index. While the emphasis of this ETF is on capital growth, investors can still enjoy some dividend returns, making it a well-rounded option for those seeking both growth and income within the technology sector.

ROBO Tracking is centered around replicating the performance of the ROBO Global Robotics and Automation Index. This exchange-traded fund, ROBO, invests in companies at the forefront of the robotics and automation industry, including manufacturers, software developers, and technology firms. By holding a diversified portfolio of such companies, ROBO aims to provide investors with exposure to the growing automation and robotics sector, making it a valuable choice for those interested in the potential long-term growth of this industry.

The correlation aspect of the ROBO Global Robotics and Automation Index ETF (ROBO) is primarily associated with the performance of companies involved in the robotics and automation industry. As ROBO tracks an index of global companies operating in this sector, its correlation with the global technology and manufacturing sectors tends to be significant. Investors seeking exposure to the growth potential of robotics and automation often look at ROBO's correlations to understand its behavior in relation to these sectors. Our tool, ETF Insider, offers a comprehensive analysis of ROBO's correlations with other assets and industries, providing valuable insights for investors looking to diversify their portfolios within the technology and automation space.

The ROBO Global Robotics and Automation ETF (ROBO) focuses on the robotics and automation sector. This ETF primarily invests in companies that are at the forefront of technological advancements in robotics, automation, artificial intelligence, and related fields. With the potential for significant disruption and growth in these industries, ROBO provides investors with exposure to cutting-edge technologies and innovation, though it may come with higher volatility due to its concentrated focus on a specific sector.

The exposure characteristic of the ROBO Global Robotics and Automation Index ETF (ROBO) highlights its distinct focus on the rapidly evolving robotics and automation sector. This ETF offers investors a unique opportunity to gain exposure to companies at the forefront of technological innovation in industries such as manufacturing, healthcare, and artificial intelligence. With holdings comprising a diverse range of companies involved in robotics and automation, ROBO provides a comprehensive view of this transformative sector, making it a valuable addition to portfolios seeking exposure to cutting-edge technologies.

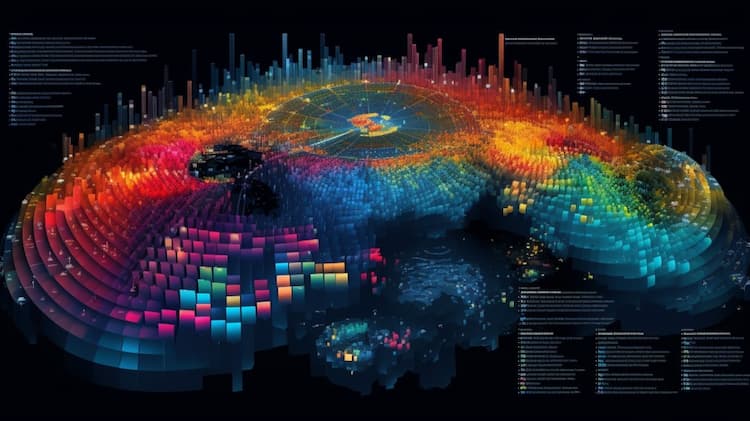

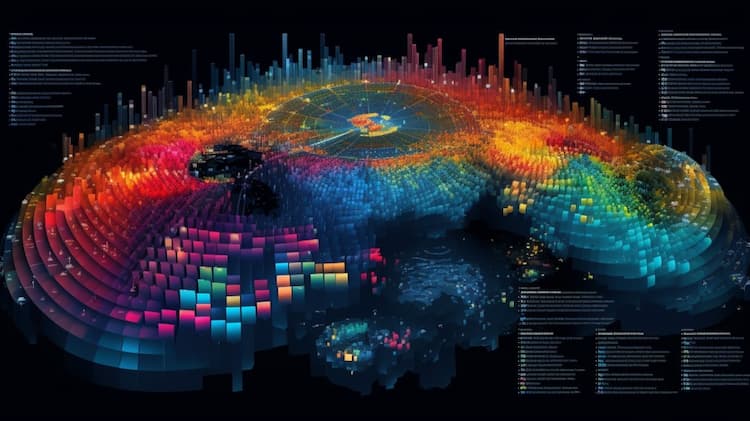

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

CIBR and ROBO are ETFs that target different but increasingly relevant sub-sectors within the broad technology industry. ETF Insider empowers investors.

The Global X Robotics & Artificial Intelligence ETF (BOTZ) stands out as a top choice for investors seeking exposure to robotics and AI companies.

Discover the top-performing Robotics and Automation Exchange-Traded Funds (ETFs) that offer investors exposure to the rapidly growing field of robotics and automation. This article analyzes the market's best ETF options, highlighting their performance, holdings, and potential for long-term growth, providing valuable insights for investors looking to capitalize on this transformative industry.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.