RRH ISSUER

The RRH is actively managed by its issuer, employing a diverse range of investment strategies to achieve its objectives. This issuer seeks to capitalize on market movements by investing in various asset classes, including U.S. Treasury securities, currency markets, equity indexes, and commodities. They employ a dynamic approach that includes long and short positions on different segments of the yield curve, interest rate-linked derivatives, and foreign currency strategies designed to profit from changing interest rate environments. The issuer's expertise lies in analyzing historical data, conducting fundamental analysis, and utilizing derivative instruments to navigate evolving market conditions. Their investment process allows for flexibility and adaptability to seize opportunities and react to shifts in market paradigms. Additionally, the issuer classifies the fund as non-diversified, indicating a potential for a higher concentration of assets in fewer issuers as part of their investment strategy.

RRH DIVIDEND

The RRH Dividend ETF, while not primarily designed for income-seeking investors, still participates in dividend distribution in line with the underlying assets. Dividends from this ETF are typically distributed on a regular basis, with the frequency and amount determined by the dividend policies and financial performances of the underlying companies. Investors in RRH Dividend may benefit from potential capital growth along with some dividend returns, although the primary focus remains on the overall performance of the ETF's holdings.

RRH TRACKING

The RRH ETF, employs an actively managed approach to achieve its investment objective. This fund primarily invests in a combination of assets, including U.S. Treasury securities, currency forwards, futures, and options, both long and short positions on the yield curve, equity indexes, and commodity futures and options. Additionally, the ETF may engage in foreign currency strategies, aiming to capitalize on depreciating currencies during periods of rising interest rates compared to the U.S. dollar. The fund also ventures into equity markets through sector-focused funds or ETFs, equity index futures, and total return swaps. This diverse blend of assets and strategies allows RRH to adapt to changing market conditions and seek positive returns when long-term U.S. interest rates rise.

RRH CORRELATION

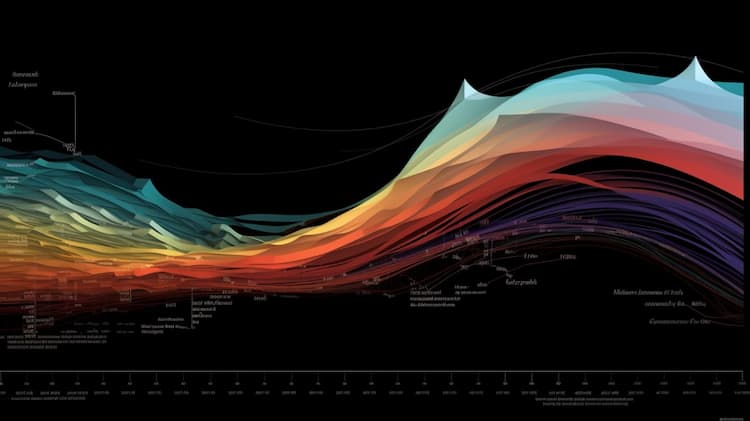

The correlation aspect of the RRH a crucial role in understanding its behavior in relation to various asset classes and market conditions. As an actively managed fund, RRH seeks to achieve its investment objective through a combination of strategies, including investments in U.S. Treasury securities, currency derivatives, interest rate-linked instruments, equity indexes, and commodity futures. The fund's correlation patterns can vary depending on the performance of these underlying assets and the prevailing economic environment. To gain deeper insights into RRH's correlations and how it interacts with different asset classes, investors can utilize the ETF Insider web app. This tool provides comprehensive data visualization and analysis capabilities, allowing users to explore correlations, overlaps, and historical performance trends associated with RRH. By leveraging this powerful tool, investors can make informed decisions and optimize their portfolio strategies based on RRH's correlation dynamics in the ever-changing market landscape.

RRH SECTOR

The Alternative Sources ETF (RRH) focuses on an unconventional investment strategy. This actively managed fund seeks to generate returns by investing in a combination of U.S. Treasury securities, currency derivatives, interest rate-linked instruments, equity indexes, and commodities. The fund's unique Yield Curve strategy aims to capitalize on shifts in the Treasury and swap yield curves, offering investors exposure to unconventional methods of generating capital appreciation during periods of rising interest rates. Additionally, RRH may employ foreign currency strategies and sector-focused investments to enhance its performance, making it a distinctive option for those seeking alternatives in the investment landscape.

RRH EXPOSURE

The RRH ETF (Flexible Exchange Options Strategy ETF) seeks exposure primarily through FLEX Options referencing the SPDR S&P 500 ETF Trust (the Underlying ETF). FLEX Options are exchange-traded option contracts with customizable terms, although they carry some counterparty risk and may have less liquidity compared to traditional options. This unique strategy aims to provide returns based on the performance of the Underlying ETF, focusing on the information technology sector while utilizing options to potentially limit downside losses and offer capped upside returns.For detailed insights into RRH's exposure and potential outcomes, including buffer levels and caps, investors can utilize ETF Insider's web app. It provides comprehensive data and visualizations for various U.S. ETFs, helping investors understand exposure, correlations, and other critical factors in their investment decisions.