SECD ISSUER

The SECD ETF is managed by Secured Income Fund, a specialized investment firm with a focus on income generation through actively managed exchange-traded funds (ETFs). Secured Income Fund's primary objective is to provide investors with exposure to first lien secured (senior) floating rate loans and fixed income securities, aiming to generate income and potential capital gains. Unlike traditional credit analysis based on credit ratings, the issuer prioritizes the fundamentals of the businesses issuing the securities, with a focus on credit health, cash flow, and intrinsic value. The portfolio is constructed with a margin of safety in mind, including investments in below investment grade (junk bonds) or unrated senior loans or bonds when deemed suitable by the Adviser. With a disciplined approach to credit quality and a diversified portfolio of 50-100 individual instruments, SECD offers an investment vehicle designed to navigate varying market conditions and provide income-seeking investors with potentially attractive risk-adjusted returns.

SECD DIVIDEND

The SEC Yield ETF (SECD) follows a unique dividend distribution strategy. This actively-managed exchange-traded fund primarily focuses on investing in first lien secured (senior) floating rate loans and fixed income securities (bonds). These investments are chosen based on their credit health, cash flow, and margin of safety rather than relying solely on credit ratings. SECD's approach is to generate income and potential capital gains from its holdings, with a portfolio comprising approximately 50-100 individual instruments, typically allocating one to two percent to any specific company. The fund aims to invest at least 80% of its net assets in senior secured obligations, providing a distinct dividend strategy for income-seeking investors.

SECD TRACKING

SECD Tracking signifies the ETF's commitment to monitoring the performance of companies within the security sector. The Security Sector ETF (SECD) strategically aligns itself with various businesses involved in cybersecurity, defense, and surveillance. By tracking these companies, SECD provides investors with a targeted and diversified approach to capitalize on the growth and developments within the dynamic security sector, making it an appealing option for those seeking exposure to this specialized industry.

SECD CORRELATION

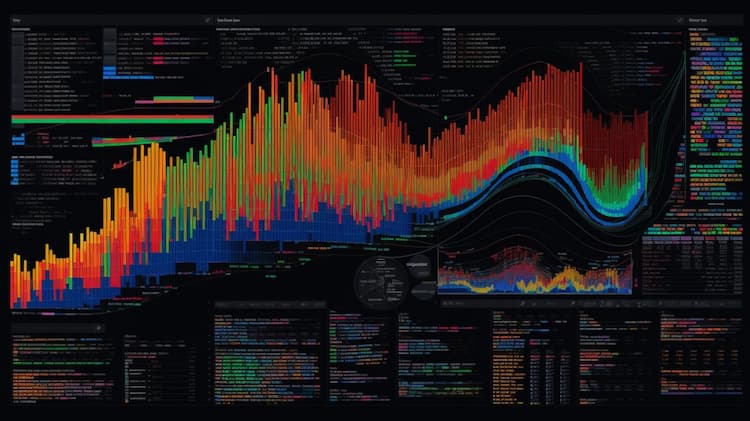

The correlation aspect of theGateway Senior Secured Credit Opportunities ETF (SECD) is significant in understanding its behavior in relation to the fixed income market, particularly senior secured floating rate loans and bonds. SECD seeks to achieve its investment objective by primarily investing in these first lien secured (senior) debt instruments. The correlation of SECD with interest rate movements and credit market conditions is critical for investors looking to assess the risk and potential returns of this actively managed ETF. While specific correlation data is not available here, investors can use ETF Insider's web app to study SECD's correlations with various market factors, providing them with deep insights and valuable data for informed investment decisions. The tool also offers simple visualizations to identify overlapping trends within the broader fixed income market.

SECD SECTOR

The Alternative Sources ETF (SECD) focuses on investing primarily in first lien secured (senior) floating rate loans and fixed income securities (bonds). These debt instruments rank highest in the order of repayment and are arranged through private negotiations between borrowers and financial institutions. The ETF aims to generate income and potential capital gains by purchasing these securities at a discount, primarily in the secondary market. The fund's adviser, Toroso Investments, LLC, emphasizes a fundamental approach to credit analysis, focusing on the credit health and cash flow of the underlying issuers rather than relying solely on credit ratings. This strategy may lead the ETF to invest in securities that are rated below investment grade (junk bonds) or unrated senior loans or bonds of comparable quality at the time of purchase. The fund's portfolio typically consists of 50-100 individual instruments, with a target allocation of one to two percent to any specific company. It generally invests at least 90% of its assets in securities issued by U.S. and Canadian companies and bank loans made to companies domiciled in these countries. The ETF's portfolio may also include privately placed securities, and it does not target a specific duration or maturity for its investments. Under normal market conditions, at least 80% of the fund's net assets are invested in senior secured obligations, which are debt instruments that rank highest in the order of repayment. This 80% policy is subject to change with shareholder notice of at least 60 days.

SECD EXPOSURE

The exposure characteristic of the SECD ETF (Secured Income ETF) is centered around actively managed investments in first lien secured (senior) floating rate loans and fixed income securities. These investments prioritize repayment over other loans or bonds issued by the respective companies. The fund''s portfolio primarily consists of U.S. dollar-denominated debt instruments, focusing on businesses in the United States and Canada. Additionally, the SECD ETF may include privately placed securities. This ETF''s investment strategy emphasizes fundamental credit analysis, seeking companies with strong cash flow generation, sustainable capital structures, and attractive risk-return profiles.