SURE ISSUER

Vanguard is the issuer behind the Vanguard Russell 1000 Value ETF (VONV), an investment fund that employs an indexing approach to track the performance of the Russell 1000 Value Index. Vanguard, a renowned investment management company, is known for its commitment to offering low-cost investment options and pioneering the concept of index funds for individual investors. With a focus on delivering long-term value to investors, Vanguard's ETFs like VONV reflect the company's dedication to providing diversified and cost-effective investment solutions.

SURE DIVIDEND

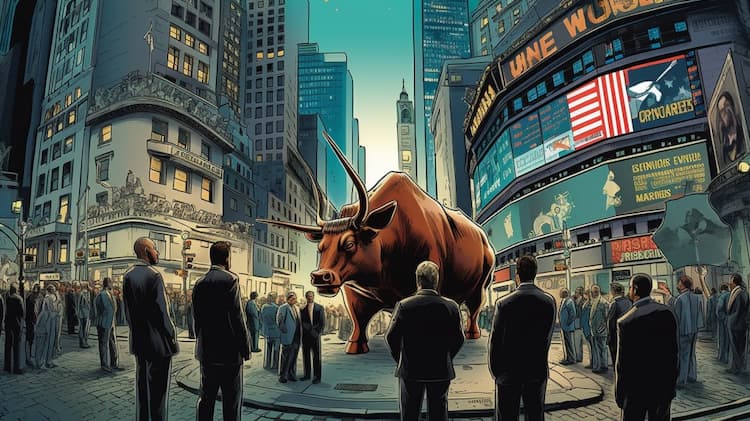

The SURE Dividend ETF focuses on investing in a portfolio of U.S. traded companies selected from a universe of the largest 3,000 U.S. equity securities based on market capitalization. With an actively-managed approach, the ETF prioritizes securities that exhibit positive insider sentiment, as indicated by factors such as shrinking public equity float, rising free cash flow, falling financial leverage, and high dividend yield. The strategy aims to generate dividend income and capital appreciation by following a disciplined and quantitative proprietary model, aligning with the philosophy that corporate insiders' insights can drive favorable market conditions and value investing opportunities.

SURE TRACKING

Exchange-Traded Funds (ETFs) have revolutionized the world of investing, offering a diversified portfolio in a single security. Among these, the ETF SURE tracking system stands out as an efficient and straightforward option for investors. SURE, which stands for Simplified Universal Real-time Exchange, utilizes cutting-edge technology to provide real-time tracking and monitoring of various ETFs. This innovative platform empowers investors with instant access to data, enabling them to make informed decisions and optimize their portfolios swiftly. ETF SURE tracking simplifies the complex world of ETF investments, making it an attractive option for both novice and seasoned investors seeking to navigate the markets with confidence.

SURE CORRELATION

Exchange-Traded Funds (ETFs) have gained immense popularity for their ability to provide diversification within a single investment. Within the ETF universe, a crucial aspect that investors need to comprehend is the concept of ETF SURE correlation. SURE, which stands for Simplified Universal Real-time Exchange, introduces a game-changing approach to understanding how various ETFs correlate with each other. This correlation measurement not only simplifies the decision-making process but also empowers investors to construct well-balanced portfolios. By analyzing the correlation between different ETFs, investors can gauge their exposure to specific market segments, mitigate risks, and seize opportunities more effectively. In an ever-evolving financial landscape, mastering ETF SURE correlation can be the key to unlocking your investment potential.SURE Sector

SURE SECTOR

Exchange-Traded Funds (ETFs) have redefined the investment landscape, offering diversification and simplicity to investors. Among the innovative tools in the ETF realm, ETF SURE Sector tracking has emerged as a powerful resource. SURE, or Simplified Universal Real-time Exchange, brings a new dimension to ETF investing by categorizing ETFs according to sectors. This approach enables investors to target specific industries or segments of the market with precision, allowing for more strategic portfolio construction. Whether you're bullish on technology, interested in healthcare, or want exposure to any other sector, ETF SURE Sector tracking streamlines the process, giving investors the tools they need to navigate the complex world of sector-specific investments effectively. By understanding and leveraging ETF SURE Sector, investors can tailor their portfolios to match their financial goals and market outlooks, all with ease and confidence.SURE Exposure

SURE EXPOSURE

When it comes to the Vanguard Russell 1000 Value ETF (VONV), its exposure revolves around the large-cap value stocks in the U.S. market. By tracking the Russell 1000® Value Index, VONV allows investors to tap into the performance of these value-oriented companies. If you're looking for a tool to explore and deeply understand exposure, ETF Insider's web app offers comprehensive data and user-friendly visualization tools to dissect the markets, regions, sectors, overlaps, correlations, and more for various U.S. ETFs, making investment decisions more informed and insightful.