How does the EUO ETF work?

The EUO ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

Empowered Funds, LLC dba EA Advisers is the issuer of the Alpha Architect ETFs, including the Empowered Funds Adaptive Quantitative Momentum ETF (VMOT). The Adviser follows a proprietary methodology developed by Empirical Finance, LLC, and licensed to the Adviser. VMOT is an actively managed fund of funds, primarily investing in other ETFs with a focus on quantitative momentum and value investment strategies. The Adviser employs a rules-based approach to construct the ETF's portfolio, aiming to identify securities with strong momentum or potential for capital appreciation. Additionally, the fund utilizes hedging techniques to manage market risk and may adjust its portfolio allocations up to twice a month.

The Alpha Architect Value Momentum Trend ETF (VMOT) has a dividend yield of 2.36% as of the latest available data. The ETF does not have a specified dividend distribution frequency, indicating that it may not follow a regular schedule for dividend payouts. Managed by Alpha Architect and actively advised by Empowered Funds, LLC, VMOT primarily invests its assets in other ETFs advised by Alpha Architect, focusing on both momentum and value investment strategies.

The Alpha Architect Value Momentum Trend ETF (VMOT) is designed to provide exposure to both value and momentum investment strategies. This actively managed fund primarily invests in a selection of Alpha Architect ETFs, aiming to capture the potential for capital appreciation through a quantitative value-centric metric and consistent positive returns. VMOT's portfolio allocation is influenced by proprietary models that prioritize higher relative momentum and cheaper valuation, making it an option for investors seeking to TRACKING a blend of value and momentum factors in their investments.

The Alpha Architect Value Momentum Trend ETF (VMOT) employs a unique investment strategy that blends both value and momentum principles. The fund is actively managed and invests in a portfolio of other exchange-traded funds (ETFs) managed by the Adviser, Alpha Architect. VMOT's strategy involves seeking exposure to value-oriented and momentum-driven securities in both domestic and international equity markets. By combining these two distinct investment styles, VMOT aims to capture potential alpha by exploiting market inefficiencies related to both value and momentum factors.

The Alpha Architect Value Momentum Trend ETF (VMOT) focuses on the dual factors of value and momentum in its investment approach. The ETF employs a quantitative value strategy that seeks to identify undervalued securities based on proprietary metrics, combined with a momentum strategy that emphasizes investing in securities with strong recent performance. As of September 30, 2022, the VMOT ETF had significant exposure to the Energy sector (30.18%) and the Materials sector (12.57%), reflecting its allocation in industries related to commodities and basic materials.

The VictoryShares Momentum ETF (VMOT) focuses on capturing momentum within the equity market using a quantitative approach. Managed by Empowered Funds, VMOT is a fund of funds, investing primarily in other ETFs managed by the adviser. Its exposure strategy involves a dynamic allocation across Alpha Architect ETFs that employ momentum and value investment styles. As of September 30, 2022, VMOT's portfolio had notable exposures to Energy (30.18%) and Materials (12.57%), reflecting its targeted sectors for momentum and value opportunities.

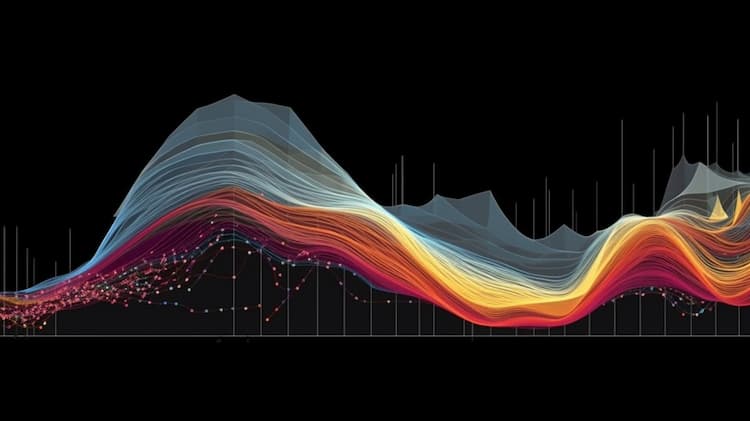

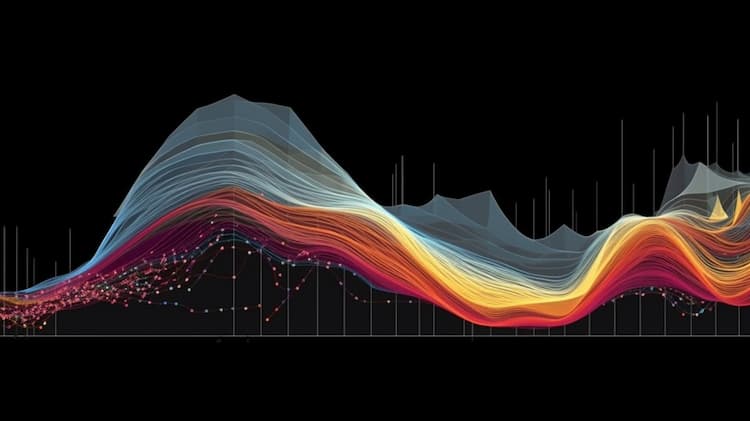

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

The EUO ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

Unlocking the Secrets of DRN and VMOT ETFs: A Comprehensive Overview of Two Prominent Investment Vehicles. Discover the ins and outs of the DRN and VMOT ETFs in this informative article, exploring their unique features and potential benefits for investors.

Compare the GLL and DUST ETFs with our thorough analysis. Dive into the performance metrics, underlying assets, and investment strategies to see how they stack up against each other. Whether you're a seasoned investor or just getting started, our comparison provides valuable insights to guide your investment decisions.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.