WBIG ISSUER

The issuer of the WBIG ETF, WBI Investments, Inc., is an affiliate of Millington Securities, Inc., the advisor to the fund. WBI Investments, Inc. is responsible for managing the ETF's investment strategy and portfolio. The fund seeks to invest in equity securities of domestic and foreign companies of various market capitalizations, focusing on those that display attractive prospects for growth in intrinsic value and other tactical investment opportunities. Their investment approach includes a buy and sell discipline, and they may also allocate a significant portion of the fund's assets to cash or cash equivalents based on the results of their proprietary selection process. WBIG ETF primarily invests in a wide range of equity and debt securities, including common stocks, preferred stocks, corporate debt securities, U.S. Government securities, high-yield bonds, ETFs, and more.

WBIG DIVIDEND

While the primary focus of the WBIG Dividend ETF may be on growth and tactical investment opportunities, it still reflects its dividend distribution strategy. The fund seeks to invest in a diverse range of equity and debt securities, including small-capitalization, mid-capitalization, and large-capitalization companies, both domestic and foreign. Its investment process involves evaluating securities for attractive yield characteristics, including the quality and consistency of dividend payments. The fund's dividend distributions, influenced by the performance and policies of its underlying investments, provide investors with a potential source of income alongside capital appreciation opportunities.

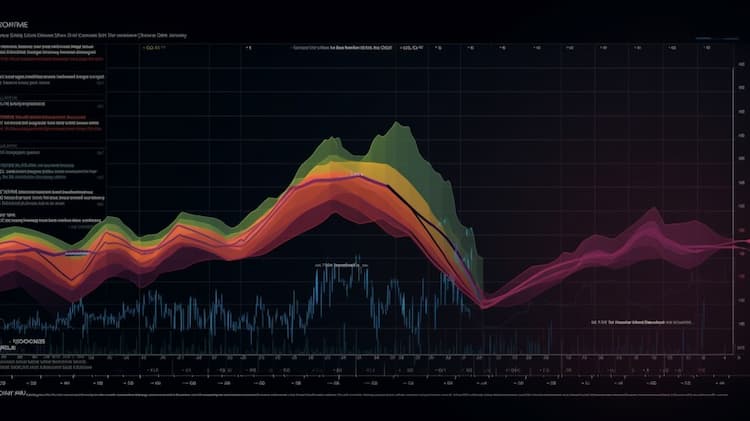

WBIG TRACKING

Tracking the WBI Tactical Growth Shares ETF (WBIG) involves investing in a diverse range of equity securities, including small-capitalization, mid-capitalization, and large-capitalization domestic and foreign companies. WBI Investments, Inc., the sub-advisor to the fund, utilizes a proprietary selection process to identify securities with attractive prospects for growth in intrinsic value and other tactical investment opportunities. WBIG may also invest in cash, cash equivalents, fixed, floating, and variable-rate corporate debt securities, U.S. Government securities, ETFs, and exchange-traded notes (ETNs). The fund employs an absolute return approach, aiming to deliver consistent, attractive returns with lower volatility and risk compared to traditional strategies, regardless of market conditions. The sub-advisor employs quantitative computer screening, fundamental analysis, technical analysis, and a sell discipline to actively manage the portfolio. As a result, WBIG is an actively managed ETF with a high portfolio turnover rate, offering investors a unique approach to seeking growth and managing risk in their portfolios.

WBIG CORRELATION

The correlation aspect of the WBI Power Factor High Dividend ETF (WBIG) is centered on its investment strategy, which seeks to invest in a diversified portfolio of domestic and foreign companies displaying attractive prospects for growth in intrinsic value. Due to this strategy, WBIG's correlation with equity markets, both in the United States and internationally, can vary depending on the selection of stocks within its portfolio. This ETF's unique approach to selecting securities may lead to correlations with different asset classes and market sectors, making it an intriguing option for investors seeking diversification opportunities.

WBIG SECTOR

The WBIG Sector ETF seeks to invest in a diverse range of equity securities, including small-capitalization, mid-capitalization, and large-capitalization domestic and foreign companies, identified as having attractive growth prospects by WBI Investments, Inc., the sub-advisor to the fund. These securities are selected based on a comprehensive investment process that incorporates buy and sell disciplines. In addition to traditional equities, the fund may also include other investment vehicles such as ETFs, REITs, and MLPs, offering investors exposure to a variety of asset classes. The ETF's active management approach aims to deliver consistent returns while managing volatility and risk, aligning with its absolute return investment objective.

WBIG EXPOSURE

The exposure characteristic of the WBI Bull|Bear Trend Switch US Total Return ETF (WBIG) is defined by its innovative investment strategy. WBIG employs a dynamic approach, seeking to invest in equity securities across small-cap, mid-cap, and large-cap domestic and foreign companies. It combines a tactical investment style with a focus on growth potential and risk mitigation, making it a versatile option for investors looking to navigate various market conditions.