How does the JHID ETF work?

The JHID ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

The issuer of the WCBR ETF, which stands for the WisdomTree Cybersecurity Fund, is dedicated to providing exposure to global equity securities of exchange-listed companies primarily engaged in cybersecurity and security-oriented technology. These companies derive at least 50% of their revenue from cybersecurity activities and demonstrate consistent revenue growth. The ETF's investment guidelines emphasize cybersecurity themes and exclude companies based on environmental, social, and governance (ESG) criteria. With semi-annual reconstitution and a focus on cybersecurity, the WCBR ETF issuer aims to offer investors a diversified and socially responsible investment option in the ever-evolving world of cybersecurity technology.

The WCBR Dividend reflects the dividend distribution of the Global Cybersecurity Revenue Index ETF (WCBR), which is primarily focused on cybersecurity and security-oriented technology companies. While dividend income may not be the primary objective of this ETF, it still offers dividend potential to investors. Dividend distributions typically occur on a regular basis, influenced by the dividend policies and performance of the constituent companies within the cybersecurity sector. To be eligible for inclusion in the index, companies must meet specific criteria related to cybersecurity activities, revenue growth, market capitalization, and trading volume. Investors interested in cybersecurity themes and potential dividend income may find this ETF appealing, as it aligns with both security and income-oriented investment goals.

Tracking the Global Cybersecurity and Security Technology Index is the primary objective of the WCBR ETF. This exchange-traded fund is dedicated to providing exposure to equity securities of companies worldwide that are heavily engaged in cybersecurity activities, generating a substantial portion of their revenue from security protocols that safeguard systems, networks, applications, computers, and mobile devices. To qualify for inclusion in the Index, companies must meet stringent criteria, including deriving at least 50% of their revenue from cybersecurity activities, demonstrating strong revenue growth, maintaining a minimum market capitalization of $300 million, and meeting specific trading volume requirements. Additionally, the Index adheres to environmental, social, and governance (ESG) criteria by excluding companies that do not align with the United Nations Global Compact Principles, are involved in core weapon systems, have significant ties to the tobacco industry, or are significantly engaged in thermal coal activities. The Index undergoes semi-annual reconstitution and rebalancing, with a notable concentration of information technology sector companies as of September 30, 2022, making it a compelling choice for investors seeking exposure to the cybersecurity and security-oriented technology sector.

The correlation aspect of theWisdomTree Cybersecurity Fund (WCBR) is essential for understanding its performance in relation to the global cybersecurity sector. Given that WCBR focuses on companies primarily engaged in cybersecurity activities, its correlation with this sector is expected to be strong. Investors looking to gain exposure to the cybersecurity industry often analyze WCBR's correlation with other cybersecurity ETFs and relevant indices to assess its effectiveness as a sector-specific investment. For those seeking deeper insights into these correlations and their implications, ETF Insider provides a user-friendly web app with robust visualization tools, making it easier to identify overlaps and make informed investment decisions in the cybersecurity sector.

The WCBR Sector ETF focuses on providing exposure to equity securities of exchange-listed companies globally that are primarily involved in cybersecurity and security-oriented technology. These companies generate a significant portion of their revenue from security protocols aimed at preventing intrusion and attacks on systems, networks, applications, computers, and mobile devices. The ETF seeks to capitalize on the growth potential within the cybersecurity sector by investing in companies that meet specific criteria, including deriving at least 50% of their revenue from cybersecurity activities and demonstrating revenue growth. Additionally, it excludes companies that do not comply with certain ESG criteria and is reconstituted and rebalanced semi-annually. As of September 30, 2022, the ETF had a significant concentration in the information technology sector, making it an attractive option for investors looking to participate in the cybersecurity industry's growth while considering ESG factors.

The exposure characteristics of the WCBR ETF focus on providing investors with exposure to global companies primarily engaged in cybersecurity and security-oriented technology. This ETF is designed to track an index that includes companies generating a significant portion of their revenue from security protocols to prevent intrusion and attacks on systems, networks, applications, computers, and mobile devices. To be included in the index, companies must meet specific criteria, including deriving at least 50% of their revenue from cybersecurity activities and having a market capitalization of at least $300 million. The index also applies environmental, social, and governance (ESG) criteria to exclude companies not complying with certain principles or significantly involved in specific industries, such as tobacco or thermal coal. As of September 30, 2022, the information technology sector constituted a substantial portion of the index. ETF Insider's web app and visualization tool can provide a deeper understanding of this ETF's exposure, helping investors uncover valuable insights, overlaps, and correlations within its portfolio.

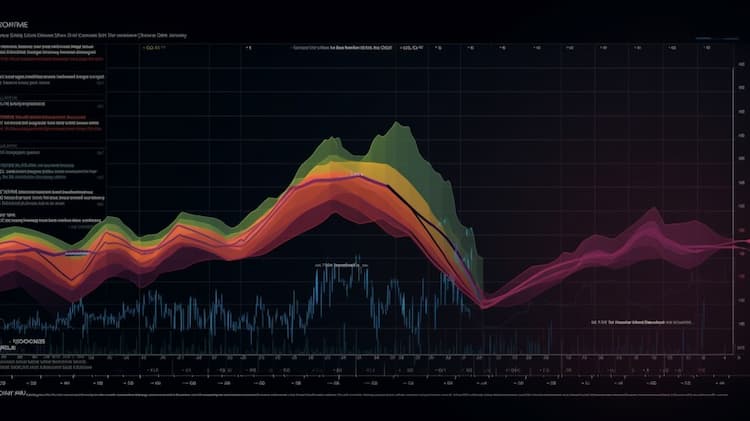

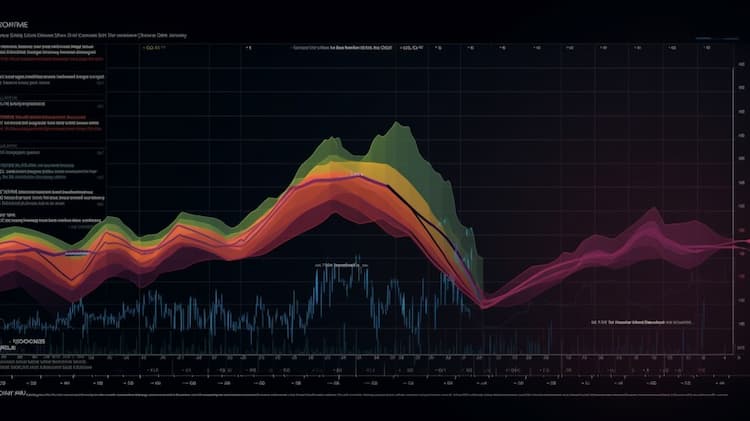

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

The JHID ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

The WCBR ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

NAIL VS ita are specialized investment funds that focus on a diverse range of sectors in the financial market. these exchange-traded funds offer investors exposure to various industries and companies, presenting potential growth opportunities and risks. it's essential to understand the underlying assets and strategies of these etfs before considering an investment.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.