How does the XYLG ETF work?

The XYLG ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

The XYLG issuer, Global X Funds, focuses on investment strategies aligned with the Cboe S&P 500 Half BuyWrite Index, committing at least 80% of its assets to securities within this index. This index measures the performance of a theoretical portfolio that includes stocks from the S&P 500 Index, with approximately 50% of the portfolio's value represented by written covered call options. These options are held until expiration and are designed to generate income while allowing for potential upside exposure. The Fund employs a buy-write strategy, purchasing securities from the Reference Index while selling call options, which helps in income generation and mitigating market declines. Managed by Global X Management Company LLC, the Fund operates under a passive approach, striving to mirror the performance of the Underlying Index. While typically employing a replication strategy, the Fund may resort to representative sampling under certain circumstances. Despite potential concentration in specific sectors like information technology, the Fund aims to maintain a high correlation with the Underlying Index, anticipating a performance correlation exceeding 95% over time, thus ensuring investors' alignment with the index's performance.

The XYLG issuer, Global X Funds, which aligns its investment strategy with the Cboe S&P 500 Half BuyWrite Index, may generate dividends for its investors. Given its focus on a buy-write strategy, the Fund earns income primarily through the sale of covered call options on the securities within the Reference Index. This approach allows the Fund to distribute dividends to shareholders from the premiums received on these call options. Additionally, dividends may also be sourced from any dividends earned on the underlying securities held within the portfolio. However, it's important to note that dividend payouts can vary depending on market conditions, the performance of the underlying securities, and the success of the buy-write strategy employed by the Fund. Investors should review the Fund's prospectus and consult with financial professionals for more detailed information on dividend policies and expected dividend yields.

The XYLG issuer, Global X Funds, aims to closely track the performance of the Cboe S&P 500 Half BuyWrite Index (the Underlying Index) through its investment strategy. By investing at least 80% of its total assets in securities tied to the Underlying Index, the Fund seeks to replicate its performance. This index measures the performance of a theoretical portfolio that combines stocks from the S&P 500 Index with written covered call options on approximately 50% of the portfolio's value. Global X Funds employs a passive approach, utilizing either a replication or representative sampling strategy to mimic the composition of the Underlying Index. The Fund's management, Global X Management Company LLC, expects a correlation of over 95% between the Fund's performance and that of the Underlying Index, ensuring investors' alignment with the index's movements. However, it's important to note that while the Fund aims to closely track the Underlying Index, there may be slight variances due to factors such as transaction costs, liquidity issues, and market fluctuations. Investors should review the Fund's prospectus for detailed information on tracking methodologies and potential tracking error.

The XYLG issuer, Global X Funds, endeavors to maintain a high correlation with the Cboe S&P 500 Half BuyWrite Index (the Underlying Index) through its investment strategy. By investing at least 80% of its total assets in securities linked to the Underlying Index, the Fund aims to closely mirror its performance. This index reflects the performance of a theoretical portfolio comprising stocks from the S&P 500 Index along with written covered call options on about 50% of the portfolio's value. Managed by Global X Management Company LLC, the Fund utilizes a passive approach, employing either a replication or representative sampling strategy to replicate the composition of the Underlying Index. Management anticipates a correlation exceeding 95% between the Fund's performance and that of the Underlying Index, suggesting a strong alignment with market movements. However, investors should acknowledge that while the Fund strives for a high correlation, slight discrepancies may occur due to factors such as transaction costs, market volatility, and differences in timing of trades. Detailed information on correlation methodologies and potential deviations can be found in the Fund's prospectus.

The XYLG issuer, Global X Funds, operates with a focus on the Cboe S&P 500 Half BuyWrite Index, which encompasses a diverse array of sectors representative of the broader U.S. stock market. The underlying index includes companies spanning various sectors such as industrial, information technology, utility, financial, and others defined by the Global Industry Classification Standard (GICS). As of December 31, 2023, the Underlying Index displayed notable exposure to the information technology sector. This suggests that the XYLG Fund, by closely tracking the Underlying Index, likely maintains a similar sectoral allocation, potentially emphasizing investments in the information technology sector alongside other key sectors represented within the index. However, investors should remain attentive to any changes in sectoral composition over time, as market conditions and economic trends may influence sector weights within the index and, consequently, within the XYLG Fund's portfolio.

The XYLG issuer, Global X Funds, offers exposure to the Cboe S&P 500 Half BuyWrite Index (the Underlying Index) through its investment strategy. By investing at least 80% of its total assets in securities linked to the Underlying Index, the XYLG Fund provides investors with exposure to a diversified portfolio. The Underlying Index comprises a mix of stocks from various sectors, including industrial, information technology, utility, financial, and others as defined by the Global Industry Classification Standard (GICS). As of December 31, 2023, the Underlying Index demonstrated significant exposure to the information technology sector. This suggests that the XYLG Fund, by tracking the Underlying Index, offers investors exposure to the performance of companies primarily within the information technology sector, alongside other key sectors represented within the index. However, investors should note that exposure may vary over time due to changes in market conditions, economic trends, and sectoral weights within the index. It's advisable for investors to review the Fund's prospectus for detailed information on current exposure levels and sectoral allocation

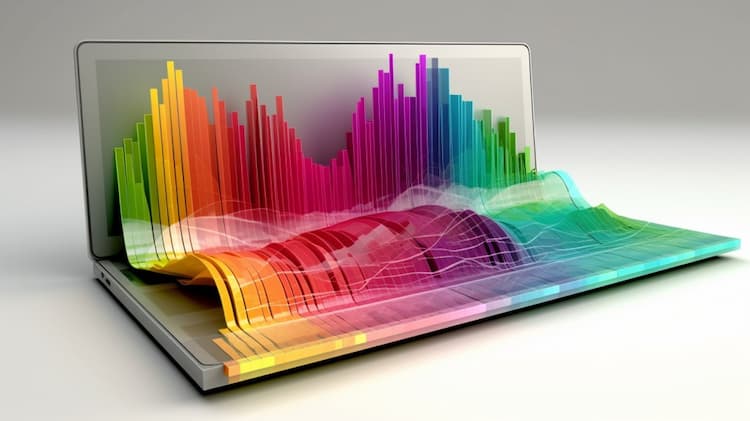

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

The XYLG ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

The BALT ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

ACWI and VEU offer investors distinct avenues for global diversification, catering to different investment preferences and strategies.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.