YUMY ISSUER

YUMY ETF, by VANECK, is an actively managed exchange-traded fund (ETF) primarily focused on investing in domestic and foreign equity securities of companies deeply involved in Agri-Food technology and innovation. This sector encompasses businesses driving or benefiting from advancements in environmentally sustainable agriculture and food products and services. The fund's investments are guided by a thorough qualitative and quantitative analysis of companies' financials to ascertain their involvement in Agri-Food technology and innovation. YUMY classifies relevant companies into three main categories: food technology, precision agriculture, and agricultural sustainability. It may concentrate on any of these categories at any given time and seeks out equity securities representing significant growth potential. Additionally, YUMY considers ESG factors in its investment process, recognizing their material impact on companies and industries. The fund's non-diversified classification allows it to invest a substantial portion of its assets in specific issuers, reflecting its strategic focus on the Agri-Food technology and innovation space. Furthermore, YUMY has the flexibility to invest in special purpose vehicles, including SPACs, IPOs, and other investment companies, to gain exposure to specific market sectors or regions when direct investments are limited or unavailable. As of December 31, 2022, YUMY's significant holdings spanned across sectors like basic materials, consumer staples, and industrials, underscoring its diversified approach within the Agri-Food technology and innovation domain.

YUMY DIVIDEND

YUMY Dividend, a constituent of the VANECK family, is an exchange-traded fund (ETF) designed to cater to income-seeking investors by focusing on dividend-yielding securities. With an emphasis on stable income generation, YUMY Dividend invests in a diversified portfolio of domestic and foreign equity securities of companies with a history of consistent dividend payments or the potential for future dividend growth. The fund employs a rigorous selection process, combining qualitative and quantitative analyses to identify companies with strong financial fundamentals and sustainable dividend policies. YUMY Dividend's investment strategy aims to provide investors with a reliable income stream while maintaining exposure to potential capital appreciation. As part of its investment approach, the fund may also consider environmental, social, and governance (ESG) factors, recognizing their significance in long-term value creation. Through its disciplined approach to dividend investing, YUMY Dividend seeks to offer investors a balance of income and growth opportunities within a diversified portfolio framework.

YUMY TRACKING

YUMY Tracking, an integral component of the VANECK suite, is an exchange-traded fund (ETF) engineered to mirror the performance of a specific market index or benchmark. Employing a passive investment approach, YUMY Tracking invests its assets in a manner that closely replicates the composition and weightings of its designated index. This strategy aims to provide investors with a cost-effective means of gaining exposure to a particular market segment or asset class. YUMY Tracking diligently maintains a portfolio that mirrors the index it tracks, periodically adjusting holdings to reflect changes in the underlying index composition. By closely tracking the performance of its benchmark, YUMY Tracking endeavors to deliver investment results that closely align with the index it seeks to replicate, offering investors a transparent and efficient way to access market returns within a diversified portfolio framework.

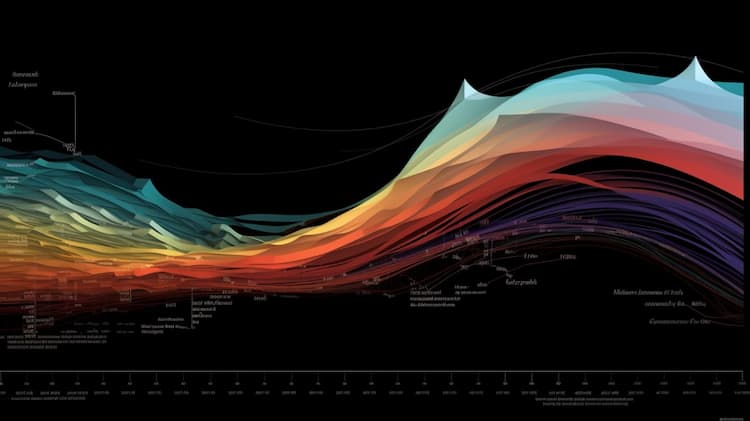

YUMY CORRELATION

YUMY Correlation, an essential offering within the VANECK family, is an exchange-traded fund (ETF) designed to provide investors with exposure to assets exhibiting a high degree of correlation. Leveraging sophisticated quantitative models, YUMY Correlation strategically selects assets that move in tandem with one another, aiming to replicate a specific correlation target or pattern. This ETF employs a dynamic allocation strategy, continuously adjusting its portfolio to maintain the desired correlation level, whether positive or negative, with its designated benchmark or reference index. YUMY Correlation's investment approach seeks to offer investors a tool for managing portfolio risk or enhancing diversification by harnessing the relationships between different asset classes. Through its focus on correlation-based investing, YUMY Correlation aims to deliver returns that align closely with its target correlation objectives, providing investors with a potential avenue for navigating various market conditions with greater predictability and stability.

YUMY SECTOR

YUMY Sector, a key component of the VANECK suite, is an exchange-traded fund (ETF) crafted to provide investors with targeted exposure to specific sectors or industries within the market. This ETF focuses on constructing a portfolio comprising equity securities from a particular sector or sectors, aiming to capitalize on the growth potential and unique dynamics of those industries. YUMY Sector's investment strategy involves in-depth research and analysis to identify sectors poised for outperformance or sectors with specific thematic relevance. By concentrating its holdings in select sectors, YUMY Sector offers investors the opportunity to align their investment strategies with their convictions about particular industries' future prospects. Whether seeking exposure to technology, healthcare, consumer staples, or other sectors, investors can utilize YUMY Sector to tailor their portfolios to specific sectoral themes, potentially enhancing returns or managing sector-specific risks within a diversified investment approach.

YUMY EXPOSURE

YUMY Exposure, an integral member of the VANECK family, is an exchange-traded fund (ETF) engineered to provide investors with diversified exposure to a broad range of asset classes and market segments. This ETF adopts a comprehensive investment strategy, allocating its assets across various asset classes such as equities, fixed income securities, commodities, and alternative investments. YUMY Exposure's portfolio construction process entails careful consideration of factors like risk tolerance, return objectives, and market conditions, aiming to optimize the risk-return profile for investors. By offering exposure to multiple asset classes within a single investment vehicle, YUMY Exposure enables investors to build well-rounded portfolios that can potentially benefit from diversification while accessing opportunities across different markets and investment strategies. Whether seeking growth, income, or risk mitigation, investors can utilize YUMY Exposure to tailor their portfolios to their specific investment preferences and objectives, providing a convenient and efficient way to achieve diversified exposure within a single investment product.