BRAZ VS FBZ: Tracking Methods and Exposure

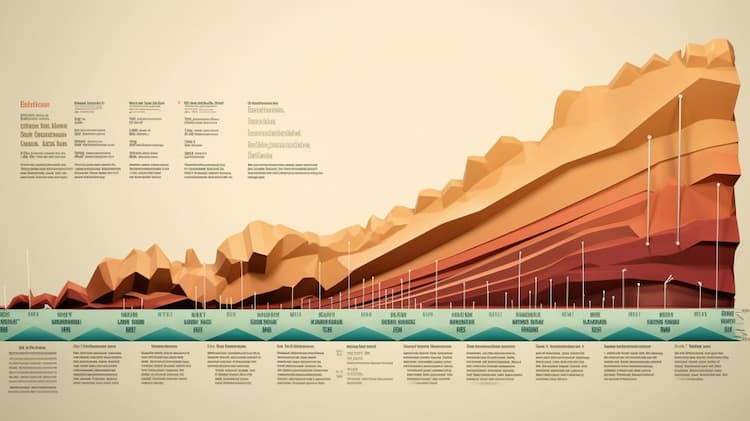

Exchange-Traded Funds (ETFs) have transformed the landscape of investment, offering diversified exposure to various sectors and asset classes. In this article, we embark on a comprehensive comparison between two notable ETFs: BRAZ (Global X Brazil Consumer ETF) and FBZ (First Trust Brazil AlphaDEX Fund). We'll delve into the ETF tickers, full names, issuers, sectors, top holdings, capitalization, investment strategy, tracking methods, and exposure.

BRAZ VS FBZ: An Overview

BRAZ and FBZ are two distinct ETFs with their sights set on the Brazilian market. While BRAZ focuses on the consumer sector within Brazil, FBZ adopts the AlphaDEX strategy to select Brazilian stocks. These differing approaches result in varying risk profiles and exposure, details of which will be scrutinized in the following sections.

BRAZ VS FBZ: Sectors and Top Holdings

The BRAZ ETF zeroes in on the Brazilian consumer sector, encompassing industries like retail, food, and beverage. Its top holdings may include prominent Brazilian companies in these sectors. On the contrary, FBZ's approach involves a methodology that identifies strong fundamental metrics among Brazilian stocks. This leads to unique sector exposure and distinctive top holdings within FBZ.

BRAZ overlap BRAZ VS FBZ: A Comprehensive Comparison of ETFs

BRAZ overlap BRAZ VS FBZ: A Comprehensive Comparison of ETFs

BRAZ VS FBZ: Capitalization and Investment Strategy

BRAZ, with its specific focus on the Brazilian consumer, can potentially capture the growth and fluctuations in this sector. FBZ, on the other hand, employs the AlphaDEX methodology, which seeks to amplify potential returns by emphasizing select stocks with favorable fundamental factors. This difference in capitalization and strategy presents investors with varied opportunities and potential outcomes.

BRAZ VS FBZ: Tracking Methods and Exposure

BRAZ and FBZ exhibit distinct tracking methods. BRAZ tracks an index that encompasses Brazilian companies within the consumer sector. FBZ employs the AlphaDEX approach, which selects and weights stocks based on multiple factors. As a result, the exposure provided by these ETFs diverges, catering to investors with different preferences for market exposure and risk tolerance.

Conclusion

BRAZ and FBZ represent unique avenues for investors looking to access the Brazilian market. Their divergent strategies and approaches provide distinctive exposures and risk profiles. For a more comprehensive understanding of the holdings, correlations, overlaps, and various insights, ETF Insider serves as an invaluable tool. With its user-friendly app, investors can gain extensive information on these ETFs and other financial instruments.

Disclaimer: This article does not provide any investment advisory services.

Sources:

Get started