Efficient frontier limitations

In this article we speak about Efficient Frontier limitations in details.

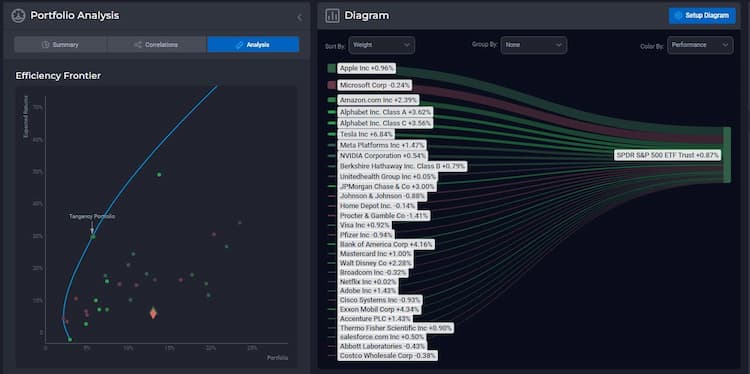

In the world of finance, the term "efficient frontier" is a crucial concept that every investor should be acquainted with. It represents the range of optimal portfolios that offer the highest expected return for a given level of risk or the lowest risk for a given level of expected return. In this article, we will delve into the depths of efficient frontiers, exploring their significance, calculation methods, and limitations.

Efficient Frontier: Calculating the Optimal Portfolio

Calculating the efficient frontier involves intricate mathematical modeling and analysis. It's a process that aims to find the perfect balance between risk and return for an investment portfolio. We will discuss the methodology behind calculating the efficient frontier and how it assists investors in making informed decisions about asset allocation.

Efficient Frontier: The Role of Technology

In today's digital age, technology has revolutionized the financial landscape, making complex calculations and portfolio optimization more accessible than ever. We will explore how efficient frontier calculators and tools have become indispensable aids for both novice and experienced investors in crafting well-balanced portfolios.

Efficient frontier overlap efficient frontier limitations

Efficient frontier overlap efficient frontier limitations

Efficient Frontier: Limitations and Real-World Application

While the concept of the efficient frontier is a valuable guide, it's essential to recognize its limitations. We'll dissect the constraints and assumptions inherent in the efficient frontier theory and discuss how these factors play out in the real-world dynamics of financial markets.

Conclusion

In conclusion, understanding the efficient frontier is pivotal for anyone looking to optimize their investment portfolio. It provides a structured approach to balancing risk and return. However, it's important to remember that while the efficient frontier is a powerful tool, it's not immune to the complexities and uncertainties of financial markets. Always consider seeking professional advice before making investment decisions.

Disclaimer: This article is for informational purposes only and does not provide investment advisory services.

Get startedFAQ

What is the Efficient Frontier?

The Efficient Frontier is a concept in portfolio theory that shows the set of optimal portfolios offering the highest expected return for a given level of risk.

How is the Efficient Frontier determined?

The Efficient Frontier is derived mathematically by using statistics like expected returns, volatility, and correlations between different assets in the portfolio.

Should I aim for a portfolio on the Efficient Frontier?

Aiming for a portfolio on the Efficient Frontier is generally advisable as it offers the highest return for a given level of risk. However, it depends on your investment goals and risk tolerance.

Are portfolios on the Efficient Frontier always profitable?

While the Efficient Frontier represents the set of optimal portfolios, it does not guarantee profitability. Market conditions can affect the returns.

Can the Efficient Frontier change over time?

Yes, the Efficient Frontier can change as market conditions, asset correlations, and other variables evolve.