ETF with CSX Corp. exposure

Investing in the stock market can be a formidable journey, especially when navigating through the extensive world of Exchange-Traded Funds (ETFs) and specific company exposures like those related to CSX Corp., a predominant player in the railway industry traded on notable indices.

ETF with CSX Corp. exposure: exposure

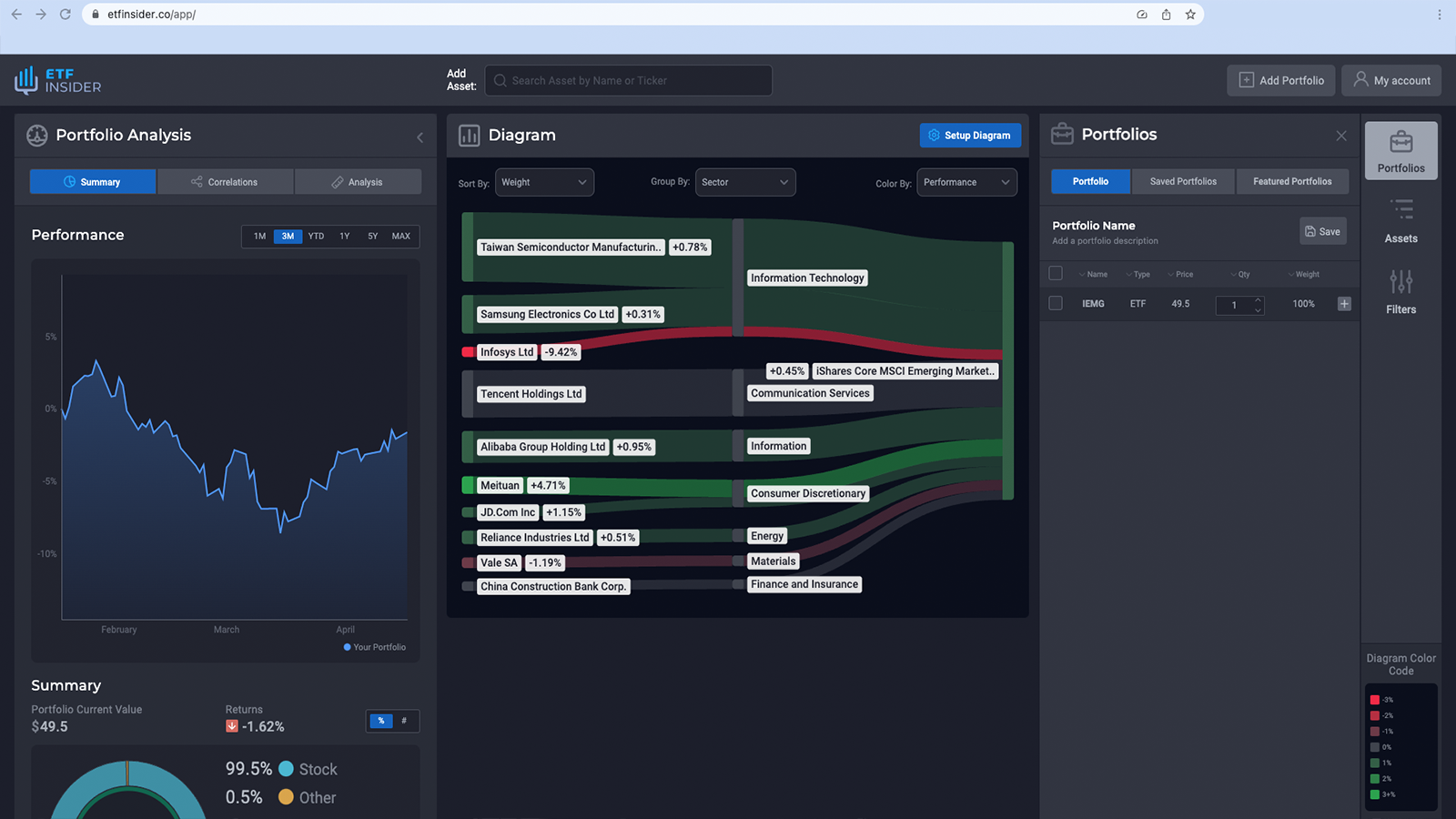

CSX Corp., a giant in the transport and logistics industry, has its shares trading on noteworthy platforms such as the S&P 500 and Nasdaq, making it a pivotal part of various ETFs. An individual ETF, for instance, the iShares Core S&P 500 ETF (IVV), provides broad exposure to the S&P 500, hence offering investors an opportunity to indirectly invest in CSX Corp. through it. Such ETFs, especially those tracking the S&P 500 or Nasdaq, like the Invesco QQQ Trust (QQQ), intertwine a myriad of investors’ fortunes with CSX Corp., amongst other companies, by giving a diversified exposure to a segment of the U.S. stock market.

ETF with CSX Corp. exposure: comparisons

Comparing ETFs that hold CSX Corp. with their counterparts, various distinctions can be noted. The SPDR S&P 500 ETF Trust (SPY) and the Vanguard S&P 500 ETF (VOO), for example, tend to focus on a broad representation of the U.S. stock market by tracking the performance of the S&P 500. On the other hand, sector-specific ETFs such as the iShares NASDAQ Biotechnology ETF (IBB) focus on specific industries, in this case, biotechnology. Thus, while SPY and VOO provide direct exposure to CSX Corp. through their comprehensive market approach, IBB offers a more niched market segment exposure, excluding companies like CSX Corp. that lie outside the biotechnology sector.

USMV overlap ETF with CSX Corp. exposure

USMV overlap ETF with CSX Corp. exposure

ETF with CSX Corp. exposure: benefits to invest in those ETFs

Investing in ETFs that hold CSX Corp. can be considered a strategic approach to capturing the potential growth of the transportation and logistics industry while simultaneously mitigating risks through diversification. Unlike stock picking, where an investor may expose themselves to the idiosyncratic risks associated with individual companies, investing in an ETF like the Invesco NASDAQ Composite ETF (QQQJ) provides a basket of companies including CSX Corp. Thus, it helps in spreading out the risk and offering a balanced portfolio, which could be beneficial for investors who are seeking to mitigate potential losses and capitalize on the collective performance of companies listed under a particular index.

ETF with CSX Corp. exposure: consideration before investing

While the allure of investing in ETFs with CSX Corp. exposure can be tempting due to potential growth and risk mitigation through diversification, it’s imperative for investors to consider several factors before investing. Investors should contemplate their risk tolerance, investment goals, and the various costs associated with investing in ETFs, such as expense ratios. For instance, the Vanguard S&P 500 ETF (VOO) is known for its low expense ratio, while other ETFs may have higher costs, thus impacting overall returns. Furthermore, considering factors like the ETF’s historical performance, its strategy, and how it aligns with one’s investment objectives is crucial in making an informed decision.

Conclusion

Investing in ETFs with exposure to CSX Corp. combines the potentials of the transport sector with the broader market dynamics, rendering it a calculated strategy for diversified investment. While it provides an avenue to be part of the company’s financial journey, understanding one’s investment goals and risk tolerance remains paramount to navigating through the investment decision-making process. Disclaimer: This article does not provide investment advisory services. Always consult with a qualified financial advisor before making any investment decisions.

Source 1: USMV ETF issuer

Source 2: USMV ETF official page

FAQ

What is the USMV ETF?

The USMV ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the USMV ETF have exposure to?

The USMV ETF has exposure to companies like CSX Corp..

How can I read more about the USMV ETF?

You can read more about the USMV ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the USMV ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the USMV ETF?

The ETF with CSX Corp. exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of CSX Corp.. This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the USMV ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.