What is the efficient frontier

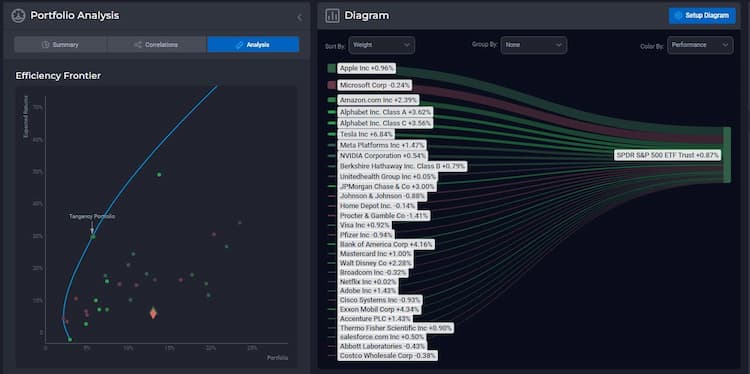

When it comes to managing investments and building a well-diversified portfolio, understanding the concept of the efficient frontier is paramount. The efficient frontier is a fundamental concept in modern portfolio theory, which aims to optimize the risk-return tradeoff in investment portfolios.

Efficient Frontier : Calculating the Efficient Frontier

Calculating the efficient frontier involves determining the ideal mix of assets that maximizes returns for a given level of risk or minimizes risk for a desired level of return. This process requires careful analysis of historical data, asset correlations, and risk measures. Investors often use quantitative tools and efficient frontier calculators to help them find the optimal portfolio allocation.

Efficient Frontier : Benefits of Efficient Frontier Analysis

Efficient frontier analysis provides several benefits for investors. By identifying the optimal portfolio, it allows investors to make informed decisions that align with their risk tolerance and financial goals. Additionally, it aids in diversification, helping to spread risk across different asset classes and reducing the impact of market volatility on a portfolio's performance.

Efficient frontier overlap what is the efficient frontier

Efficient frontier overlap what is the efficient frontier

Efficient Frontier : Implementing the Efficient Frontier Strategy

Implementing an efficient frontier strategy involves selecting a mix of assets that falls on the efficient frontier curve. Investors may need to periodically rebalance their portfolios to maintain the desired asset allocation. It's important to note that the efficient frontier is not a static concept and can change over time due to market conditions and economic factors.

Conclusion

In conclusion, the efficient frontier is a powerful tool for investors seeking to optimize their portfolios. It helps in the strategic allocation of assets to achieve the best possible risk-return tradeoff. However, it's essential to remember that while the efficient frontier provides valuable insights, it doesn't guarantee specific investment outcomes. Therefore, investors should conduct thorough research and consider consulting with financial professionals before making investment decisions.

Disclaimer: This article is for informational purposes only and does not provide investment advisory services.

FAQ

What is the Efficient Frontier?

The Efficient Frontier is a concept in portfolio theory that shows the set of optimal portfolios offering the highest expected return for a given level of risk.

How is the Efficient Frontier determined?

The Efficient Frontier is derived mathematically by using statistics like expected returns, volatility, and correlations between different assets in the portfolio.

Should I aim for a portfolio on the Efficient Frontier?

Aiming for a portfolio on the Efficient Frontier is generally advisable as it offers the highest return for a given level of risk. However, it depends on your investment goals and risk tolerance.

Are portfolios on the Efficient Frontier always profitable?

While the Efficient Frontier represents the set of optimal portfolios, it does not guarantee profitability. Market conditions can affect the returns.

Can the Efficient Frontier change over time?

Yes, the Efficient Frontier can change as market conditions, asset correlations, and other variables evolve.