What is the ESG ETF ?

ESG ETF: Overview

ESG ETFs, short for Environmental, Social, and Governance Exchange-Traded Funds, are a category of financial instruments that have gained immense popularity in recent years. These ETFs aim to incorporate ESG principles into their investment strategies, aligning with the values of socially conscious investors. One such notable ESG ETF is ESG ETF.

ESG ETF: Underlying and Exposure - What Does It Track and How?

The underlying index of ESG ETF is designed to reflect the performance of a select group of companies that score better on a set of ESG key performance indicators (KPIs) relative to U.S. companies in the STOXX® Global 1800 Index. The selection process involves eliminating non-U.S. companies and those involved in controversial weapons or coal mining, and then assessing each company's ESG score. Companies with lower ESG scores within their respective industries are excluded, and higher-scoring ESG companies are given greater weights. This approach allows ESG ETF to offer enhanced ESG characteristics compared to the broader U.S. large-cap equity market.

ESG ETF: Benefits to Invest in This ETF

Investing in ESG ETF offers several advantages for socially conscious investors. By focusing on companies with strong ESG practices, this ETF provides an opportunity to support businesses that prioritize sustainability, social responsibility, and good governance. Additionally, research has shown that companies with better ESG performance may outperform their peers in the long run, making ESG ETF an attractive option for those seeking both financial returns and positive societal impact.

ESG ETF: Considerations Before Investing

While ESG ETF offers compelling benefits, investors should consider certain factors before making a decision. As with any investment, it's crucial to evaluate the fund's historical performance, expense ratio, and risk factors. Furthermore, investors must align their personal ESG preferences with the companies included in the ETF's underlying index to ensure their investments are consistent with their values.

Conclusion:

ESG ETFs, such as ESG ETF, represent a growing trend in the finance world, appealing to investors who want to make a positive impact with their investments. By incorporating ESG principles, these funds provide an opportunity to support sustainable and responsible companies. However, investors should conduct thorough research and consider their financial goals and risk tolerance before investing in any ETF.

Disclaimer: This article is for informational purposes only and does not provide investment advice. The content presented here is based on publicly available information and should not be considered as offering any investment advisory services. Investors are advised to consult with a financial professional before making any investment decisions.

Sources:

The Underlying Index - The selection process, methodology, and characteristics of the index on which ESG ETF is based.

NTI - The investment approach and strategy employed by the fund manager.

Index Provider - The organization responsible for determining the composition and weightings of securities in the Underlying Index.

Remember to verify the latest information and data from reputable sources before making any investment decisions.

ESG ETF issuer

ESG ETF official page

ESG quote and analysis

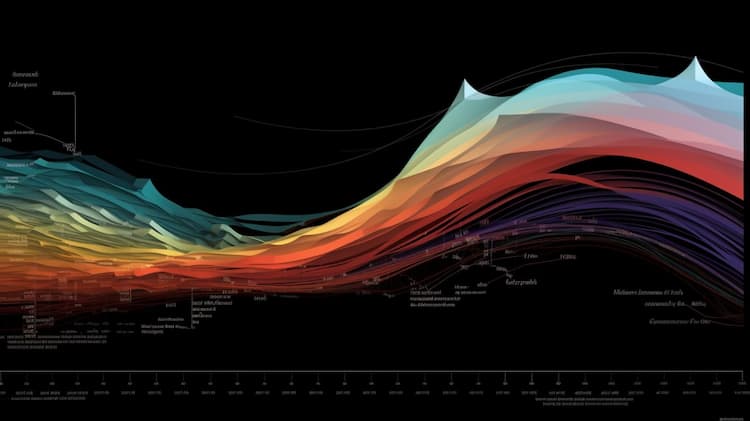

Discover the top holdings, correlations, and overlaps of ETFs using our visualization tool.

Our app allows you to build and track your portfolio.

To learn more about the ESG FlexShares Trust FlexShares STOXX US ESG Select Index Fund, access our dedicated page now.

FAQ

What is the ESG ETF?

The ESG ETF, also known as an Environmental, Social, and Governance ETF, is an exchange-traded fund that focuses on investing in companies that meet certain sustainability and ethical criteria.

What are the underlying principles of the ESG ETF?

The ESG ETF follows a set of environmental, social, and governance principles. Environmental criteria assess a company's impact on the environment. Social criteria evaluate a company's relationships with employees, customers, and communities. Governance criteria analyze a company's management and corporate governance practices.

What types of companies are included in the ESG ETF?

The ESG ETF includes companies that excel in areas related to sustainability, social responsibility, and corporate governance. These may include companies with strong environmental practices, a commitment to social justice, and transparent and accountable corporate governance.

How does the ESG ETF work?

The ESG ETF operates by selecting companies that meet specific ESG criteria and then constructing a portfolio based on these selected companies. Investors can buy shares of the ETF, providing them exposure to a diversified basket of ESG-compliant companies.

What are the advantages of investing in the ESG ETF?

Investing in the ESG ETF allows investors to align their investments with their values and support companies that prioritize sustainability and ethical practices. It may also provide potential long-term financial returns while contributing to positive social and environmental outcomes.