What is the ESGA ETF ?

In the rapidly evolving world of finance, investors are increasingly seeking sustainable investment options that align with their environmental, social, and governance (ESG) values. One such option gaining popularity is the ESGA ETF, an actively managed exchange-traded fund (ETF) that aims to invest in companies showing sustainable business improvement while considering their ESG metrics. In this article, we'll delve into the overview of ESGA ETF, its underlying and exposure criteria, the benefits of investing in this ETF, and crucial considerations before making investment decisions.

ESGA ETF : Overview

[ETF NAME] is a forward-looking ETF designed to invest primarily in large capitalization companies with sustainable business practices. It employs a proprietary multi-factor model that combines fundamental measures of a stock's value and growth potential with ESG metrics. The model assigns each security a financial metrics score and an ESG score, which are then blended to create an overall score. The fund seeks to build a portfolio of stocks with sustainable competitive advantages, better returns, and a stronger ESG profile than the S&P 500® Index.

ESGA ETF Underlying and Exposure: What Does It Track and How?

The underlying strategy of ESGA ETF is centered on identifying companies that demonstrate positive ESG characteristics. To measure value, the portfolio managers may use ratios such as stock price-to-earnings and stock price-to-cash flow. For growth assessment, they consider the rate of growth of a company's earnings and cash flow, along with changes in its earnings estimates. Additionally, the model incorporates price momentum as part of its evaluation process. The ETF's team carefully evaluates multiple ESG metrics for each characteristic—environmental, social, and governance—to determine a comprehensive ESG score.

Environmental criteria include a company's carbon emission profile, energy and water usage, and waste generation. Social factors encompass employee turnover rates, digital privacy, and worker safety, while governance involves scrutinizing corporate leadership, board chair independence, audit and compensation committee independence, and shareholder rights.

ESGA overlap What is the ESGA ETF ?

ESGA overlap What is the ESGA ETF ?

ESGA ETF : Benefits of Investing in this ETF

Investing in [ETF NAME] offers numerous benefits. Firstly, it allows investors to support companies that exhibit sustainable practices and a commitment to ESG principles. By investing in such companies, investors contribute to a positive impact on society and the environment. Secondly, ESGA ETF aims to outperform the S&P 500® Index, providing better returns without significantly increasing risk. Thirdly, as an exchange-traded fund, ESGA ETF offers the advantage of intraday trading and diversification within a single investment vehicle.

ESGA ETF : Considerations Before Investing

While ESGA ETF presents exciting opportunities, investors must carefully assess their own financial goals and risk tolerance before investing. As an actively managed fund, it may involve higher expense ratios compared to passively managed ETFs. Moreover, the fund's performance will depend on the portfolio managers' ability to identify companies with sustainable competitive advantages and strong ESG profiles. Investors should also be aware that ESGA ETF does not seek to replicate the performance of a specific index, and its holdings are not fully disclosed daily.

Conclusion:

In conclusion, ESGA ETF offers a compelling avenue for investors seeking to align their financial goals with their ESG values. With its innovative multi-factor model and focus on sustainable practices, ESGA ETF aims to provide better returns while making a positive impact on society and the environment. However, investors should remember that all investments carry inherent risks, and thorough research and consideration of personal financial objectives are essential before making any investment decisions.

Disclaimer:

This article is for informational purposes only and does not provide investment advisory services. Before making any investment decisions, consult with a qualified financial advisor and carefully review the fund's prospectus. The performance of investments is subject to market fluctuations, and there are no guarantees of specific outcomes.

ESGA ETF issuer

ESGA ETF official page

ESGA quote and analysis

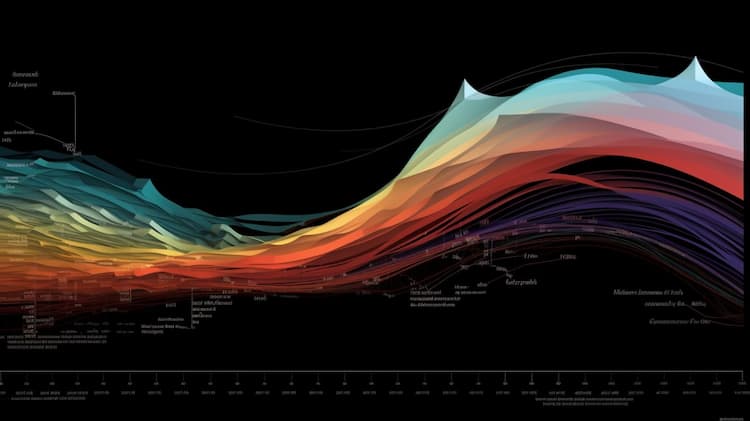

Discover the top holdings, correlations, and overlaps of ETFs using our visualization tool.

Our app allows you to build and track your portfolio.

To learn more about the ESGA American Century Sustainable Equity ETF, access our dedicated page now.

FAQ

What is the ESGA ETF?

The ESGA ETF, also known as the iShares ESG Aware MSCI USA ETF, is an exchange-traded fund that focuses on investing in U.S. companies that exhibit strong environmental, social, and governance (ESG) practices.

What is the underlying index that the ESGA ETF aims to track?

The ESGA ETF aims to track the performance of the MSCI USA Extended ESG Focus Index, which includes U.S. large and mid-capitalization companies that have high ESG ratings.

How does the ESGA ETF select companies for its portfolio?

The ESGA ETF uses a representative sampling indexing strategy to invest in a portfolio of securities that collectively has an investment profile similar to that of the MSCI USA Extended ESG Focus Index. It seeks to include companies with strong ESG practices while aiming to achieve lower costs and better after-tax performance.

What are the advantages of investing in the ESGA ETF?

Investing in the ESGA ETF allows investors to support companies with positive ESG attributes, align their investments with their values, and potentially contribute to positive social and environmental impacts. Additionally, the ETF provides exposure to a diversified basket of U.S. stocks.

What is the industry concentration policy of the ESGA ETF?

The ESGA ETF follows an industry concentration policy that mirrors the concentration of the MSCI USA Extended ESG Focus Index. This means the fund will concentrate its investments in certain industries to approximately the same extent as the underlying index.