The Unseen Risks of Fund Overlap

Diversification has long been touted as the key to successful investing..

The First Trust NASDAQ Global Auto Index Fund (CARZ) is managed by First Trust Advisors L.P., a well-known investment management company. CARZ was established to track the performance of the NASDAQ OMX Global Auto Index, which includes companies engaged in the manufacturing, distribution, retailing, and leasing of automobiles. With a focus on the global automotive industry, the CARZ ETF provides investors with exposure to this sector's dynamics and trends.

The First Trust NASDAQ Global Auto Index Fund (CARZ) focuses on tracking the performance of the NASDAQ OMX Global Auto Index, which consists of companies in the global automobile industry. While CARZ's primary objective is not centered around dividends, it reflects the dividend distribution of the underlying index, which includes global auto manufacturers and related businesses. Dividend distributions from the constituent companies of the index can vary based on individual company policies and performance, offering investors potential dividend returns alongside exposure to the global auto sector.

In the dynamic world of investing, ETFs (Exchange Traded Funds) have proven to be a formidable means for investors to tap into specific industries or sectors without owning individual stocks. One such specialized ETF is CARZ, which tracks the global automobile industry. Designed to provide exposure to the world's largest auto manufacturers, CARZ encompasses a wide range of companies, from traditional internal combustion engine manufacturers to those pioneering in electric and autonomous vehicles. Its growth and popularity mirror the transformative changes happening in the automotive world, with shifts towards sustainable transportation and advanced technologies. Investors looking to steer their portfolios into the rapidly evolving auto sector might find CARZ to be a vehicle worth considering.

Understanding the correlation of the First Trust NASDAQ Global Auto Index Fund (CARZ) is essential for gauging its performance in relation to the global automotive sector. CARZ, as an ETF that tracks the NASDAQ OMX Global Auto Index, is expected to exhibit correlation with the performance of global auto companies. This correlation insight is valuable for investors seeking to assess the impact of industry trends and economic factors on the fund's returns. For a comprehensive analysis of correlations and to delve into intricate data about various US ETFs, ETF Insider offers an intuitive web app with powerful visualization tools. This tool aids in exploring correlations, identifying overlaps, and providing in-depth information for investors looking to make informed decisions.CARZ Sector

The First Trust NASDAQ Global Auto Index Fund (CARZ) primarily focuses on the automotive sector, investing in companies involved in manufacturing and related activities within the global automobile industry. This sector-specific approach allows investors to gain exposure to companies engaged in the production, development, and distribution of automobiles and automotive parts. By concentrating on this sector, CARZ provides a unique investment avenue for those interested in the dynamics of the global auto market and its associated industries. CARZ Exposure

The First Trust NASDAQ Global Auto Index Fund (CARZ) offers investors exposure to the global automobile industry by tracking the performance of the NASDAQ OMX Global Auto Index. This ETF provides a unique opportunity to capitalize on the growth and trends within the automotive sector, spanning across various regions and markets. For investors seeking insights into the exposure and correlations within CARZ and other ETFs, ETF Insider's web app serves as a valuable tool, offering deep and insightful data visualizations for a comprehensive understanding of market connections and trends.

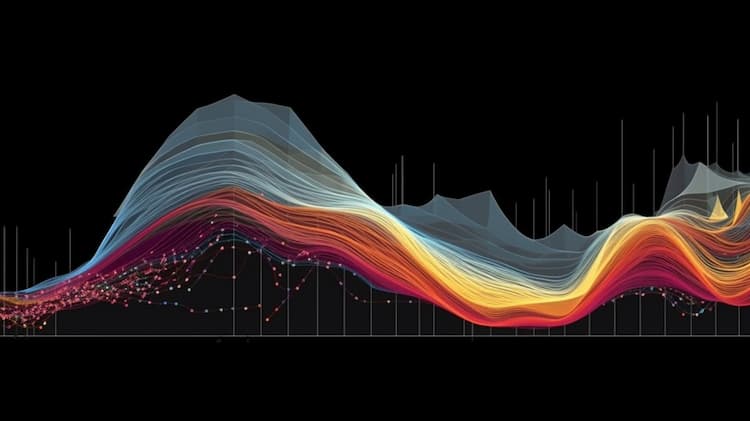

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

Diversification has long been touted as the key to successful investing..

The CARZ ETF, or Autonomous and Electric Vehicles ETF, is an innovative investment tool focused on the rapidly growing autonomous and electric vehicle industries. This exchange-traded fund offers investors exposure to a diverse portfolio of companies at the forefront of the transportation revolution, driving advancements in electric mobility and self-driving technologies. Discover how the CARZ ETF presents a compelling opportunity to invest in the future of transportation and be part of the sustainable and tech-driven revolution on the roads.

Compare the FXI and VWO ETFs with our thorough analysis. Dive into the performance metrics, underlying assets, and investment strategies.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.