How does the CHB ETF work?

The CHB ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

The Global X China Biotech Innovation ETF (CHB) is managed by Global X Management Company LLC, serving as the issuer of this fund. Global X is known for offering a range of thematic and niche-focused exchange-traded funds. Established with a focus on providing investors exposure to innovative companies operating in the rapidly evolving biotechnology sector of China, CHB aims to track the Solactive China Biotech Innovation Index. The Index includes a selection of exchange-listed companies directly involved in China's biotechnology industry, offering investors an opportunity to participate in the growth potential of this dynamic sector.

While the primary focus of the Global X China Biotech Innovation ETF (CHB) lies in tracking the performance of the Solactive China Biotech Innovation Index, it does not prioritize dividend distributions. The fund typically adheres to quarterly distributions influenced by the constituent companies' individual dividend policies and performances. Investors should note that CHB emphasizes exposure to China's biotechnology industry, making it more oriented towards capital appreciation rather than substantial dividend returns.

Tracking the Solactive China Biotech Innovation Index is the primary objective of the CHB ETF. This exchange-traded fund invests at least 80% of its assets in securities from the Solactive China Biotech Innovation Index, along with American Depositary Receipts (ADRs) and Global Depositary Receipts (GDRs) based on the index. The Solactive China Biotech Innovation Index focuses on Chinese biotechnology companies, including H-Shares, Red Chips, P-Chips, A-Shares accessible through Stock Connect Programs, and foreign listings such as ADRs. The ETF aims to provide investors with exposure to China's biotech industry and is reconstituted and re-weighted semi-annually to maintain diversification within the sector.

The correlation aspect of the Global X China Biotech Innovation ETF (CHB) is essential for investors seeking exposure to China's biotechnology industry. CHB tracks the Solactive China Biotech Innovation Index, which includes companies directly involved in China's biotechnology sector, such as H-Shares, Red Chips, P-Chips, A-Shares, and foreign listings. The correlation of CHB with this specific sector provides investors with insights into the performance and trends of China's biotechnology industry.

The Global X China Biotech Innovation ETF (CHB) focuses on the burgeoning biotechnology industry in China. This ETF primarily invests in companies directly involved in China's biotech sector, including H-Shares, Red Chips, P-Chips, A-Shares accessible through Stock Connect Programs, and foreign listings such as ADRs. The fund tracks the Solactive China Biotech Innovation Index, offering investors exposure to this rapidly evolving industry in the world's second-largest economy. It's important to note that CHB is concentrated in the biotech sector, which can present higher risks but also potential for significant growth opportunities for investors.

The exposure characteristic of the Global X China Biotech Innovation ETF (CHB) is centered around the burgeoning biotechnology industry in China. This ETF provides investors with targeted access to exchange-listed companies directly involved in China''s biotechnology sector, including H-Shares, Red Chips, P-Chips, A-Shares accessible through Stock Connect Programs, and Foreign listings like ADRs. The underlying index is designed to emphasize market capitalization and liquidity, ensuring representation of companies with a minimum free float market capitalization of $200 million and a minimum average daily turnover of $2 million. CHB''s investment approach is primarily passive, aiming to replicate the performance of the underlying index, resulting in a high correlation of over 95% before fees and expenses. As of the latest available data, the underlying index is concentrated in the biotechnology industry and has significant exposure to the health care sector.

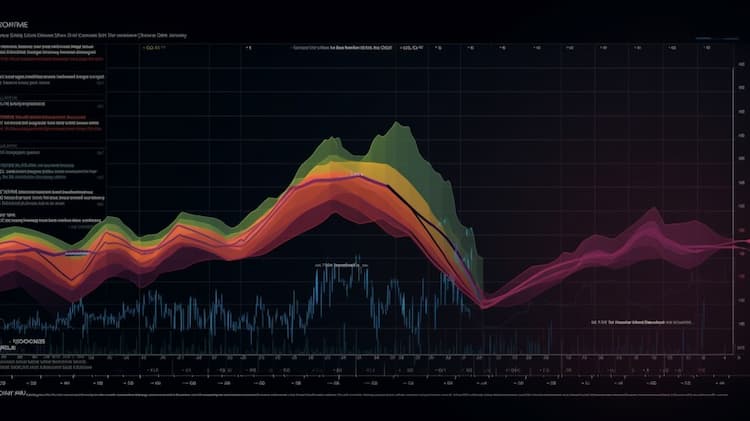

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

The CHB ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

The CHIQ ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

Discover the Best Gold ETFs for investors looking to tap into the potential of the precious metal. This article analyzes the performance, liquidity, and expense ratios of top gold exchange-traded funds (ETFs), providing valuable insights for individuals seeking exposure to the gold market and diversification in their investment portfolios

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.