CPI ISSUER

The Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (CPI) is managed by Invesco, a global leader in exchange-traded funds and investment management. This ETF employs a passive management approach, seeking to track the performance of the Bloomberg IQ Multi-Asset Inflation Index, which was developed by Bloomberg Index Services Limited, the Index Provider. The Underlying Index aims to provide investors with a hedge against inflation by offering diversified exposure to assets expected to benefit from increases in the prices of goods and services, making CPI a valuable addition to an inflation-focused investment strategy.

CPI DIVIDEND

The CPI Dividend ETF focuses primarily on dividend-paying stocks within the Consumer Price Index (CPI). This ETF offers investors a steady stream of income through its dividend distributions. Eligibility for dividends depends on the performance and payout policies of the underlying CPI constituents. Typically, dividends are distributed quarterly, providing investors with a regular income stream and the potential for capital growth, making CPI Dividend an appealing choice for income-oriented investors.

CPI TRACKING

Investors seeking to monitor and hedge against changes in the Consumer Price Index (CPI) can turn to this ETF. The CPI Tracking ETF aims to replicate the performance of the CPI, which is a widely followed indicator of inflation. This ETF provides a convenient way for investors to gain exposure to inflationary trends and protect their purchasing power in a dynamic economic environment.

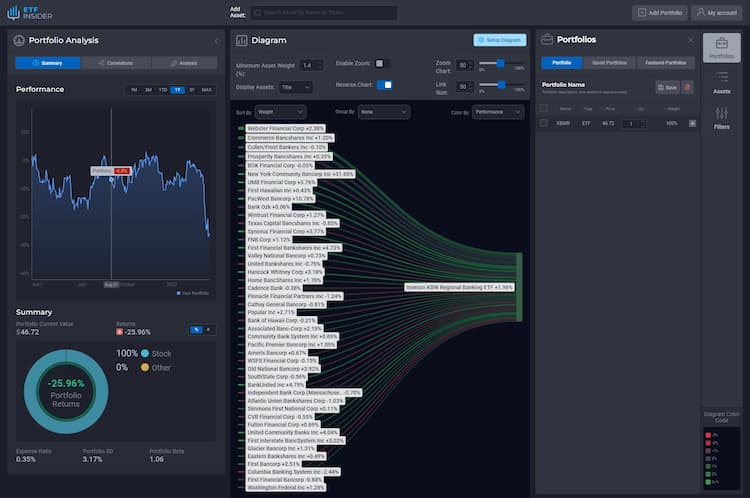

CPI CORRELATION

The correlation aspect of the ETF named CPI is crucial for investors seeking protection against inflation. This ETF employs a passive management approach to track the performance of the Bloomberg IQ Multi-Asset Inflation Index, which is designed to provide exposure to assets expected to benefit from increases in the prices of goods and services. As a result, CPI's correlation is expected to be positively influenced by inflationary trends, making it an essential tool for investors looking to hedge against rising prices. To delve deeper into CPI's correlations with various assets and sectors, investors can leverage ETF Insider's web app, which offers comprehensive data and insightful visualizations, enabling a better understanding of its performance and market overlap.

CPI SECTOR

The CPI Sector ETF seeks to provide investors with a hedge against inflation by tracking the performance of the Bloomberg IQ Multi-Asset Inflation Index. This index is designed to offer diversified exposure to assets that are expected to benefit from increases in the prices of goods and services, making it a suitable choice for those looking to protect their investments against inflationary pressures. The fund's passive management approach aims to replicate the index's performance, offering a convenient way to access inflation-sensitive assets within a single ETF.

CPI EXPOSURE

The exposure characteristic of the CPI Large Cap Value ETF highlights its focus on U.S. large-cap value stocks. Under normal market conditions, the fund invests at least 80% of its assets in component securities of the U.S. Large Cap Underlying Index, a proprietary index developed in collaboration with FTSE Russell and Franklin Templeton. This index aims to achieve a lower level of risk and higher risk-adjusted performance than the Russell 1000® Index by emphasizing factors like quality, value, and momentum.CPI's exposure strategy allows investors to access a portfolio of large-cap U.S. stocks that exhibit favorable characteristics, such as strong returns on equity, attractive valuations, and positive price momentum. The fund may use replication or representative sampling strategies to closely track the index's performance. Additionally, it may utilize equity futures and total return swaps to enhance returns and manage liquidity. As of May 31, 2023, the U.S. Large Cap Underlying Index represented approximately 93% of the total market capitalization of the Russell 3000® Index and was concentrated in the technology sector. To gain deeper insights into CPI and other U.S. ETF exposures, ETF Insider offers a user-friendly web app with visualization tools to explore factors like overlap and correlations among various ETFs.