SOIL VS MOO

Compare the SOIL and MOO ETFs with our thorough analysis. Dive into the performance metrics, underlying assets, and investment strategies.

The International Core ETF (DFAI) is managed by Dimensional Fund Advisors LP (the Advisor), a firm known for its integrated investment approach that combines research, portfolio design, portfolio management, and trading functions. DFAI is designed to invest in a diverse group of non-U.S. companies within the International Universe, focusing on factors such as long-term expected returns, risk diversification, and trading costs. The Advisor's strategies emphasize factors like smaller capitalization, lower relative price, and higher profitability companies, with the flexibility to adjust exposure based on shorter-term considerations, all while maintaining a focus on long-term value and efficient trading practices.

While the primary focus of the Dimensional International Core ETF (DFAI) may not revolve around dividends, its dividend distribution reflects the approach taken by Dimensional Fund Advisors LP. As an actively managed ETF, the dividend distributions are influenced by the underlying equity securities of non-U.S. companies within approved markets. The fund's investment strategy balances long-term drivers of expected returns and diversification, making its dividend distribution a reflection of the overall portfolio composition.

DFAI (Deep Learning-Based Financial Asset Index) tracking ETFs represent an innovative approach to investing in financial markets. These exchange-traded funds are designed to mirror the performance of DFAI, an index powered by cutting-edge deep learning algorithms. DFAI's unique methodology leverages artificial intelligence to analyze a wide array of financial data, identify trends, and make data-driven investment decisions. By investing in DFAI tracking ETFs, investors gain exposure to a diversified portfolio of assets, optimized for potential returns and risk management through the power of AI. This emerging trend in ETFs offers a new level of sophistication and adaptability in the world of passive investing, appealing to those seeking a data-centric approach to their investment strategy.

Understanding the correlation patterns of the Dimensional International Core ETF (DFAI) is vital for comprehending its behavior relative to non-U.S. equity markets. As DFAI aims to invest in a diverse group of non-U.S. companies, its correlation with various international markets is of interest to investors seeking exposure beyond U.S. equities. To delve into these correlations and gain deeper insights into DFAI's behavior, investors can utilize the ETF Insider web app. This tool provides comprehensive data visualization and analysis, shedding light on correlations and overlaps between DFAI and other ETFs, aiding investors in making informed decisions about international market trends and portfolio diversification.DFAI Sector

The DFA International Core ETF's (DFAI) sector allocation is strategically designed to encompass a diverse range of sectors across non-U.S. developed markets. By investing in a broad and varied group of readily marketable securities, the ETF aims to capture growth potential while balancing risk through diversification across companies, sectors, and countries. DFAI's investment approach emphasizes long-term drivers of expected returns while considering shorter-term dynamics to optimize performance within the international equities space.DFAI Exposure

The Dimensional International Core ETF (DFAI) boasts a unique exposure strategy that targets a diverse range of non-U.S. companies associated with developed markets. With a focus on long-term drivers of expected returns and a balanced approach to risk through broad diversification across various companies, sectors, and countries, DFAI offers investors the opportunity to tap into the growth potential of international markets. For those looking to uncover the intricacies of DFAI's exposure and gain valuable insights, the ETF Insider web app presents a powerful tool. This tool provides comprehensive data and visualizations, allowing investors to delve into overlap, correlations, and more, ultimately aiding in making informed investment decisions for U.S. ETFs.

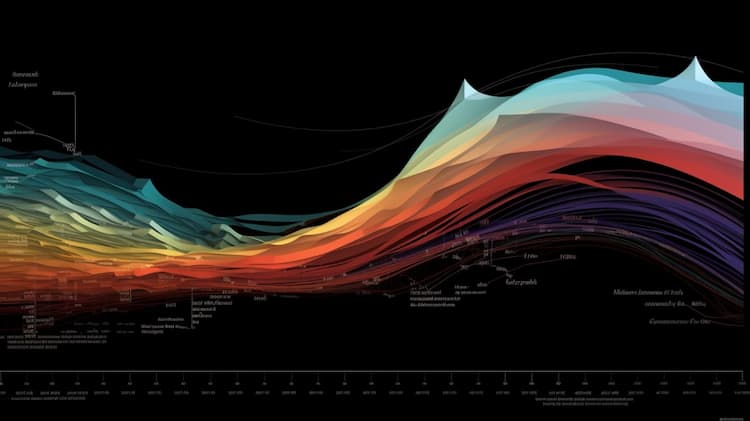

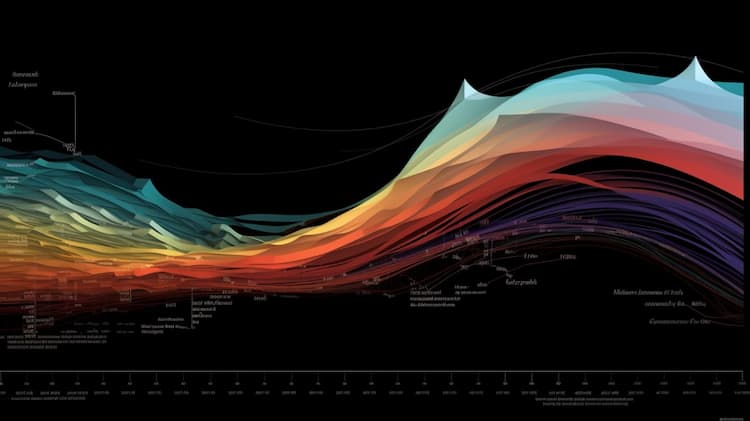

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

Compare the SOIL and MOO ETFs with our thorough analysis. Dive into the performance metrics, underlying assets, and investment strategies.

Delve into the intricacies of the DFAI ETF, a fund known for its focus on international fixed income, in this detailed article. Learn about its composition, historical performance, and how it can be a stable component of a balanced investment portfolio.

TLT commonly refers to the iShares 20+ Year Treasury Bond ETF. This ETF aims to track the performance of long-term U.S. Treasury bonds. It provides investors with exposure to the price and yield performance of U.S. Treasury bonds with remaining maturities of more than 20 years.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.